This article aims to summarise my SID 2021 business conference talk, on an area of thought that fascinates me: the role of the economics of display innovation and the role of innovation leadership in our industry. The basic argument, that I tried to put forward is in two pieces.

The first,is that there are two tiers of innovation leaders in our business; tier one, Apple and Samsung and tier 2, national groupings of the Taiwanese, Japanese and Chinese and second, that the bar for future technology innovations in QDEL, RGB IJP OLED, MicroLED and other technologies remains stubbornly high. Despite current profits, it may be that groups of companies will be required to pull of major industry shaking innovations in future more than leadership by single firms (such as SDC for RGB OLED and LGD for WOLED in the past).

The leadership board of innovation – Tier 1: Apple and Samsung: the Priest and the Pragmatist.

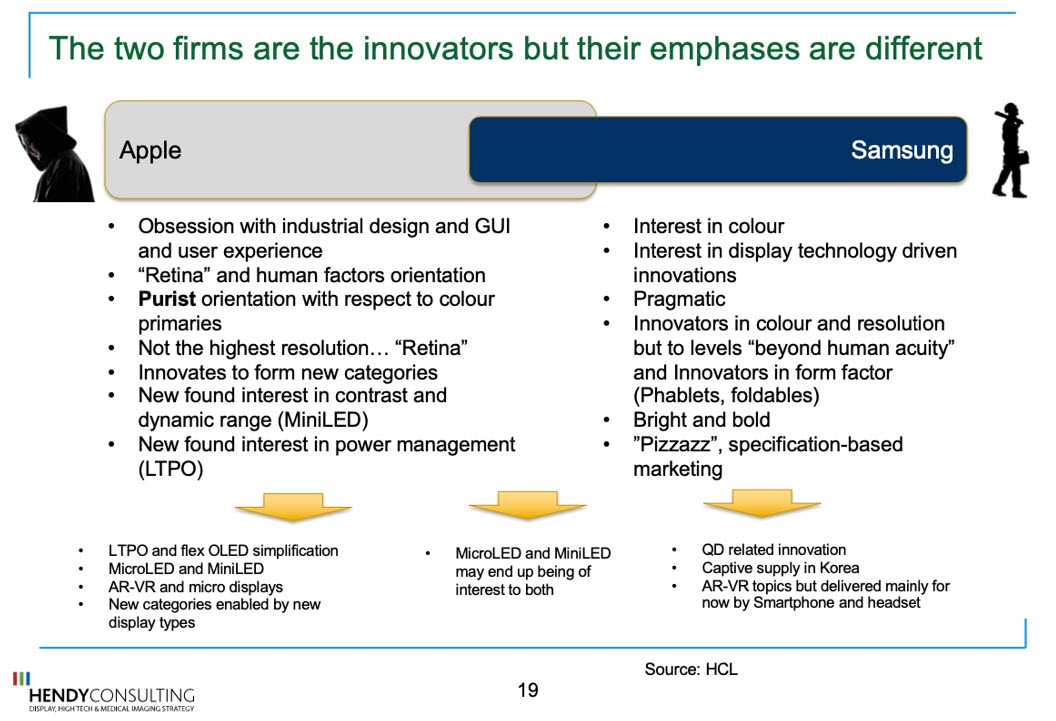

I think few observers of the industry would refute that top innovators in the industry include Samsung and Apple. My basic argument is that while both companies are deeply interested in product innovation in displays, that their emphases and methods differ.

Apple, “the priest” is obsessed with the human elements and industrial design implications – loves colour purity, loves dynamic range and loves form factor (including bezel, thickness). Apple innovates though a long hand over the industry working through leaders such as LGD and JDI by designing product and influencing adoption. Samsung, “the pragmatist”, on the other hand, is fascinated also with display innovation, but their essence is on “how to get there” themselves. They are fascinated with new materials and new equipment as part of a strategy to protect for their own use their own innovations.

This also means they have different emphases for the future (see Fig 1)

The leadership board of innovation – Tier 2. National groupings emerging

The second tier of the industry, then, is probably best classified as small national groupings: Taiwan, Japan and China. Taiwan might be best seen for the E-Ink Holdings innovations in electrophoretic displays, and the recent work on MicroLED for automotive where companies in Taiwan seem to be working together. Japan was noted for its work on the fundamental beginnings of the LCD industry, including such things as IPS mode (Hitachi) but also on the development of higher performance semiconductors (IGZO and LTPS). China can best perhaps be seen by their work and experience in Gen 10.5 mass production and more recently the work of CSOT and Juhua on printing and QDEL.

