Increasing consumer demand for large TVs, UltraHD TVs and high-end monitors drove a double-digit increase in large-area TFT-LCD panel area shipments last year, according to IHS DisplaySearch.

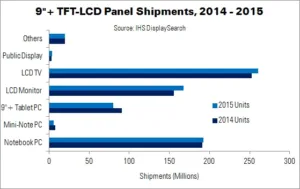

There was moderate growth in shipments, revenue and area in 2014. 9″+ shipments were up 4% to 721 million units, while overall shipment area grew 13%. Revenues climbed 2% YoY, to $74.4 billion.

Dividing the total by size, shipment area of 40″+ panels was up 34%. Notebook panel shipments grew 8%, with a 16% revenue rise. However, 9″+ tablet panels suffered from weaker demand, slowing unit growth to just 1% and sending revenues into a 6% decline.

| 9″+ TFT-LCD Panel Unit Shipments (2014-2015) (Millions) | |||

|---|---|---|---|

| Application | 2014 Units | 2015 Units | YoY Change |

| Notebook PC | 190.7 | 192.2 | 1% |

| Mini-Note PC | 7.9 | 5.8 | -27% |

| 9″+ Tablet PC | 90.7 | 80.2 | -11% |

| LCD Monitor | 155.7 | 167.6 | 8% |

| LCD TV | 252.5 | 260.5 | 3% |

| Public Display | 3.3 | 3.5 | 7% |

| Others | 20 | 19.5 | -2% |

| Total | 720.6 | 729.5 | 1% |

| Source: IHS DisplaySearch | |||

IHS says that similar shipment trends are expected this year. Overall large-area shipments are predicted to climb 1%, to 729.5 million units. However, revenue and area growth are predicted to climb 6% and 8%, respectively.

LCD TV panel shipments will climb 3% this year, to 280.5 million units. Shipment area will grow 8%, from 113 million m² to 123 million m². UltraHD importance will continue to climb, ending the year at more than 40 million units (15% of total shipments) – representing market penetration more than double that of 2014.

Notebook and mini-note panel shipments will be flat this year, at 198 million units. Yoonsung Chung of IHS says, “Lacklustre sales are forcing panel makers to begin upgrading to FHD and other high-resolution formats and to adopt flat light guide plates in the backlight for ultra-slim panels, in hopes of raising profit margins”.

IHS’ forecast is that 9″+ LCD tablet panel shipments will fall 11% in 2015, primarily caused by Samsung’s switch to OLED.

Meanwhile, LCD monitor panel shipments are expected to climb 8% YoY, to 168 million units. Last year’s profit margin was solid due to larger sizes, technology improvements and depreciation in old fabs, causing panel makers to plan more shipments this year.

Finally, shipments of public display panels were up 44% YoY in 2014, due to the market exit of plasma and stronger digital signage momentum. IHS expects this category’s shipments to rise 7% in 2015.