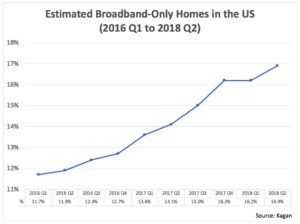

The number of wireline broadband homes not subscribing to traditional multichannel reached a new record high in the second quarter of 2018, according to Kagan, a division of S&P Global Intelligence. Overall, an estimated 16.9% of US occupied households were “broadband-only homes” in the second quarter, up nearly 3% year-on-year.

The boom in broadband-only homes is a boon for broadband ISPs, analysts say. Assuming that the vast majority of those households fill their video needs with online services, this suggests an increase in data consumption.

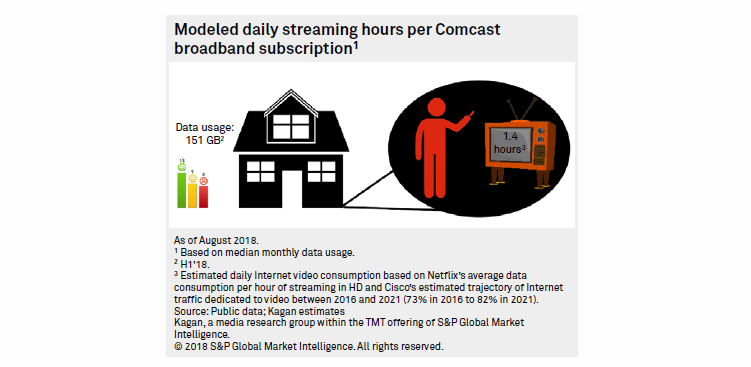

Comcast reported that average monthly data usage across its internet customer base came in at 151GB in the first six months of 2018. This compares to 100GB in the first half of 2017 and 131GB in the second half.

In the long run, the upward trajectory in data consumption points to room for higher HSD average revenue per users, prolonged broadband revenue momentum and expanded cash flows, even under the current reluctance to enforce data caps.

Of note, this mechanism contributes to sending cable’s profitability to record levels, with the top MSOs now firmly ensconced in 40%-plus territory, Kagan said.

Click here for the full report.