For observers of the display industry over a long horizon, it is pretty clear that Apple and Samsung have had a major impact on innovation and the introduction of new technologies. From the first iPhone in 2007 that fundamentally changed the way the market thought about a display on a handheld device and the role of capacitive touch, to the role of Samsung in driving OLED in smartphones and phablets, these two firms have made major changes to how all of us see and use displays. These are probably the two most innovative groupings in the industry.

The aim of this article is to highlight some of the major innovations and then to ask the question “What innovations would we expect to appeal to either in the future?”

Case examples of key innovations:

What is clear is that the Apple and the Samsung group of companies have different roles and interests in the display market. While Apple manages its role at arms-length and uses third party suppliers to execute on its innovations, Samsung has its own vertically integrated display company, SDC. This means that, on balance, Apple is a purist – fascinated with industrial design and visual human factors – whereas Samsung is a pragmatist and fascinated both with device innovation, but also with manufacturing process innovation. These are the themes of this debate – the priest and the pragmatist. What is it that they want and have supported in the past, and what might they be interested in in the future?

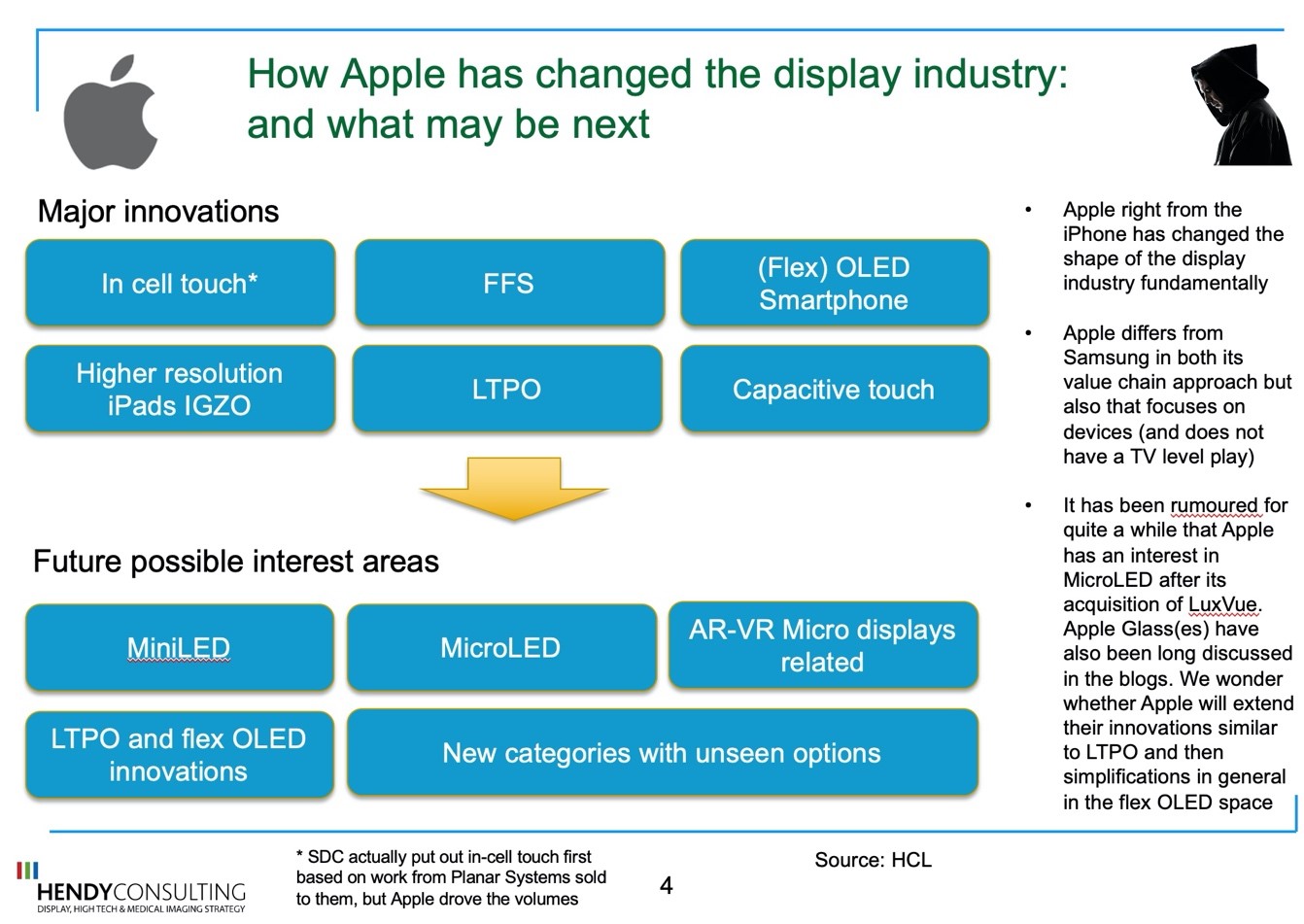

Apple

Apple pushed the first iPhone display, that moved the market from smaller transflective TFT designs as developed by the then leader, Nokia, to what we now know as a large, PCap-touch enabled transmissive LCDs. Sharp was the immediate beneficiary in those days – back when Apple was a new market entrant.

Apple has championed TFT device designs like the FFS pixel design (a variant of an IPS pixel structure). This led to the broad licensing of this piece of Hydis technology that was purchased by E Ink Holdings (EIH), leading to a multi-hundred-million-dollar stream of licensing income for EIH.

