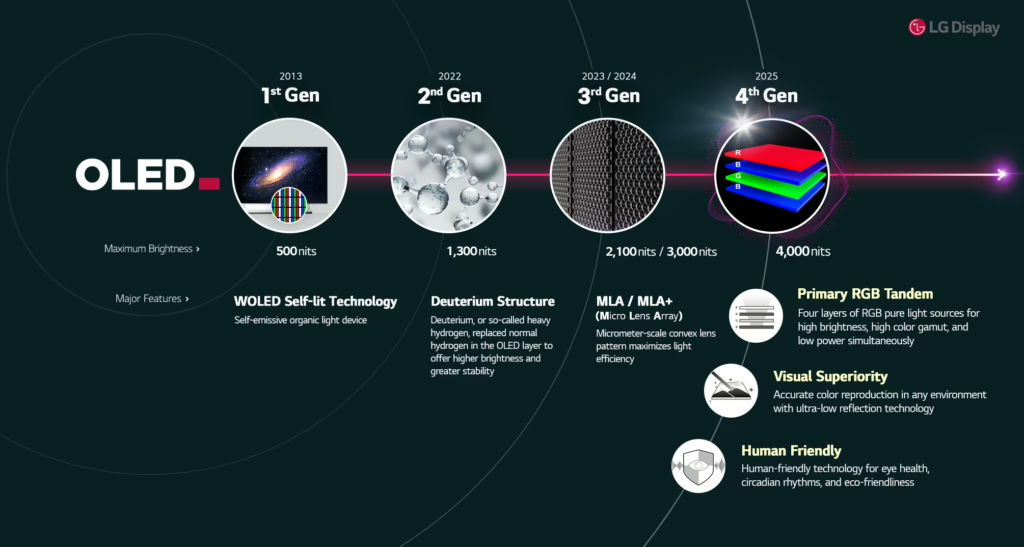

LG has announced its four-generation OLED roadmap. Building on its WOLED platform, Most everyone covering LG at CES 2025 already knows this but LG Display didn’t have its own media presence at the show, and today is the day of the official unveiling of its four-stack OLED structure.

By 2025, the company aims to introduce a fourth-generation Primary RGB Tandem stack that could achieve a peak brightness of around 4,000 nits. Below is a table illustrating the key attributes of each generation:

| Generation | Year / Time Frame | Max Brightness | Key Innovation | Notable Features / Benefits | Strategic Takeaway for Competitors |

| 1st Gen (WOLED Self-lit) | 2013 | ~500 nits | WOLED (White OLED) | – Self-emissive organic layer – Competitive at launch, but limited peak brightness | – Shows early mastery of large OLED manufacturing – Performance gap in brightness could be exploited by rivals |

| 2nd Gen (Deuterium) | 2022 | ~1,300 nits | Deuterium in the OLED layer | – Higher brightness & stability (due to heavy hydrogen) – Improves efficiency, addresses longevity concerns | – Signals more mature material science approach – Focus on reliability for premium TV segments |

| 3rd Gen (MLA / MLA+) | 2023–2024 | ~2,100–3,000 nits | Micro Lens Array (micrometer-scale convex lens pattern) | – Significantly boosts light extraction – Closes brightness gap vs. high-luminance LCD and mini-LED – Potential cost/complexity | – Major brightness leap, enabling new HDR benchmarks – Requires competitive R&D on optical technologies |

| 4th Gen (Primary RGB Tandem) | 2025 (Projected) | ~4,000 nits (Target) | Four-layer RGB emitter stack (tandem structure) | – Higher brightness with lower power – Greater color purity & expanded color volume – Potential new peak HDR standard | – Could redefine the premium TV/monitor space – Competitors must differentiate in cost, form factor, or efficiency |

At the same time as all this happening, LG Display has also made a regulatory filing about its fourth quarter 2024 performance. G Display posted 7.8 trillion won ($5.3 billion) in revenue and 83.1 billion won ($57 million) in profit in the fourth quarter of 2024, marking its first profitable quarter since late 2023 but that was an operating profit. I guess the company is promoting its focus on more profitable OLED panels, coupled with cost-cutting measures that have helped streamline operations and reduce losses.

That’s the Korean press angle. As far as the Shawnee angle is concerned, LG Display still has some way to go to get clear of its financial woes. The full year assessment from the filing is below.

On the plus side, sales jumped by 24.8% YoY, reaching 26.6 trillion won ($19.8 billion). The operating loss shrank by 77.7% (from -2.51 trillion won to -560.6 billion won, or -$1.87 billion to -$420 million). Net loss fell from -2.58 trillion won to -2.41 trillion won (-$1.91 billion to -$1.79 billion). Total debt dropped from 26.99 trillion won to 24.79 trillion won ($20.2 billion to $18.6 billion) which may strengthen the company’s liquidity.

Despite the improvements, LG Display remains in the red with a net loss of -2.41 trillion won (-$1.79 billion). Profitability remains a key challenge, to put it mildly. Total capital declined from 8.77 trillion won to 8.07 trillion won ($6.57 billion to $6.05 billion). Persistent losses continue to chip away at shareholders’ equity. If not reversed, a shrinking capital base could limit future investment and expansion opportunities. Total assets decreased from 35.76 trillion won to 32.86 trillion won ($26.77 billion to $24.57 billion). While partly reflecting strategic divestitures (e.g., LCD facilities) and ongoing restructuring, this can also reduce LG Display’s capacity for large-scale projects if not offset by profits.

The improved numbers have not yet been audited but they are probably close enough to the final release coming in the next few weeks. LG Display is also going to have to contend with LG’s overall performance and that is likely to be a burden if the cost of carrying these losses effects more strategic opportunities in the group.

| Changes in sales or profit and loss structure (unit: thousand won) | Current fiscal year | Previous fiscal year | Increase/decrease amount | Increase/Decrease Rate (%) | |

| Sales | 26,615,346,869 | 21,330,818,935 | 5,284,527,934 | 24.8 | |

| -Operating profit | -560,596,289 | -2,510,163,608 | 1,949,567,319 | 77.7 | |

| Profit from continuing operations before deducting corporate tax expense | -2,191,539,696 | -3,339,441,284 | 1,147,901,588 | 34.4 | |

| Net income | -2,409,299,855 | -2,576,729,163 | 167,429,308 | 6.5 | |

LG Electronics did a good job of wowing the crowds at CES 2025 with transparent displays and a range of consumer electronics upgrades using AI. But, we will have to wait until Display Week 2025 to get any real sense of how much pressure there is on LG Display.