The Nikkei has quoted an executive at Sharp as saying that the firm would take the lead in a plan to build a new LCD fab in the US, with investment mainly from Sharp or Foxconn, but also with investment from outside the companies. The article suggests more certainty about a plan than previous reports. (Rumor: Foxconn to Build Display Factory in the USA?)

Analyst Comment

In an interesting blog post, Bob O’Brien of Display Supply Chain Consultants has calculated that there could be useful logistic cost savings by moving production to the mid-West of the US. The suggestion is that logistics cost would drop from $30 for production in Asia, compared to $10 for a local set or $23 when made in Mexico. He suggests that, given the tiny margins in TV making, that might make a difference. However, it seems to me that there are a lot of other factors that could mitigate against such a cost saving. If, for example, glass cost more, which it might if Corning had to build a new plant, effectively for one client, which it has previously said that it wouldn’t do. The other materials such as plastics and metalwork might also cost more (even if the difference is only extra logistics cost).

Further, the Chinese panel makers enjoy access to very low cost capital and may get other less obvious cost help from the regional governments. As has been pointed out by IHS and reported in this publication, Chinese regional governments are incentivised by Beijing to drive economic growth and activity, so may do all sorts of things that help the companies to keep costs down, from lower cost land, power and water, support of training or extra work by R&D institutes and universities that may be less available in the US (although regional authorities would also be keen on such a plant).

However, the big issue is likely to be tariffs. Panel and set assembly developed in Eastern Europe for two reasons. First, the import duty for TVs from outside the EU and Turkey (and Korea because of the deal between the EU and Korea) is 14%. That typically offset the cost savings between China and European assembly, providing that set makers had enough volume in Europe. However, the duty into the US is currently 3.9%. If the US was to significantly increase the duty on imported TVs to the US, that would increase the incentive for US manufacture. (although one wonders how popular increased TV set prices would be for US consumers/voters).

The second factor, especially for the module makers is the reduction in working capital. In a TV, most of the cost is not in the LCD cell, it is in the backlight and the other components of the set. By moving module assembly and pushing the supply chain to support assembly in Europe, integrated TV and panel makers were able to buy most of the components a lot closer to the time of the sale, than having to buy all of those materials and then ship finished products which take a long time to get to the market in Europe from the factory in Asia. For the panel makers, this could mean months of difference. In the case of the US, the supply chain is much shorter, so the advantage of this kind of change would be reduced. (BR)

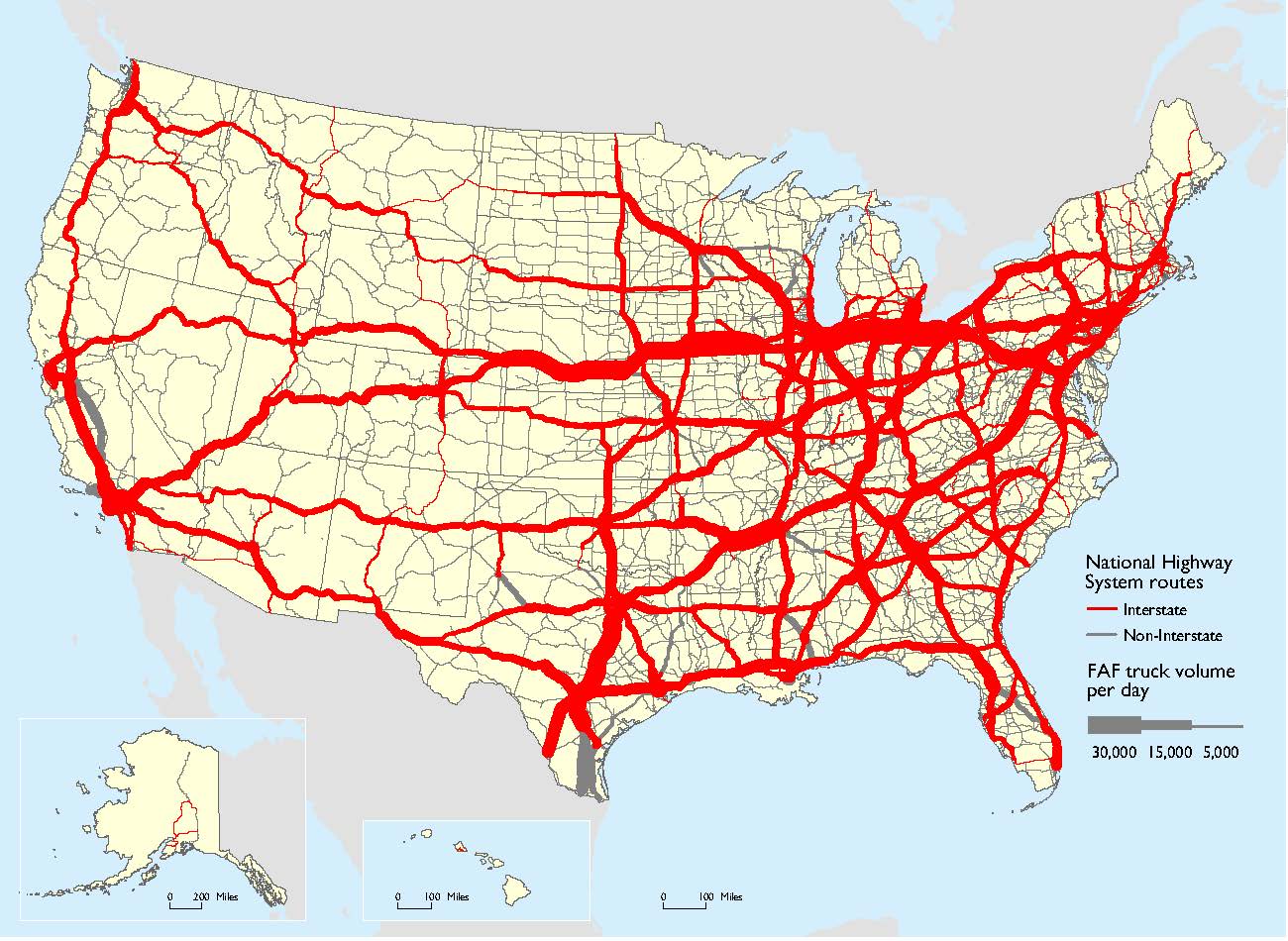

Forecast Average Daily Long Haul Truck Traffic on the NHS in 2045 – Click for higher resolution

Forecast Average Daily Long Haul Truck Traffic on the NHS in 2045 – Click for higher resolution