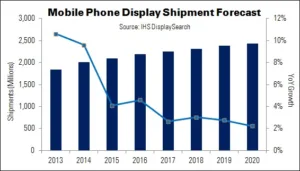

Global shipments of mobile phone display modules will rise just 4% YoY in 2015, says IHS, to 2 billion units. The result will be stronger competition among manufacturers of these units. Chinese makers are trying to increase their share of the global market – with BOE toppling Samsung Display in Q3 last year, to become the world’s leading mobile phone display module supplier.

BOE was aggressive in developing its direct relationships with Chinese mobile phone makers last year, said IHS’ Terry Yu. With Tianma and Infovision, BOE is one of the companies focusing on its G5 capacity in the mobile phone market, with an emphasis on a-Si displays.

The high-end mobile phone display market is also a focus for Chinese module makers. However, until their new fabs are ready, competition will be focused on panel makers in other parts of Asia: especially among Japan Display, Samsung Display and Sharp. These companies have aggressive plans for the Chinese smartphone market in 2015.

AMOLED is being promoted heavily in China by OLED module makers, reacting to lower handset demand. However, there is still competitive pricing pressure. The average price of a 5″ AMOLED module (HD, 1280 x 720) in China, without cover glass or the lamination cost, fell from $43 in Q1’14 to $25 in Q1’15.

5″ HD display modules are widely-used in cost-effective handsets, which sell for between $95 and $160. Due to competition, prices are expected to fall to as low as $80; this means that $25 AMOLED modules will still face cost-control challenges.

Higher-end cost-effective handsets from Chinese makers will adopt 1920 x 1080 modules, says IHS, which are sold for around $160. For example, local brand Meizu has launched its Noblue Note, which has a 5.5″ display with 1920 x 1080 resolution and costs $160 at retail.