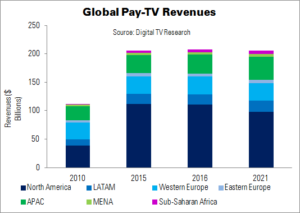

Digital TV Research is conservative about global pay-TV revenues (including subscription fees and pay-per-view) over the coming years. The firm expects revenues to peak in 2018, growing ‘only’ $99 million between 2015 and 2021, to $205.9 billion. Growth was 19.5% between 2010 and 2015.

North America will have a significant impact on the world total, with its revenues falling by $13.5 billion over the period. Only some of this loss will come from cord-cutting; more pressing factors are greater competition and conversion to bundles.

Although 27 countries will experience falling revenues to 2021, they will not be hit to the same extent as North America, which is the world’s most mature pay-TV market. In fact, excluding North America shows a rise of $13.6 billion in global revenues (up 14%), to $107.9 billion. Growth from 2010 to 2015, without North America, was $20 billion (up 28%). From a market share of 57.4% in 2010, North America will fall to 47.6% in 2021.

Revenues will rise by $8 billion in APAC (up 25%), to $40 billion. This region overtook Western Europe (which will be flat at $31 billion) in 2014, and will be larger than all of Europe by 2018.

Sub-Saharan Africa revenues will ‘rocket’ up by 63% ($2.5 billion), while MENA will climb 26% ($1 billion). Sub-Saharan Africa will pass MENA this year.

Between 2010 and 2021, Eastern European pay-TV revenues will climb 40%: from $4.3 billion to $6 billion. However, revenues will only rise 9.9% between 2015 and 2021. LATAM will add a further $1.6 billion (up by 9.1%) to the global total.

Revenues will fall for 27 countries over the forecast period, but will more than double for 19 countries. Most of the fast-growth nations will be in Africa (Myanmar, Laos, Oman and Bangladesh will be exceptions). India will climb by $3.5 billion (to $7.8 billion), and China by $1.9 billion (to $11.7 billion).