posted a surprise return to operating profitability in the first quarter of 2025, even as sales tumbled sharply from the previous quarter, signaling early signs of stabilization after a turbulent year in the display industry. This was the first time in three years that LG Display has had consecutive quarters of profitability.

| LG Display Financials | Q1 ’25 | Q4 ’24 | Change QoQ | Q1 ’24 | Change YoY |

|---|---|---|---|---|---|

| Sales (Current) | 6,065,298 | 7,832,872 | -23% | 5,252,975 | 15% |

| Sales (Cumulative) | 6,065,298 | 26,615,347 | 5,252,975 | 15% | |

| Operating Profit (Current) | 33,464 | 83,108 | -60% | -469,432 | Turned Profitable |

| Operating Profit (Cumulative) | 33,464 | -560,596 | -469,432 | Turned Profitable | |

| Profit Before Tax (Current) | -148,495 | -562,351 | 74% | -989,348 | 85% |

| Profit Before Tax (Cumulative) | -148,495 | -2,191,540 | -989,348 | 85% | |

| Net Profit (Current) | -237,032 | -839,118 | 72% | -761,276 | 69% |

| Net Profit (Cumulative) | -237,032 | -2,409,300 | -761,276 | 69% | |

| Net Profit to Owners (Current) | -262,725 | -917,763 | 71% | -783,157 | 66% |

| Net Profit to Owners (Cumulative) | -262,725 | -2,562,606 | -783,157 | 66% |

| LG Display Financials | Q1 ’25 | Q4 ’24 | Change QoQ | Q1 ’24 | Change YoY |

|---|---|---|---|---|---|

| Sales (Current) | 4,221 | 5,451 | 23% | 3,656 | 15% |

| Sales (Cumulative) | 4,221 | 18,521 | 3,656 | 15% | |

| Operating Profit (Current) | 23 | 58 | -66% | -327 | Turned Profitable |

| Operating Profit (Cumulative) | 23 | -390 | -327 | Turned Profitable | |

| Profit Before Tax (Current) | -103 | -391 | 74% | -688 | 85% |

| Profit Before Tax (Cumulative) | -103 | -1,525 | -688 | 85% | |

| Net Profit (Current) | -165 | -584 | 72% | -530 | 69% |

| Net Profit (Cumulative) | -165 | -1,677 | -530 | 69% | |

| Net Profit to Owners (Current) | -183 | -639 | 71% | -545 | 66% |

| Net Profit to Owners (Cumulative) | -183 | -1,783 | -545 | 66% |

Revenue for the quarter came in at $4.22 billion, down 23% sequentially from $5.45 billion in Q4 2024, though up 15% from a year earlier. Despite the sales drop, operating profit rose to $23.29 million, marking a sharp reversal from a $326.68 million loss a year ago and a sign of tightening cost controls and margin discipline.

The company’s EBITDA margin expanded to 20.3%, with total EBITDA reaching approximately $946 million. Analysts noted that strong cost rationalization, including lower depreciation and more favorable product mix, likely supported the improved profitability.

Losses continued on the bottom line, though they narrowed significantly. The firm reported a net loss of $164.95 million, improving 72% quarter-over-quarter and 69% year-over-year. Pre-tax losses also narrowed to $103.34 million, compared with $391.33 million in the previous quarter and $688.44 million a year earlier.

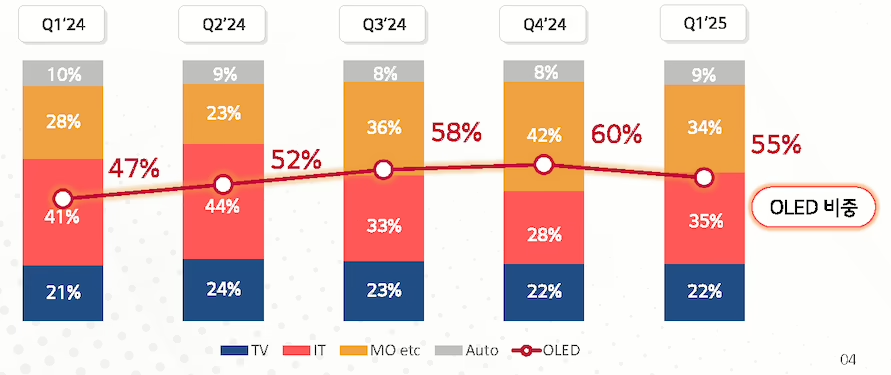

LG Display is pushing full steam ahead with its OLED-focused strategy to turn things around financially this year. They’ve made some good progress already, with OLED sales hitting a record 60% of their total business in Q4 2024, up a bit from the previous quarter.

On the smartphone front, they’re aiming to ship over 20% more OLED panels in the first half of 2025 compared to the same time last year. Their automotive display business looks promising too, with expected OLED growth exceeding 70% YoY, while their LTPS LCD segment should grow by more than 20%. They’re particularly proud of their growing relationships with customers across Korea, Japan, the US, and Europe, projecting their automotive OLED customer base to double this year.

They’re keeping things cautious on the spending side, planning to invest roughly the same as last year (around 2.2 trillion won or $15.3 billion) in facilities. The IT OLED market hasn’t been as hot as they hoped as Apple’s first OLED tablet sold about 6 million units versus the 10+ million target, but they still expect growth through their specialized features like low-power tandems.

On the balance sheet, total assets fell to ₩31.99 trillion, down from ₩36.11 trillion in Q1 2024. Cash and equivalents plunged to ₩982 billion, reflecting ongoing investment outflows and maturing debt. The company’s net debt ratio climbed to 174%, raising concerns about liquidity management and long-term leverage.

Free cash flow generation weakened, with operating cash flow at ₩609 billion and investment outflows of ₩419 billion. Overall, the firm recorded a net cash decrease of ₩1.04 trillion for the quarter.