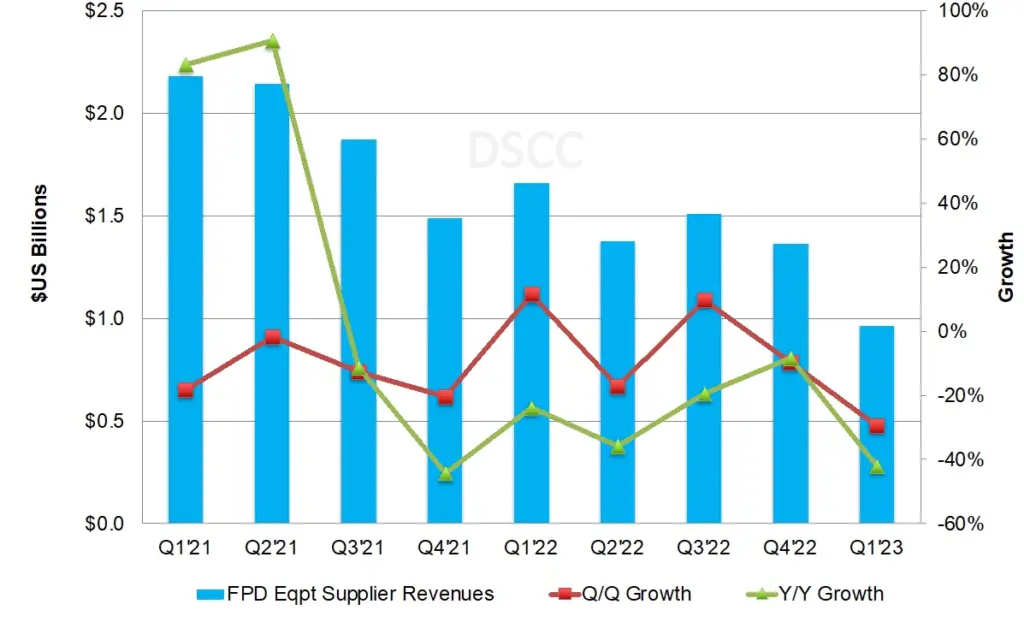

Q1’23 marked a difficult period for display equipment suppliers, witnessing the lowest revenues and capex since 2015. DSCC is reporting that display equipment revenues for 16 top suppliers slid 29% QoQ and 42% YoY, while capex from 13 publicly traded companies fell 14% QoQ and 29% YoY. Despite this, capital intensity rose to 18% as display revenues dropped faster, with revenues for the suppliers constituting just 22% of the estimated total capex. Nikon emerged as a dominant player, dethroning Canon with display equipment revenues at $201M, while other major players like AMAT, TEL, and Screen saw mixed shifts in their revenue percentages.

Despite the rough quarter, bookings rose 28% QoQ for eight companies, hinting at potential future revenue growth, despite a 24% YoY dip. V Tech had the highest backlog promising strong future revenue potential. Liquidity remains healthy with only two companies, including AMAT, reporting positive net debt/equity. Notably, operating cash flow increased 6% QoQ and a massive 476% YoY, led by AMAT, and free cash flow grew 11% QoQ and over $2.8B YoY, primarily due to the strong performance from AMAT, TEL, and Canon.