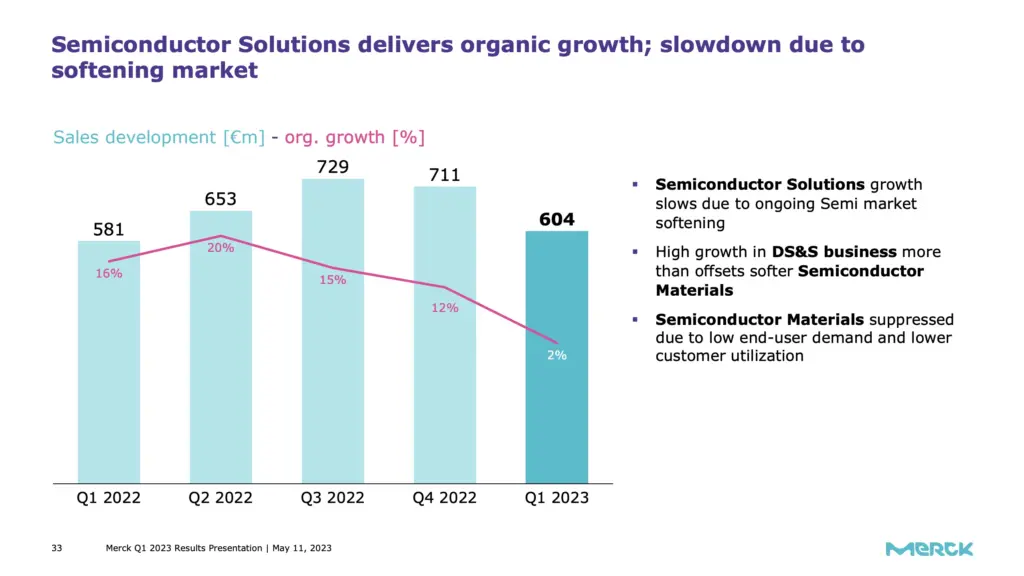

Merck’s Q1’23 results revealed challenges within its display solutions and electronics business units, contributing to a 2.6% fall in EBITDA to €1,587 million ($1,740 million). Decreased customer utilization of display solutions and reduced demand for liquid crystals resulted in a 5.9% sales drop in the electronics business unit to €901 million ($988 million). Price reductions in liquid crystals business and a weaker semiconductor solutions market further impacted profits and sales. Merck forecasts ongoing sales impacts in 2023 due to a slowing display solutions business and a weakened semiconductor materials market, alongside inflation-related cost pressures across all sectors.

There was no mention of Universal Display Corporation (UDC) having acquired the phosphorescent OLED emitter intellectual property (IP) assets of Merck recently. The portfolio included over 550 issued and pending patents worldwide, representing more than 15 years of research and development. In addition to the acquisition, UDC and Merck have entered a multi-year collaboration agreement to develop advanced PHOLED stacks. UDC will integrate Merck’s inventions into its comprehensive intellectual property library and development programs, while Merck aims to accelerate the growth of its OLED business by gaining access to UDC’s leading-edge emitters.

| Display Solutions | Q1’22 | Q2’22 | Q3’22 | Q4’22 | Q1’23 |

| % of total sales | 27.30% | 23.30% | 19.30% | 20.00% | 20.80% |

| Revenues (in millions) | €261.60 | €232.50 | €200.40 | €205.20 | €187.00 |