The DDIC (display driver integrated circuit) market is set to experience a dynamic yet challenging phase in 2024, according to Trendforce. After a year of relative stability and marginal price declines in 2023, the DDIC market is gearing up for a transformative shift next year. A significant rise in demand is anticipated, especially for large-scale applications such as TVs, gaming monitors, and commercial notebooks. This surge is expected to drive an increase in panel shipments and, consequently, a spike in DDIC demand.

Despite the optimistic forecast in demand, DDIC prices are projected to continue their downward trend due to ongoing market pressures. In 2023, the brief relief experienced by panel makers due to rebounding TV panel prices was quickly overshadowed by the continued pressure to reduce costs from upstream component suppliers. This has led DDIC suppliers to focus on enhancing product designs for cost-effectiveness and building stronger partnerships with more economical foundries.

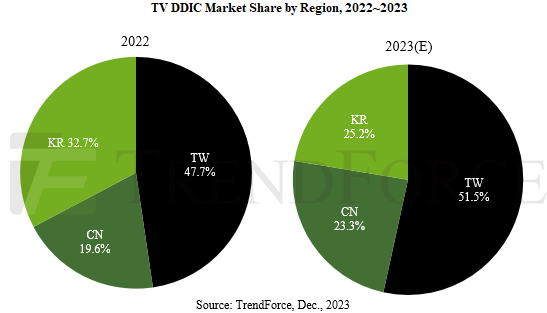

The rise of Chinese foundries has been a notable development in the market. Benefiting from government-backed domestic policies to expand production capabilities, these foundries have attracted DDIC suppliers with their competitive pricing strategies. Since the second half of 2023, these foundries have been operating at full capacity, driven by peak season demand, and are ambitiously expanding their production capacity. In contrast, Taiwanese 8-inch foundries are struggling in a tougher market environment, leading to less competitive pricing and reduced utilization rates to around 50%.

The first quarter of 2024 is expected to see a traditional market lull, with major panel makers likely maintaining capacity control measures to avoid overproduction and potential panel price declines. However, the second quarter may witness a surge in end-user demand, which could challenge the supply-demand equilibrium in the industry.