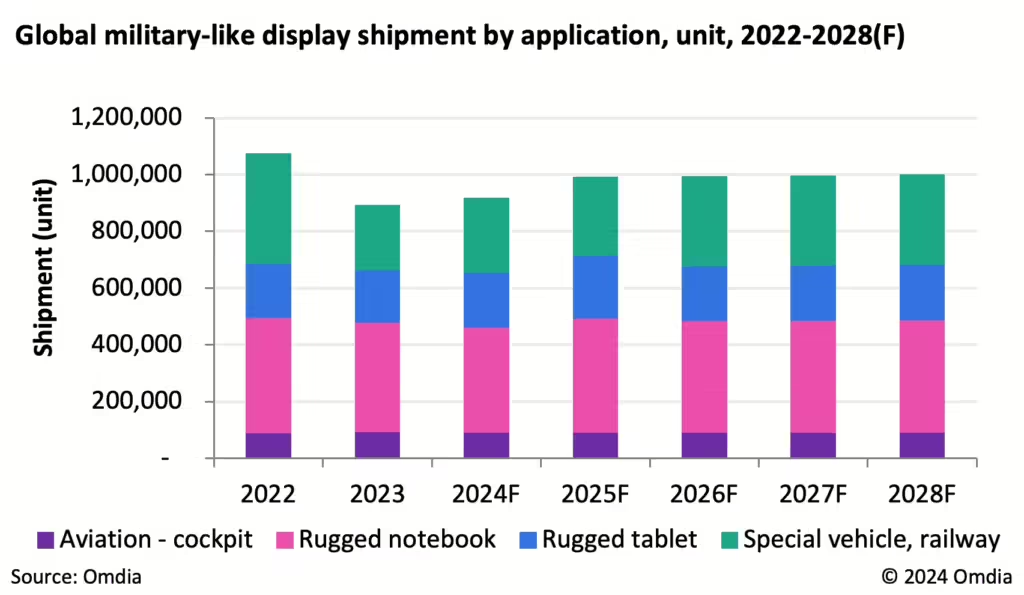

Global shipments of military-grade displays are poised for significant growth in the coming years, driven by rising geopolitical concerns, according to Omdia. Shipments are projected to reach 916,000 units in 2024, marking a 2.8% year-over-year increase. By 2025, the figure is expected to climb to 989,000 units, an 8% annual growth, and surpass the one-million-unit milestone by 2028.

These specialized displays are used across various sectors, including gaming, medical, smart retail, transportation, and rugged devices. In military applications, they are essential components in aviation cockpits, rugged tablets and notebooks, specialized vehicles, and increasingly, drones.

Tianma and Innolux are set to dominate the global military display market in 2024, holding a combined market share of 78%. In aviation, where long-term supply stability is critical, 3.1-inch to 7-inch displays account for 40% of shipments, with Innolux being the primary supplier.

For rugged tablets and notebooks, amorphous silicon (a-Si) display technology is prevalent. In 2024, 10.1-inch displays are expected to capture 81% of rugged tablet shipments, while 13.3-inch displays will comprise 77% of rugged notebook shipments. Tianma is anticipated to supply 86% of these notebooks.

Specialized military vehicles require high-brightness displays capable of operating in wide temperature ranges and resistant to vibration. Displays between 3.1 inches and 7 inches make up 54% of shipments in this category, with Innolux supplying 66%.

Recent conflicts have highlighted the growing role of drones in military operations. Manufacturers are now offering open-cell displays ranging from 5 to 7 inches to address cost concerns, alongside 10.1-inch rugged tablets for remote control and 15.6-inch dual-screen ground stations.

“Global military-grade displays are primarily supplied by Tianma, BOE, Innolux, AUO Display Plus (ADP), and Truly,” said TzuYu Huang, Principal Analyst for Large Area Display and Supply Chain at Omdia. “Should geopolitical conflicts arise, we may see supply chain restructuring that could affect future relationships.”