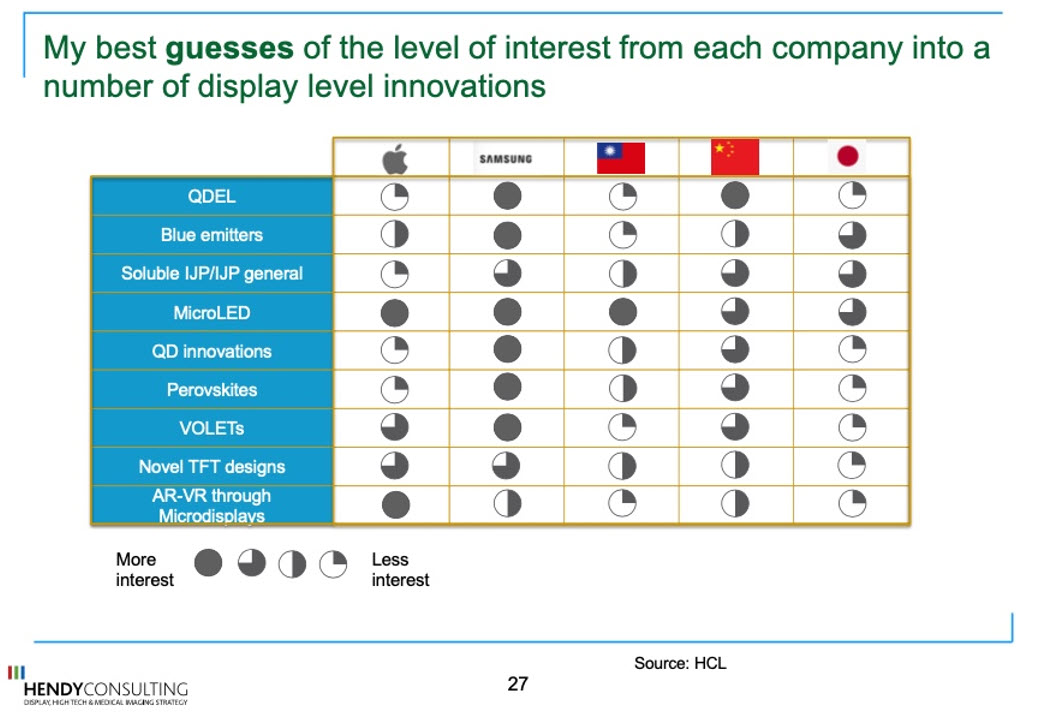

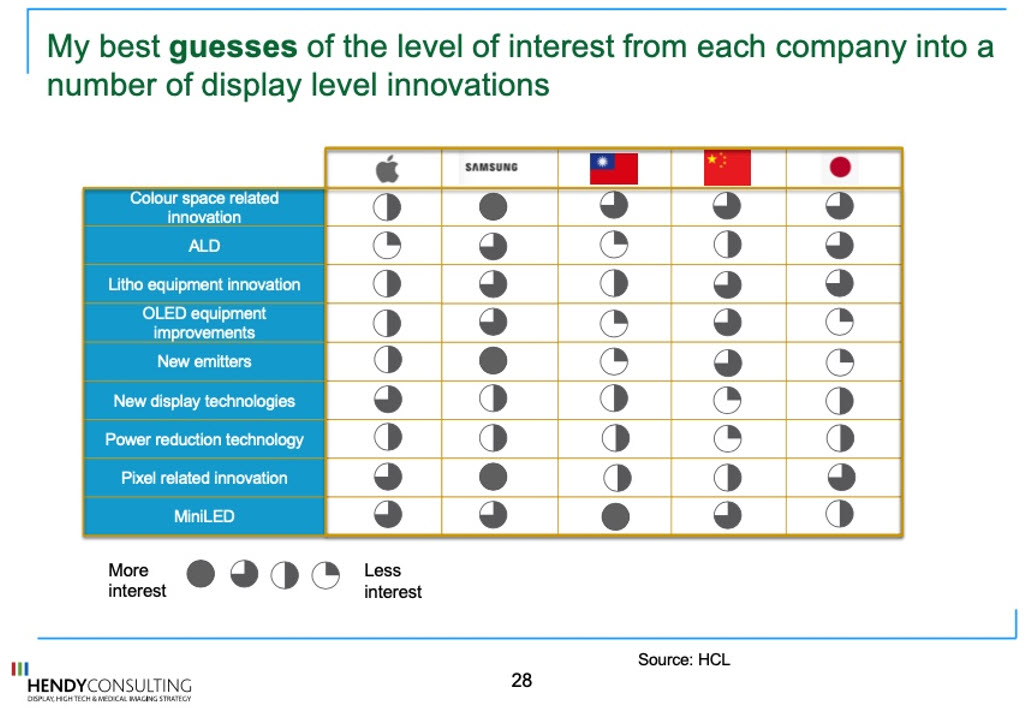

What is interesting in studying each of the groupings is the differential interest in new technology from each group (Fig 2 and Fig 3). This is what makes the display industry so fascinating to me. There is so much difference in competences, in history and in strategy player by player and that determines very different corporate approaches and interests. One of the roles of my business is to help match entrepreneurial display suppliers with the right customer.

