There is a plethora of market data riches from DSCC these past few days. The company has been holding events in the Bay Area on the display market, and AR/VR so, there is probably a lot more for us to cover, but in the meantime, here are two sets of data that join up to make for an interesting discussion of how the display industry is shaping up for the second half of 2024.

MiniLED Technology Continues to Shine with Steady Growth

DSCC just highlighted the steady growth of MiniLED technology, showing promise across multiple sectors, including automotive and AI.

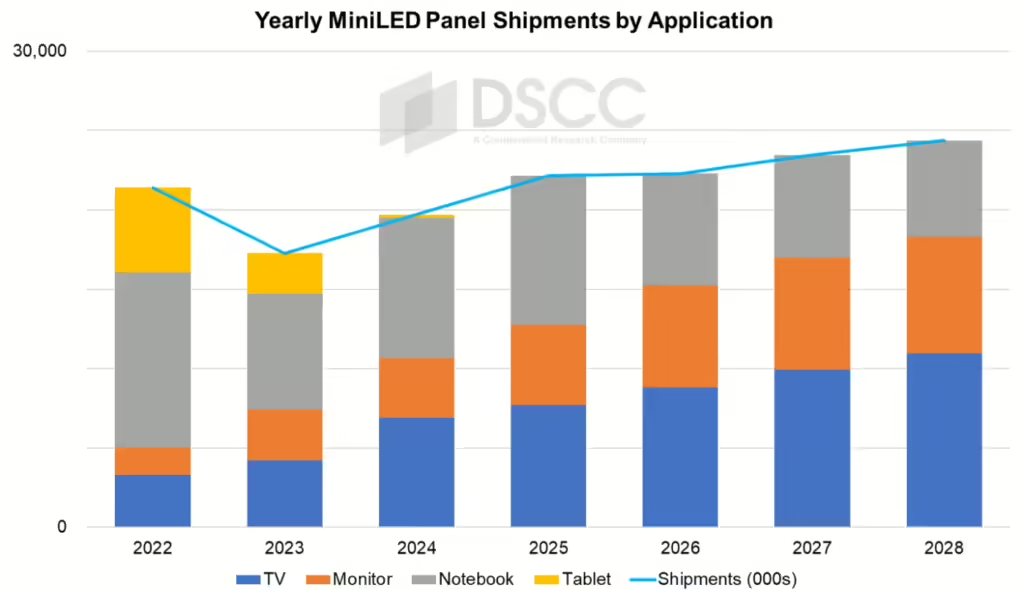

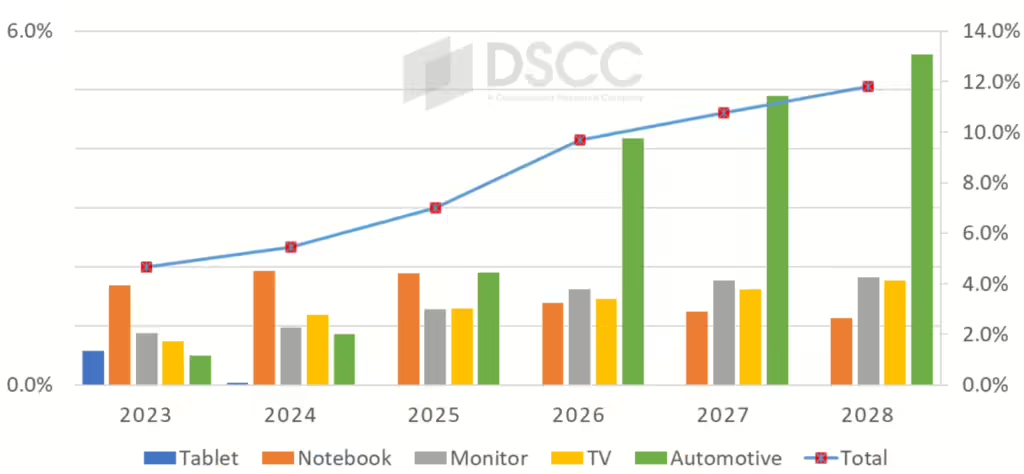

MiniLED technology is projected to get to a total market penetration rate of 2.3% in 2024. This progress comes despite an anticipated dip in Q3 2024 due to weak demand in the TV sector. Nevertheless, total shipments of MiniLED panels are expected to exceed 19 million units in 2024.

