North Americans are switching from pay-TV to Internet delivered TV services, but at different rates. In the US, Leichtman Research Group reported that the largest pay-TV providers, representing about 95% of the market, lost around 795,000 net subscribers in 2016, compared to the loss of around 445,000 in the previous year.

North Americans are switching from pay-TV to Internet delivered TV services, but at different rates. In the US, Leichtman Research Group reported that the largest pay-TV providers, representing about 95% of the market, lost around 795,000 net subscribers in 2016, compared to the loss of around 445,000 in the previous year.

Separately, Boon Dog Professional Services said that the largest traditional TV service providers in Canada lost a record 202,000 subscribers in their respective 2016/2017 fiscal years, compared to the loss of 160,000 in the previous fiscal year.

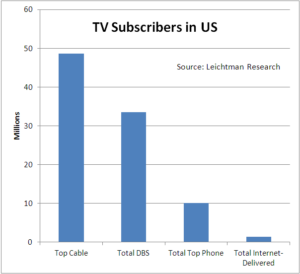

The largest pay-TV providers in the US have 93.6 million subscribers, with the top six cable operators having over 48.6 million subscribers; satellite TV services have 33.5 million subscribers; the top phone companies have 10.1 million subscribers, and the top Internet-delivered pay-TV services providers have around 1.4 million subscribers.

In Canada, even with record subscriber losses, the traditional TV service providers are holding their own against a multitude of choices. At the end of 2016, there were around 11.3 million households subscribing to a traditional TV service, and the loss of 202,000 subscribers only represents 2% of the total market. The 2016 results show a slowdown of IPTV subscriber growth and a slowdown in cable TV subscriber losses, with the major IPTV providers adding almost three times fewer subscribers in 2016 than they did in 2015. Possibly reasons for this are the limited IPTV footprint and competition from the cable companies.

In the US, the top six cable companies lost about 280,000 subscribers last year. compared to a loss of around 410,000 subscribers in 2015, and 1,200,000 subscribers in 2014. In fact, the losses for the top cable providers were the lowest in any year since 2006, which is the year that the telephone companies introduced their video services.

| Pay-TV Providers | Subscribers at End of 4Q 2016 | Net Adds in 2016 |

| Cable Companies | ||

| Comcast | 22,508,000 | 161,000 |

| Charter | 17,236,000 | -187,000 |

| Altice* | 3,469,000 | -111,000 |

| Mediacom | 828,000 | -27,000 |

| Cable ONE | 320,246 | -43,904 |

| Other major private company** | 4,290,000 | -70,000 |

| Total Top Cable | 48,651,246 | -277,904 |

| Satellite Services (DBS) | ||

| DirecTV | 21,012,000 | 1,228,000 |

| Dish-DBS | 12,491,000 | -1,037,000 |

| Total DBS | 33,503,000 | 191,000 |

| Phone Companies | ||

| Verizon FiOS | 4,694,000 | 59,000 |

| AT&T U-verse | 4,281,000 | -1,359,000 |

| Frontier | 1,125,000 | -255,000 |

| Total Top Phone | 10,100,000 | -1,555,000 |

| Internet-Delivered | ||

| Sling TV | 1,180,000 | 645,000 |

| DirectTV NOW | 200,000 | 200,000 |

| Total Internet-Delivered | 1,380,000 | 845,000 |

| Total Top Providers | 93,634,246 | -796,904 |