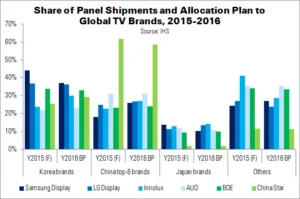

Both LG and Samsung plan to rely less on their own captive TV panel makers (LG Display and Samsung Display), and seek to outsource work to external companies this year. IHS says that the move comes as LG and Samsung seek to increase back-up supply, boost savings and complete product line-ups.

Samsung and LG took 41% of all panel shipments from LGD and SDC last year, down from 46% in 2014. IHS predicts a further decline, to 37%, this year.

Deborah Yang, director of display supply chain research and analysis at IHS, said, “During a downturn in the business cycle, TV brands have tended to purchase panels primarily from their own captive suppliers… This year, however, TV brands are uncharacteristically lowering their reliance on internal supply and instead outsourcing more to vendors in China and Taiwan, which have become better aligned with their product lineups. The external vendors have also become more competitive in supply availability, panel pricing and quality.”

The Korean companies plan to take advantage of Chinese firms’ larger supply base and large scale, Yang continued. They will also make use of the supply of competitive panel sizes from Taiwan.

IHS’ forecast for TV demand in 2016 is low, bringing an increased risk to the supply chain – especially for panel makers that rely on TV brands, such as SDC and LGD. Such a reliance dominates purchasing and can influence panel allocations. “The bleak forecast is responsible for the panel oversupply, one of the critical reasons for the significant TV panel price corrections in the second half of 2015,” Yang said.