One of the most promising areas for MiniLED technology is the automotive industry. According to DSCC, MiniLED penetration in automotive displays is set to reach 9.8% by 2026 and will grow further to 13.1% by 2028.

While MiniLED technology has seen a decline in the tablet market, it continues to expand in other sectors. The technology is gaining traction in monitors and TV markets, with brands like TCL and BenQ launching new MiniLED monitors in Q2 2024. DSCC also emphasizes the role of AI in driving the future of MiniLED adoption, particularly in personal computers. As AI-integrated PCs become more common, MiniLED displays are expected to see greater demand due to their low power consumption.

Beyond traditional screens, MiniLED is breaking into new applications such as automotive headlights, taillights, and interactive graphic displays.

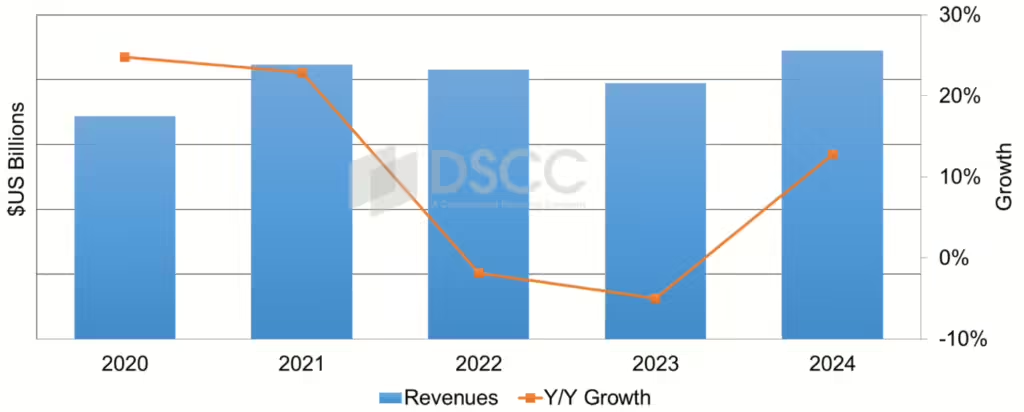

OLED Revenues Set for a 13% Increase in 2024

DSCC is also forecasting a significant rise in OLED technology revenues in 2024, thanks to increased demand across smartphones, TVs, and IT applications. This growth is expected to result in a 13% revenue increases.

DSCC reports that Q2 2024 has already shown strong performance, with a 36% YoY rise in OLED revenues, driven by an impressive 49% increase in unit growth. In the tablet market. DSCC projects a staggering 584% YoY revenue growth for OLED tablets in 2024, thanks largely to a substantial 221% increase in unit shipments. This explosive growth can be credited to Apple’s launch of new OLED iPad Pro models.

OLED technology isn’t just thriving in tablets; other applications like OLED monitors and TVs are also experiencing robust growth. In Q2 2024, OLED monitors and tablets saw triple-digit increases in both unit sales and revenue year-on-year. Meanwhile, OLED TVs experienced a 30% rise in unit sales and a 36% uptick in revenue.

Samsung Display (SDC) currently holds a large share of the OLED market. However, DSCC predicts that SDC will face increased competition in the coming years from companies like TCL CSOT, LGD, Tianma, and Visionox, potentially losing some of its market dominance. This shift could lead to more competition and innovation within the OLED sector as various players vie for a larger slice of the market.

Good News, Bad News

DSCC is upbeat about the future of the display market, but let’s not ignore the cautionary flags. Samsung, which should be enjoying the fruits of its investment in OLED tech, is now facing serious competition right when it should be cementing its lead. The Chinese players are closing in, and that’s putting a dent in what should have been smooth sailing for Samsung.

MiniLED seems to be finding its stride—but mostly by virtue Chinese brands. They’re the ones making gains and chipping away at market share, while others are still figuring out how to make their mark.

As for mobile, OLED’s got the market on lock, whether we’re talking smartphones or tablets. But if it weren’t for Apple, Samsung might have a lot more to worry about in the mobile devices game. Guess we’ll see how this all shakes out next year.