According to IDC, certified mobile workstations continued to exhibit stronger growth than desktop workstations in Q2’15. While desktop unit shipments fell 3.7% YoY (to 641,580 units), mobile workstation shipments rose 5.4% (to 288,270 units). Overall, worldwide workstation shipments improved slightly from last year, falling 1%, compared to a 1.6% decline in Q2’14.

Performance in EMEA has not been impressive in the first half of 2015. Shipments have fallen for two consecutive quarters. IDC points to disappointing growth in larger markets in Western Europe (France, Germany, the Netherlands) as the primary reason for this. Meanwhile, developing countries in MEA continued to show high growth potential, despite a slower expansion in Q2. Overall, shipments in EMEA fell 4%, to 283,759 units: a 30.5% share of the worldwide market.

Shipments in the Americas remained flat, at 416,116 units. LATAM shipments fell 17.5%, after six consecutive quarters of strong growth. The USA, which alone has a 40% worldwide market share, rose 5 percentage points QoQ and 1.4 points YoY. Canada had its steepest decline since Q4’13: shipments were down 18.8% YoY.

The APAC region represented 24.7% of the worldwide market. Excluding Japan, the region showed the fastest growth (11.5%) of any region: its seventh consecutive quarter of double-digit increases. China took 40.1% of the APAC market and continued to grow, while India’s rise slowed. Japan, with 23.5% of the APAC market, lose 9.8 percentage points of share QoQ, and 7.3 points YoY.

Despite the low Q2 results, IDC expects the workstation market to continue to grow, as high-end PC and Mac users migrate to workstations.

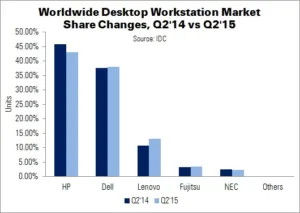

IDC highlighted the performance of the top desktop workstation vendors. Surprisingly, cyclical growth improved for all of these players, although all vendors experienced a QoQ fall.

HP was the market leader, with a 43.1% market share, despite a 9.3% YoY and 0.6% QoQ decline. This was HP’s fourth consecutive quarter of YoY decline. Dell came in at second place, gaining share after net losses in Q1. Shipments were down 2.6% YoY, marking the third consecutive quarter of declines. Dell took 37.9% of the global market.

Lenovo was the only vendor ending Q2 with positive growth, outperforming the market with its seventh consecutive quarter of double-digit increases. The firm ended the quarter with 13.2% market share.

Other vendors, representing the remaining 5.8% of the market, posted a net loss of 1 percentage point QoQ. Fujitsu and NEC were notable amongst the ‘other’ vendors, with combined results declining 4.6% YoY.