The worldwide boom in LCD panel production is coming to an end, according to a new report from display market research firm DSCC. After ramping up fabrication utilization aggressively in the second and third quarters of 2023, LCD makers are now slowing down production as demand softens.

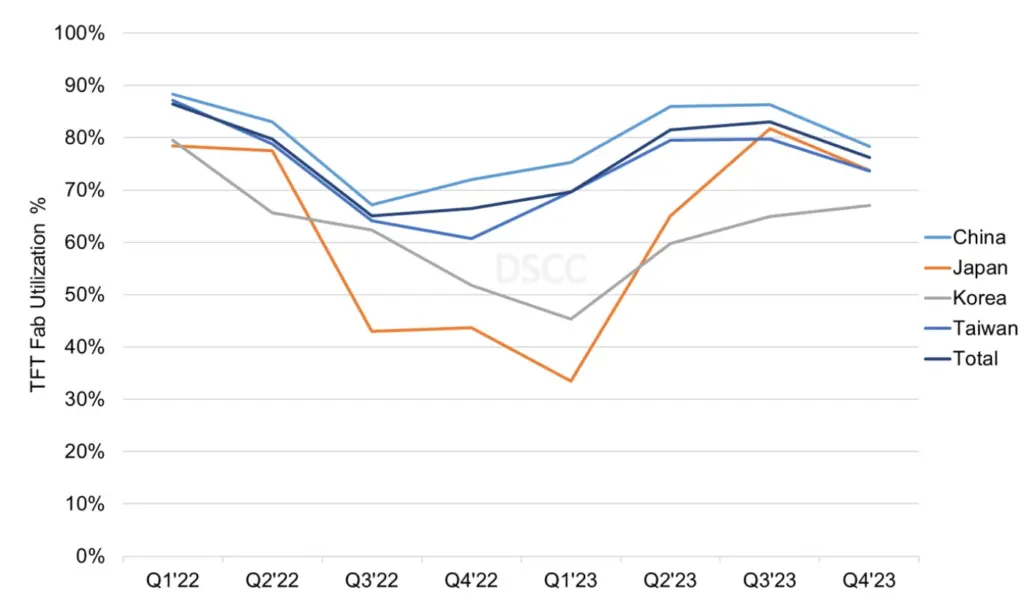

Worldwide LCD fab utilization jumped to 83% in Q3’23, up from just 65% a year earlier during the depths of the downturn. However, utilization is forecast to drop back to 76% in Q4 as panel makers put the brakes on output. Fab utilization rose sharply in 2021 and early 2022 amid pandemic-related demand, then plunged due to macroeconomic and geopolitical shocks. Chinese makers started recovering in Q4’22, followed by Taiwan makers in Q1’23 and Korean makers in Q2.

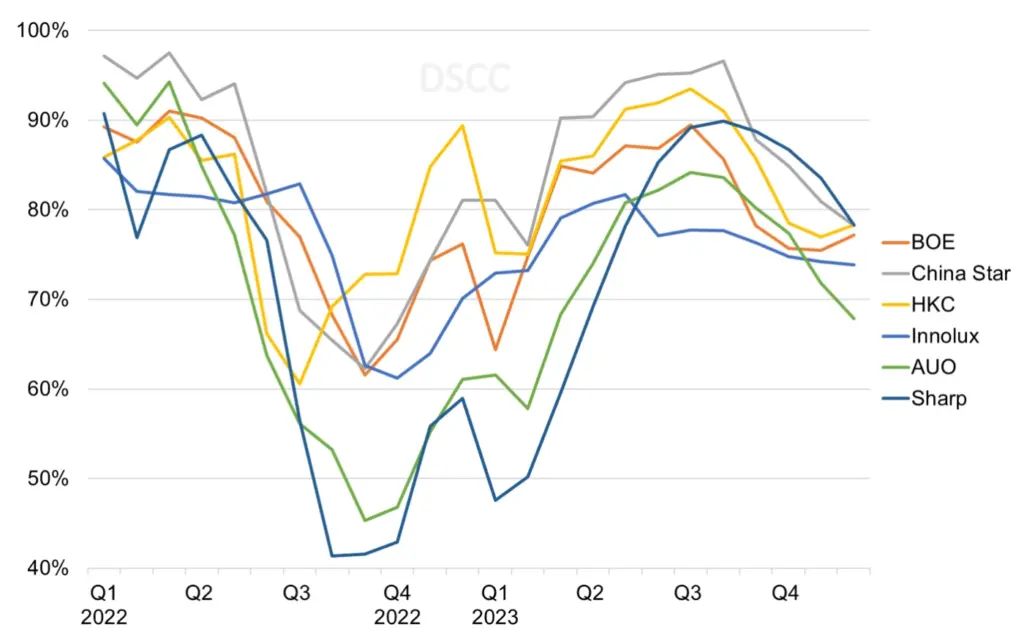

Now, all regions except Korea to slow LCD output in Q4, as the supply chain has built sufficient inventory for the holidays. Panel prices rose in Q2’23, allowing makers like AUO to increase utilization. But others like Sharp have seen a slower recovery after deep utilization drops in late 2022.

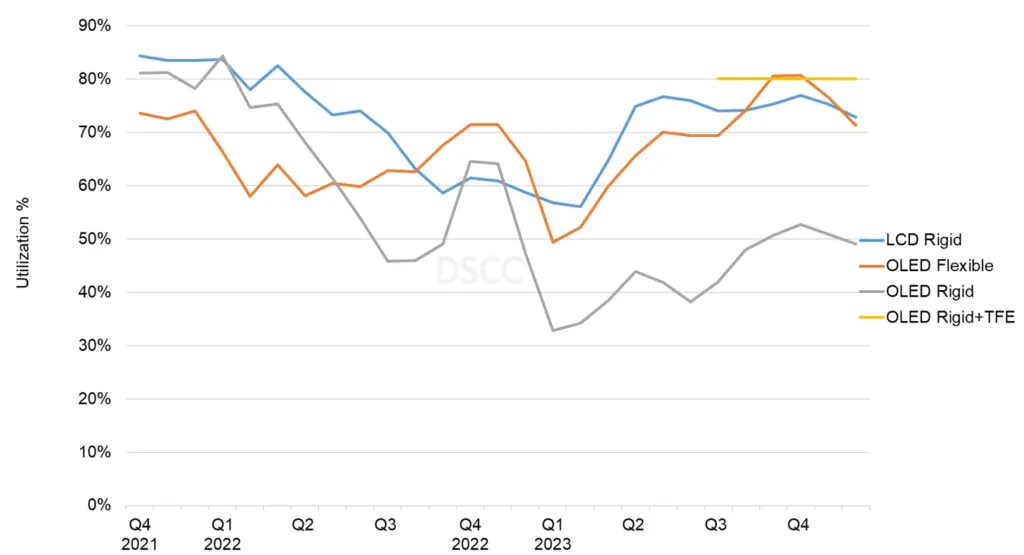

The OLED sector has also been affected, with lower demand in electronics leading to OLED overcapacity as well. The slowdown was more severe and longer-lasting for OLED lines compared to LCD. OLED accounts for 59% of capacity in Korea but only 6% in China.

While LCD capacity is largely interchangeable, OLED capacity falls into five distinct categories with little overlap. This makes managing OLED oversupply more complex than LCD. With LCD panel inventory replenished, makers are now aiming for a soft landing to avoid another oversupply crisis, the report indicates.