Fig 2 and 3: So who might be interested in what based on analysing past behaviour?

My thesis: Will we see national or company-relationship-based innovation groupings this decade?

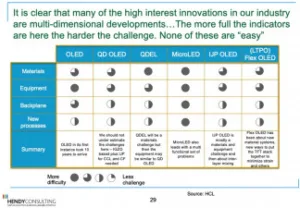

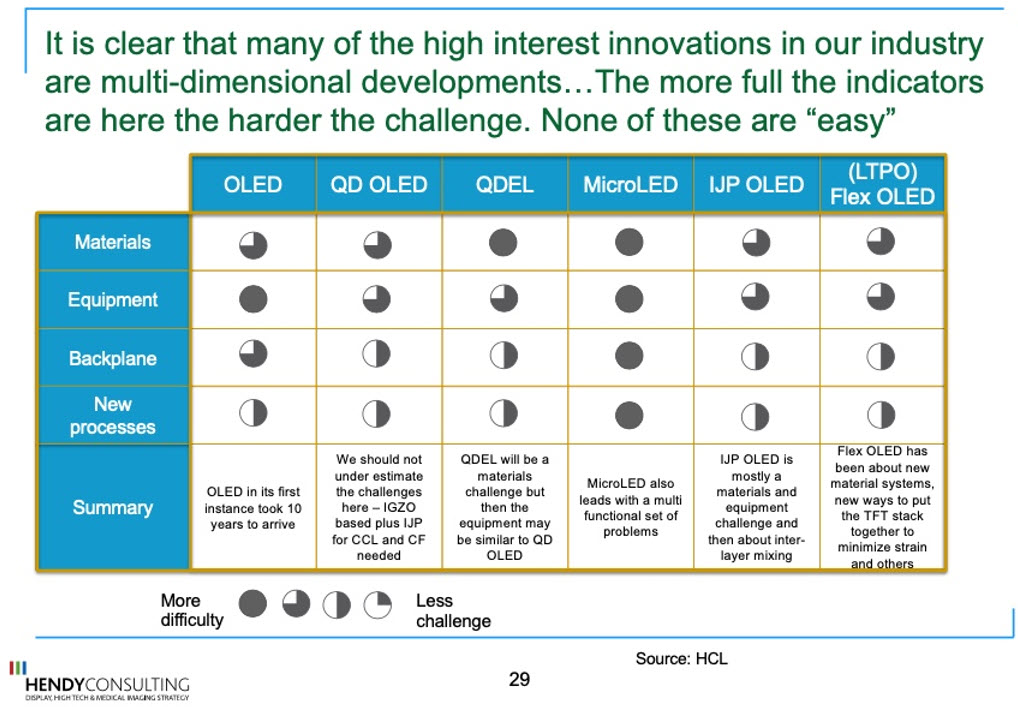

My second tentative assertion and idea, is that the bar for major novel technology (such as we have seen with top emission RGB OLED at SDC or WOLED at LGD) remains stubbornly high for the future. Figure 4 reviews some of the major technologies we see for the future with an idea of the difficulty that is implied in materials, equipment, backplane innovation or new processes.

A number of these are really challenging technologies, and one assertion that I make is that MicroLED may be one of the most difficult – there being challenges in materials (the new emitters), equipment (especially mass transfer), backplane (currently 9T+ tiled LTPS but probably moving to high performance IGZO long term) and process (many areas but including mass transfer, repair/redundancy, new driving approaches and others). This may mean the death-knell for single company dominance.

Clusters of companies may need to work together to pull off the biggest innovations of the next decade in displays. While we may see an emergence of national level innovation agendas (Koreans together for the continued leadership of Korea, for example), the alternative may be groupings of companies (e.g. Samsung-CSOT-JOLED) that seek to create the new ecosystems of tomorrow. Companies may need to learn to partner, and suppliers will need to be able to navigate much more complex groupings. (IH)

Ian Hendy is a Display Stategy Consultant based in London, UK. Hendy Consulting provides growth strategy, technology strategy and deal/M&A assessments for players throughout the display value chain. Amorphyx is a client of Hendy Consulting.