The market for LTPO (low-temperature polycrystalline oxide) OLED displays for smartphones is set to boom, with shipments expected to hit 520 million units by 2031, capturing over half of the OLED market share, according to Omdia. This shift is largely due to LTPO’s power efficiency over LTPS (low-temperature polycrystalline silicon) OLED.

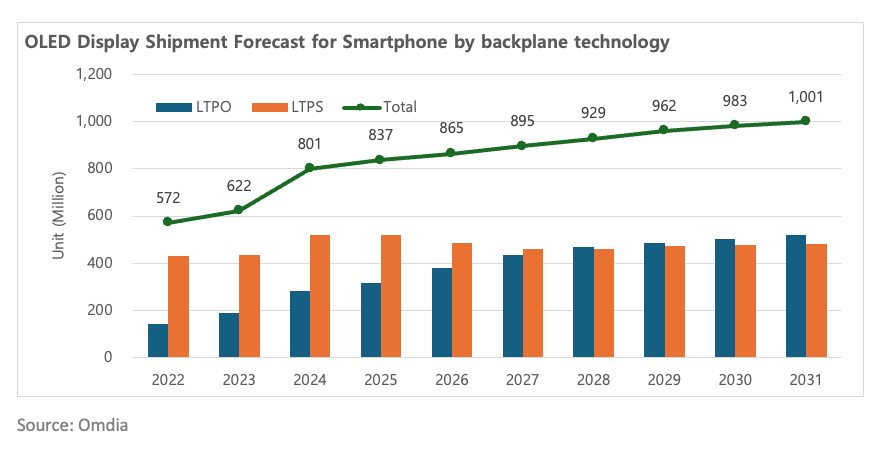

In 2024, smartphone OLED display shipments are projected to grow by 28.8% from last year, reaching over 800 million units, and surpassing 1 billion units by 2031. While LTPS OLED shipments are expected to decline, LTPO OLED is forecasted to grow at a compound annual growth rate (CAGR) of 8.0%.

LTPO OLED technology took off when Samsung used it in the Galaxy Note 20 Ultra in 2020. It has since been adopted by flagship models like the Apple iPhone 13 Pro/Pro Max, Google Pixel 7 Pro, Motorola Razr, and Huawei Mate X5. The technology is also expanding into smartwatches and tablets, encouraging manufacturers to create new LTPO driving circuits for various devices.

The appeal of LTPO OLED lies in its lower leakage current, which allows for power-saving at lower refresh rates. As smartphones incorporate more AI features, power management becomes crucial.

Omdia’s research suggests manufacturers will focus on LTPO for new investments in small to medium OLED capacities, converting much of the existing LTPS capacity to LTPO. For larger OLED production, competition between LTPO and oxide methods will hinge on performance and cost efficiency.