Apple’s smartphone payment system – Apple Pay – was quietly launched in the UK in mid-July. Is it just a matter of time before we are all using smartphones as a digital wallet?

Not according to a Harris poll in the USA. Interest in mobile transactions – including Apple Pay and using mobile apps to redeem offers – was found to be low in the country. While a growing number of Americans believe that these systems will eventually replace cash and cards, few think that it is likely to become a reality in the near future.

No one point of service (i.e petrol stations) was identified as the clear winner for mobile payment usefulness. However, interest is not keeping pace, at 27% amongst the general population and 37% amongst smartphone users – where it has been since 2013. Reasons for the low interest mainly had to do with security, or respondents simply seeing no reason to switch from cash and card.

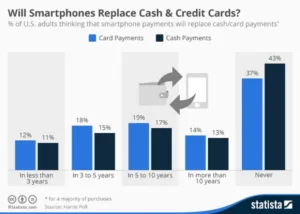

30% of Americans believe that mobile payments will replace card payments in five years, and 26% believe that it will replace cash in the same timeframe. On the other hand, 43% believe that smartphones will never replace cash, and 13% do not see it happening for 10 years.