Worldwide monitor shipments totaled 31.7 million units in the fourth quarter of 2017 (4Q17), according to the International Data Corporation (IDC) Worldwide Quarterly PC Monitor Tracker.

“The fourth quarter of 2017 was a strong one for monitors, posting 2.5% year-over-year growth. The holiday season helped fuel the consumer sector, benefiting consumer-oriented vendors like TPV, LG Electronics, and Samsung. Looking ahead, monitors are expected to decline at rates around 2% year over year from 2018 through 2022. However, 4Q17 proved better than forecast overall with all regions recording positive year-over-year growth,” said Maura Fitzgerald, senior research analyst, Worldwide Trackers.

IDC currently forecasts 116 million PC monitor units will be shipped for full year 2018 and expects to see a year-over-year decline of 3.6% in worldwide shipments to 30.6 million units in the fourth quarter of 2018. By 2020, worldwide shipments are expected to be less than 112 million units as the adoption of mobile devices at lower price points is expected to continue.

Technology Highlights

- Curved monitors continue to show steady growth with 4.6% market share in 4Q17. This represents year-over-year growth of 64.6%.

- 21.5-inch wide and 23.8-inch wide dominated the worldwide market with 22.6% and 12.4% market share respectively in 4Q17. Of the top 10 screen sizes, 23.8-inch wide and 27-inch wide saw the largest year-over-year growth, posting 57.2% and 28.7%, respectively, in 4Q17.

- Monitors with TV tuners are expected to have 4.6% market share in 4Q18, down from 4.8% in 4Q17, led by LG and Samsung with a combined market share of 99.0% in this category.

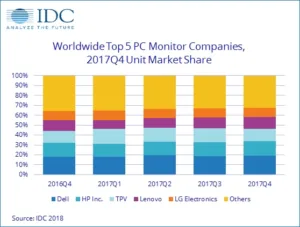

Vendor Highlights

- Dell – Dell retained the top position in 4Q17 with worldwide market share of 19.3% on shipments of over 6 million units. The vendor posted strong year-over-year growth in Central & Eastern Europe (29.1%), Middle East & Africa (14.6%), and Latin America (13.3%). The largest growing screen sizes year over year included 23.6-inch wide and 34 inch wide.

- HP – HP saw more than 4.6 million units shipped, resulting in 14.6% share in 4Q17. Substantial year-over-year unit increases were posted in Japan (33%) and Central & Eastern Europe (36.7%) which contributed to a total year-over-year increase of 7.3%.

- TPV – TPV experienced year-over-year declines in Central & Eastern Europe (-4.7%), Japan (-8.3%) and Middle East & Africa (-5.9%). However significant gains were made in their best-selling region, Asia/Pacific (excluding Japan) with 5.1% year-over-year growth.

- Lenovo – Lenovo maintained the number 4 position with strong year-over-year growth of 12.8% and more than 3.8 million units shipped. This was largely due to significant quarter-over-quarter growth in Asia/Pacific (excluding Japan) (20.7%) and Western Europe (30.3%). In terms of screen size growth, 27-inch wide & 23.8-inch wide dominated with 487% & 309 % year-over-year growth, respectively.

- LG Electronics – LGE rounded out the Top 5 in 4Q17 with 2.8 million units shipped. Despite a year-over-year decline of 1.7%, the vendor witnessed year-over-year gains in the United States, Japan, and Middle East & Africa.

|

Worldwide PC Monitor Unit Shipments, Market Share, and Year-over-Year Growth, Fourth Quarter 2017 |

|||||

|

Vendors |

4Q17 Unit Shipments |

4Q17 Market Share |

4Q16 Unit Shipments |

4Q16 Market Share |

4Q17/4Q16 Growth |

|

1. Dell |

6,129,970 |

19.3% |

5,631,990 |

18.2% |

8.8% |

|

2. HP Inc. |

4,619,648 |

14.6% |

4,304,642 |

13.9% |

7.3% |

|

3. TPV |

3,947,529 |

12.4% |

3,715,288 |

12.0% |

6.3% |

|

4. Lenovo |

3,812,404 |

12.0% |

3,379,708 |

10.9% |

12.8% |

|

5. LG Electronics |

2,816,612 |

8.9% |

2,866,052 |

9.3% |

-1.7% |

|

Others |

10,406,482 |

32.8% |

11,069,637 |

35.7% |

-6.0% |

|

Total |

31,732,645 |

100.0% |

30,967,317 |

100.0% |

2.5% |

|

Source: IDC Worldwide Quarterly PC Monitor Tracker, March 2018 |

|||||

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading media, data and marketing services company that activates and engages the most influential technology buyers. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.