According to Jon Peddie Research, the add-in graphics board market behaved seasonally in the fourth quarter of 2017, decreasing 4.6% sequentially. This figure is just below the seasonal ten-year average for the fourth quarter (-4.4%) which JPR believes is due to the sharp rise in prices driven by demand from cryptocurrency miners.

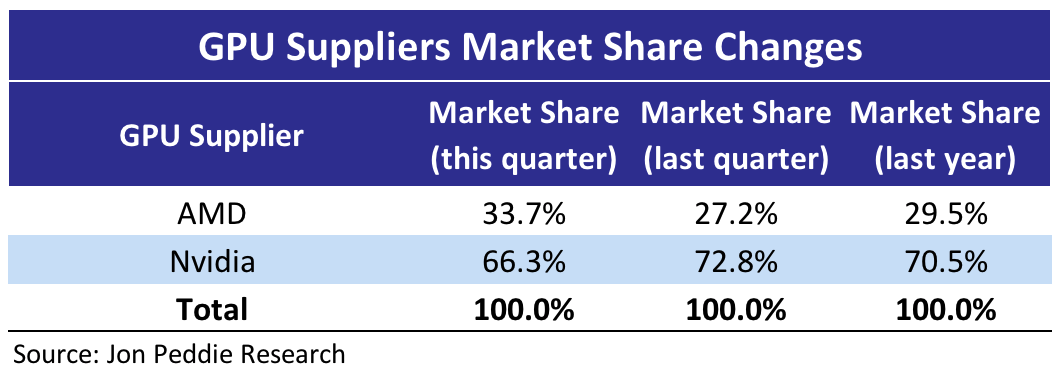

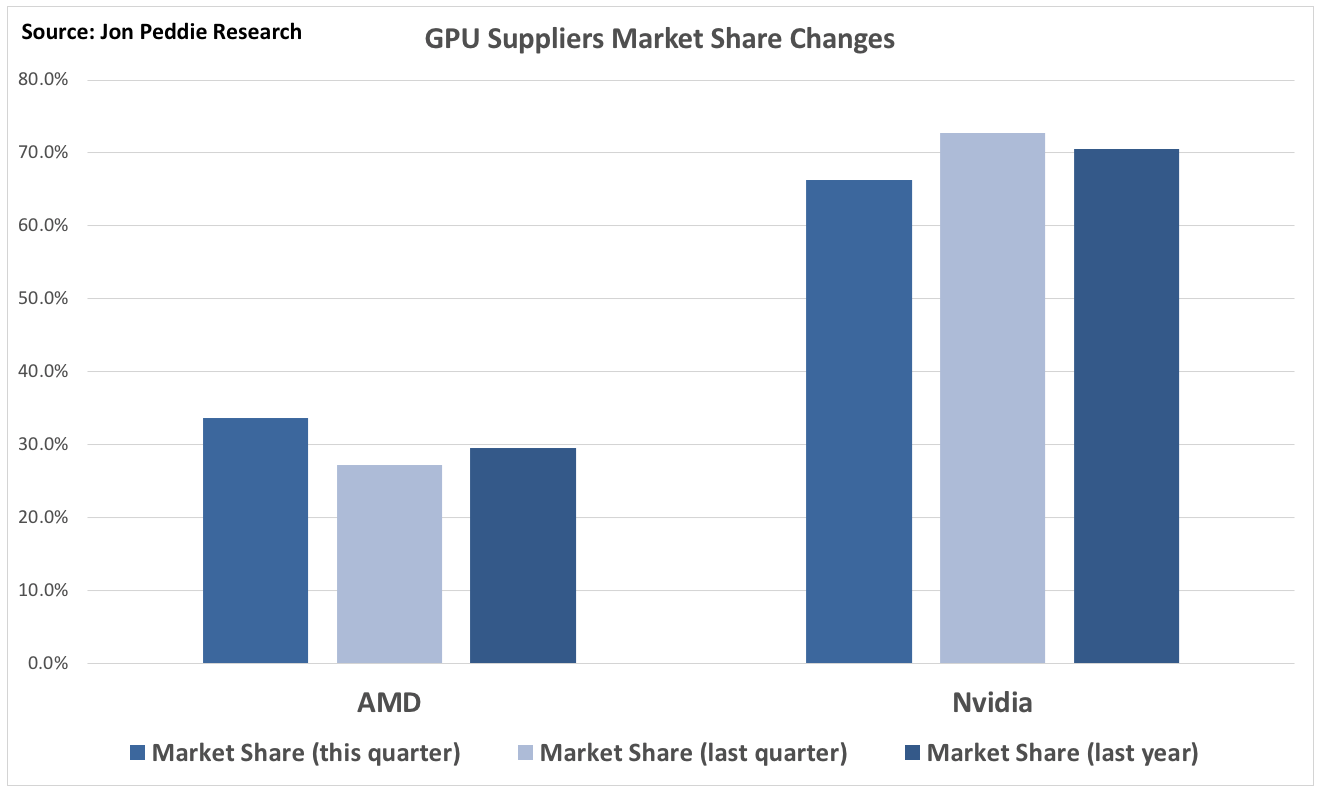

The market share for desktop discrete GPU suppliers shifted during the fourth quarter as well. Over three million add-in boards (AIBs) worth $776 million were sold to cryptocurrency miners in 2017. AMD was the primary benefactor of these sales. AIBs using discrete GPUs are found in desktop PCs, workstations, servers, rendering and mining farms, and other devices such as scientific instruments.

They are sold directly to customers as aftermarket products, or are factory-installed by OEMs. In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and private, often large, high-speed memory, compared to the integrated GPUs in CPUs that share slower system memory.

Overall GPU shipments (integrated and discrete) are greater than desktop PC shipments due to double-attach—the adding of an AIB to a system with integrated processor graphics, or a second AIB using either AMD’s Crossfire or Nvidia’s SLI technology. The attach rate of AIBs in desktop PCs has declined from a peak of 84% in 2002 to a low of 36% in 2015, and steadily increased since then to 54% this quarter. Compared to the fourth quarter of 2016, the attach rate increased by 15.8%.