DSCC is reporting that the flat panel display market is transitioning from an oversupply of LCDs to a potential shortage within the next five years.

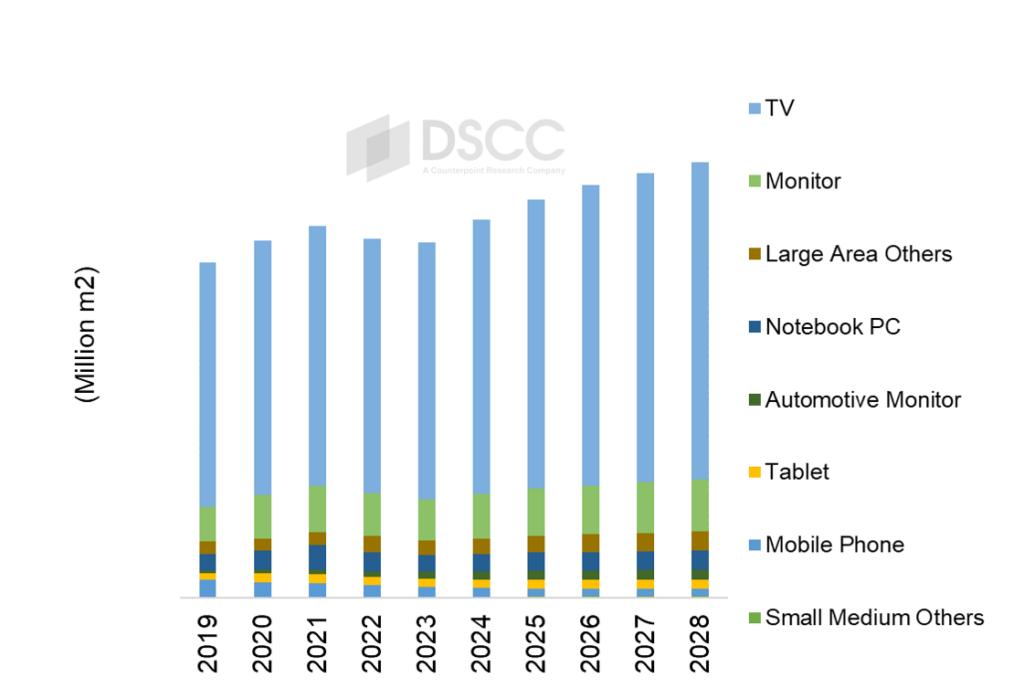

According to DSCC, the FPD market should grow at a compound annual growth rate (CAGR) of 5% from 2023 to 2028, driven by increasing average screen sizes in TVs. IT applications, such as monitors, notebooks, and tablets, are also expected to contribute to this growth as the market recovers from a post-pandemic slump.

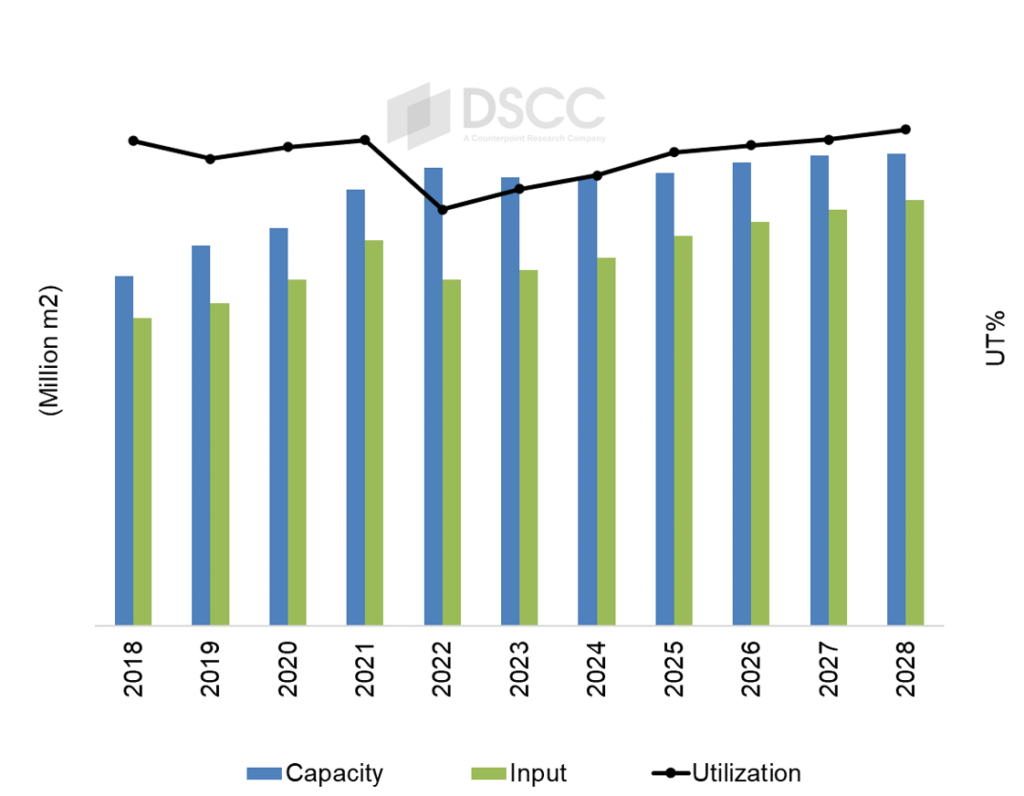

OLED capacity is expected to grow with a 5% CAGR but LCD capacity is anticipated to grow by less than 1% CAGR from 2022 to 2028. The LCD industry saw a capacity decrease in 2023 by 2%, with smaller fabs shutting down, leading to an overall reduction in Gen 7 and smaller fabs’ capacity.

The LCD industry’s low point in 2022 was characterized by low utilization rates and significant operating losses. However, utilization rates have been improving since, and tDSCCanticipates that by 2027, utilization will reach the peak levels seen during the pandemic in 2021, with even higher rates expected in 2028. This high utilization could drive up LCD panel prices and pressure the industry to expand capacity.

Despite the modest growth in LCD capacity, the steady demand increase is likely to result in a shortage unless more LCD production capacity is added. The report warns that while additional OLED capacity could partially address the gap, it would require a substantial expansion of OLED manufacturing capabilities.