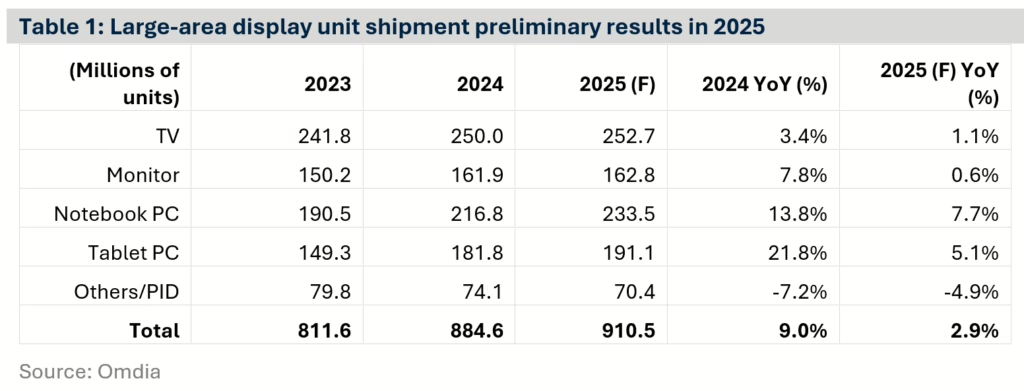

Large-area display shipments reached 910.5 million units in 2025, up 2.9% year-over-year despite global economic uncertainty and new US tariff policies, according to Omdia’s large-area display market tracker for Q4 2025. The growth rate marked a significant deceleration from 2024’s 9.0% expansion.

The headline numbers masked divergent trends across technologies and applications. Large-area LCD shipments grew 2.6% to 876.8 million units, while OLED shipments increased 12.9% to approximately 33.7 million units. Within OLED, however, the growth concentrated heavily in IT applications rather than television.

OLED TV Stalls as Monitors Surge

OLED monitor shipments grew 69.3% year-over-year in 2025, with notebook PC OLED shipments up 26.8%. OLED TV shipments, by contrast, increased just 1.5% over the same period.

The disparity reflected a strategic pivot by Korean OLED manufacturers. Samsung Display and LG Display continued shifting focus from OLED TV displays toward monitor panels, which offered stronger financial returns. Both companies also emphasized notebook PC OLEDs ahead of planned Gen 8.6 IT OLED fab ramps beginning in 2026, seeking to expand business volumes during the transition year.

Samsung Display is preparing to bring its Gen 8.6 IT OLED line online, with BOE also ramping similar capacity. The 2025 shipment patterns suggested suppliers were building customer relationships and refining production processes in advance of the capacity expansion.

LCD Restructuring Continues

Korean and Japanese panel makers reduced LCD TV display production during 2025 as part of ongoing business restructuring, according to Peter Su, Senior Principal Analyst in Omdia’s Display research practice. Panel makers outside China also scaled back monitor LCD production amid intense pricing pressure from Chinese competitors.

Shipments in the “Others” and Public Information Display categories declined in 2025. Many system integrators and lower-tier manufacturers based in mainland China had limited flexibility to relocate production in response to US tariff issues, and ongoing economic uncertainty weighed on demand.

Market Share Concentration

BOE extended its position as the dominant large-area display supplier, capturing an estimated 35.0% of total unit shipments in 2025. China Star followed at 15.8%, with Innolux at 11.3%.

In LCD specifically, BOE held 36.2% share, followed by China Star at 16.4% and Innolux at 11.7%.

The OLED market remained more concentrated among Korean suppliers. Samsung Display maintained the largest share at 50.9%, followed by LG Display at 31.8% and BOE’s display subsidiary EDO at 14.8%.

The data reinforced the structural shift in the display industry: Chinese manufacturers dominating LCD volume while Korean suppliers defend premium positions in OLED, increasingly through IT applications rather than the television market where growth has stagnated.