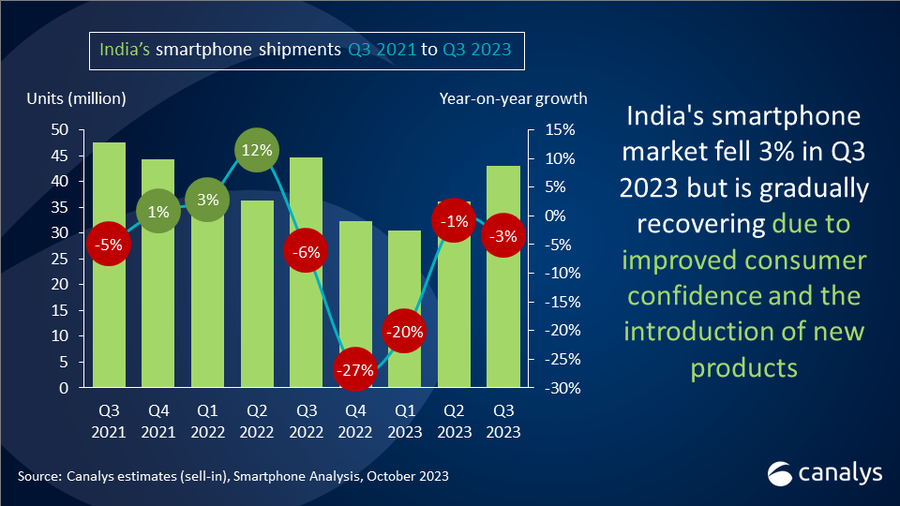

The India smartphone market shipped 43 million units in Q3’23, posting a mild 3% annual decline according to Canalys. While still contracting, the improved consumer environment allowed vendors to drive new product sales. The market is steadily recovering, but macro uncertainties persist.

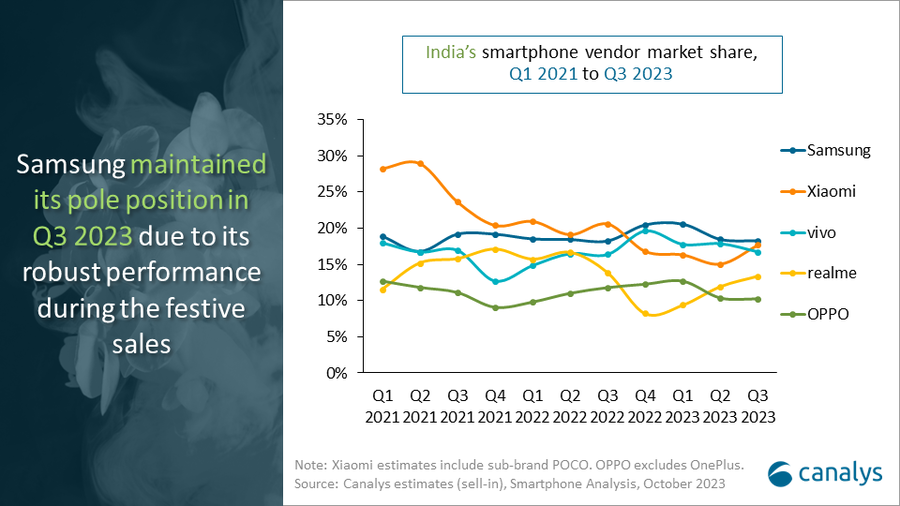

Samsung held onto first place with 18% share, shipping 7.9 million smartphones. Xiaomi advanced to second as affordable 5G devices like the Redmi 12 5G propelled 7.6 million shipments. Vivo, realme, and Oppo rounded out the top five.

Vendors strategically pushed new models and budget-friendly 5G options during festive sales promotions. Demand increased for mass-market 5G devices from Xiaomi, realme, and others. Premium 5G saw continued momentum from Samsung’s S23 series and older discounted iPhones.

Though the top brands declined annually, smaller players like OnePlus, Infinix, and Motorola grew share through expanded channel presence and new offerings. However, market conditions remain challenging. Oppo is prioritizing profits over volumes in India. Samsung streamlined its portfolio across segments.

Analysts caution that global headwinds could still derail India’s smartphone recovery in 2024, especially affecting entry-level price bands. However, India’s relative economic resilience provides optimism brands can adapt and maintain share.

| Vendor | Q3’23 Shipments (millions) | Q3’23 Share | Q3’22 Shipments (millions) | Q3’22 Share | Annual Δ |

|---|---|---|---|---|---|

| Samsung | 7.9 | 18% | 8.1 | 18% | -3% |

| Xiaomi | 7.6 | 18% | 9.2 | 21% | -17% |

| vivo | 7.2 | 17% | 7.3 | 16% | -1% |

| realme | 5.8 | 13% | 6.2 | 14% | -6% |

| Oppo | 4.4 | 10% | 5.3 | 12% | -16% |

| Others | 10.1 | 24% | 8.5 | 19% | 19% |

| Total | 43.0 | 100% | 44.6 | 100% | -3% |