Apple reported Q2’16 net profit of $10.5 billion, down 23% YoY from $13.6 billion. Turnover was $50.6 billion, down 13% YoY from $58 billion. The company experienced the first ever decline in iPhone sales by volume (down 16%), reflected in the lower financials. A bright spot was seen in the services business, where revenues rose 20% YoY.

The falling result marks the end of 13 straight years of revenue growth for Apple. The company – which spent only a single paragraph discussing the result in its press release – suffered from weakness in China, the lack of a key new product to drive sales and its own large size. Many iPhone markets are now saturated.

CEO Tim Cook described the result as a “pause” in growth, telling Wall Street analysts, “This, too, shall pass…The future of Apple is very bright.” He said that the result reflects the two-year release cycle of the iPhone; the new iPhone SE was released too late to affect Q2 sales.

Despite Cook’s words, Apple’s forecast for its fiscal Q3 was pretty dim; revenues will total between $41 billion and $43 billion, below analysts’ expectations.

Sales in Greater China (which includes Hong Kong and Taiwan) fell more sharply than any other region: 26% YoY. Sales in Mainland China (Apple’s second-largest market, after the USA) were down 11%.

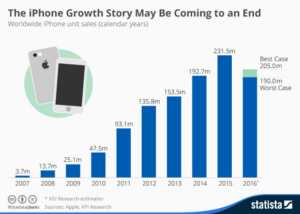

KGI Securities analyst Ming-Chi Kuo – who has been a reliable source of Apple forecasts in the past – expects annual iPhone sales to fall by a similar percentage to the Q2 result. Kuo forecasts sales of between 190 million and 205 million, which would translate into a decline of 12% – 18%. However, sales will recover in 2017.

Analyst Comment

Apple’s result follows a trend seen in many industries: companies cannot maintain high growth levels when they reach such large sizes. Additionally – like many American firms – Apple has been hurt by the strong US dollar. (TA)