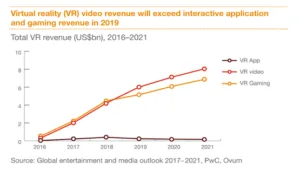

Technological advances, such as VR, are driving direct-to-consumer strategies, according to the global entertainment and media outlook for 2017 to 2021 from PwC. The consumer VR content market is expected to be worth $15.1 billion by 2021, with VR video revenue accounting for $8 billion of this and rising at 91.2% CAGR.

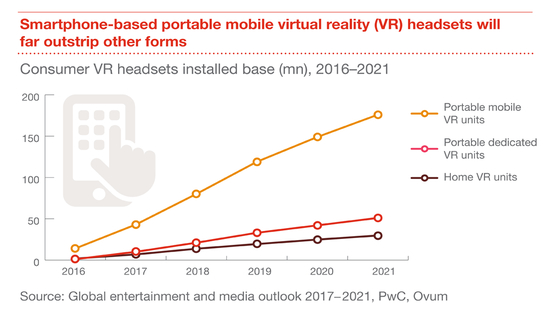

Smartphone-based VR headsets are predicted to outstrip all other forms during the next few years.

PwC said that by internet video revenues will grow with a CAGR of 11.6% to $36.7 billion in 2021 and would go past the value of the sales of physical media such as DVD and Blu-ray this year, which will be $13.9 billion.

Physical OOH revenue will continue to decline as spending is diverted to DOOH. By 2020, Asia-Pacific will be the most digitalised OOH region.

China’s 41,056 cinema screens in 2016, compared to 40,928 in the US, underlines the growing popularity of cinema among Chinese audiences of different ages and demographics. Box office revenue in Asia-Pacific is expected to rise at a 7.9% CAGR in the next five years. By 2021, Asia-Pacific box office revenue will significantly eclipse that of North America.

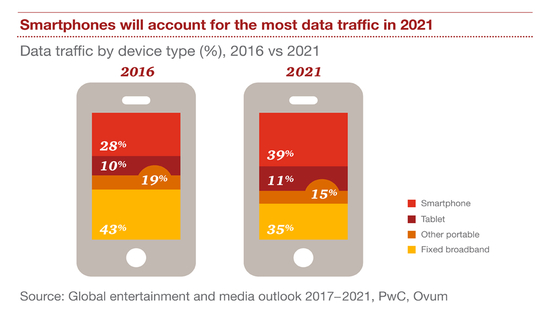

Mobile advertising, which has grown by 57% in the past year, is driving internet advertising, which now generates more turnover than TV advertising. Smartphone data traffic is expected to exceed broadband traffic data in 2020. While data consumption in Russia will overtake that of Japan by 2020, the USA and China will account for almost half of all data traffic.

Not surprisingly, the low-spending markets will be the fastest growing regionally, with Nigeria the fastest with a 12.1% CAGR. China now has more cinema screens than the USA and box office turnover is forecast to rise at a 7.9% CAGR.