More recently, Apple has championed the LTPO process: a high-mask innovation combining the low leakage current of oxide with the stability of LTPS. The combination delivers a 5-15% power-saving for flexible OLED displays – and was considered a breakthrough by Apple to get to an “all-day-on” Apple watch display.

These are only a few of the key innovations that Apple has championed and Apple is not standing still: its interests for now include Mini and MicroLEDs, after the purchase of LuxVue, in Apple Glass type innovations. Their purchase of the Qualcomm fab in Taiwan has led to them taking more and more direct interest in device innovations – such as the LTPO case – and we expect to see further ideas and innovations here.

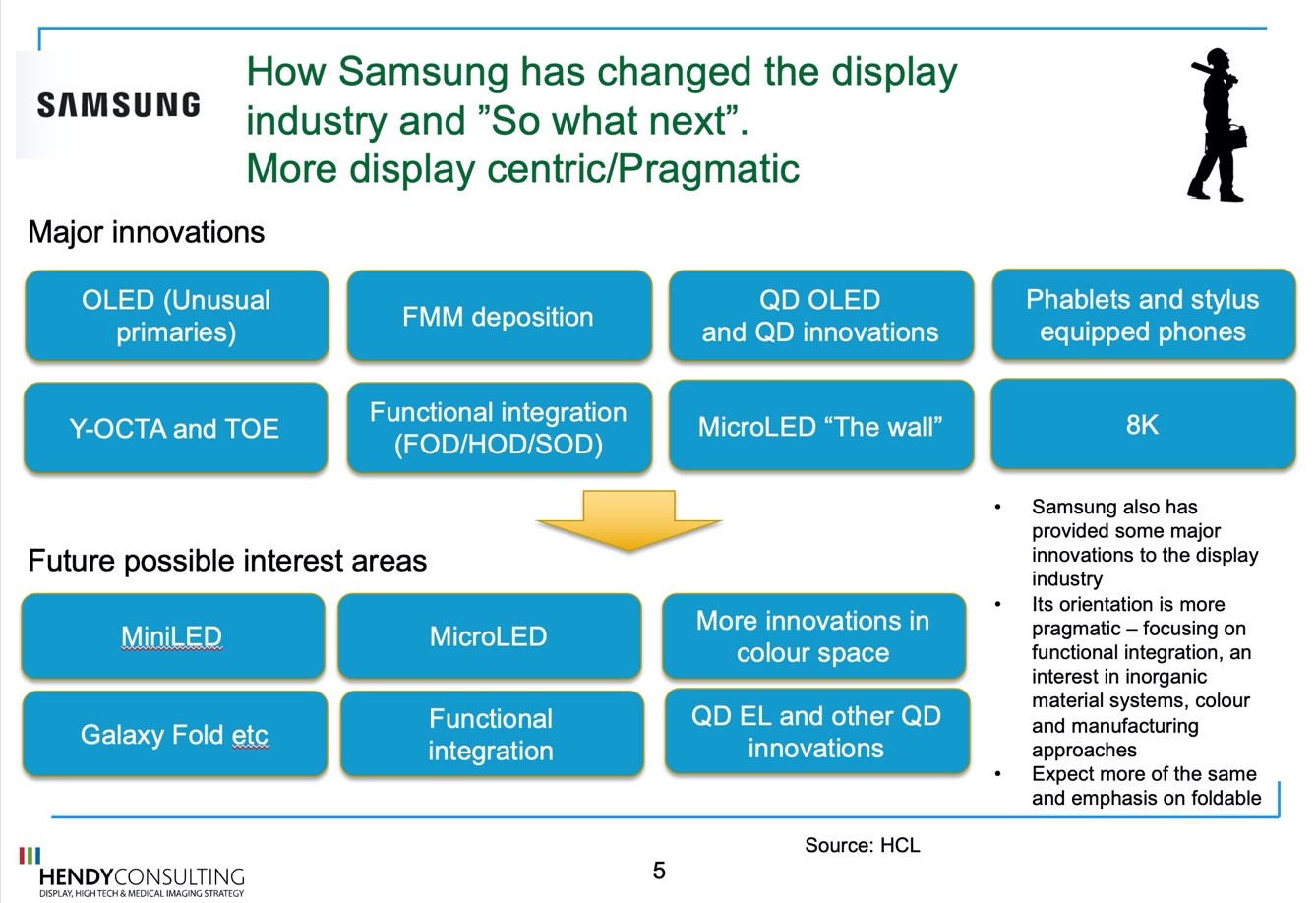

Samsung

When we talk about Samsung, we need to distinguish between Samsung Electronics, the parent company and Samsung Display Corp, the in-house display company. Samsung (SDC) was the father of OLED (in a former life as SDI). It developed the key processes for top emission RGB rigid and flexible OLEDs, including working on fine metal mask evaporation techniques with Tokki, TFE top encapsulation layers with Vitex and AMAT/Kateeva, and flexible/foldable processing with a number of material and equipment players.

It pioneered non-side-by-side pixel approaches to allow for early OLED displays. More recently it has been fascinated both by new emissive technology innovations for TV, such as QD OLED and QNED (and this is one way in which the Samsung group of companies differs from Apple, that has no TV device play). (Are Quantum Nano Emitting Diodes (QNEDs) the Next Big Thing?)

Samsung Electronics (SEC) on the other hand has innovated by driving the role of phablets, the role of the stylus (with the Note series of smartphones) and has shown real interest in MicroLED for large panel applications (“The Wall”).

We expect more from the Samsung cluster, with key themes being the role of QD and LED based innovations, and of functional integration and of form-factor innovation (foldables).

Future innovations

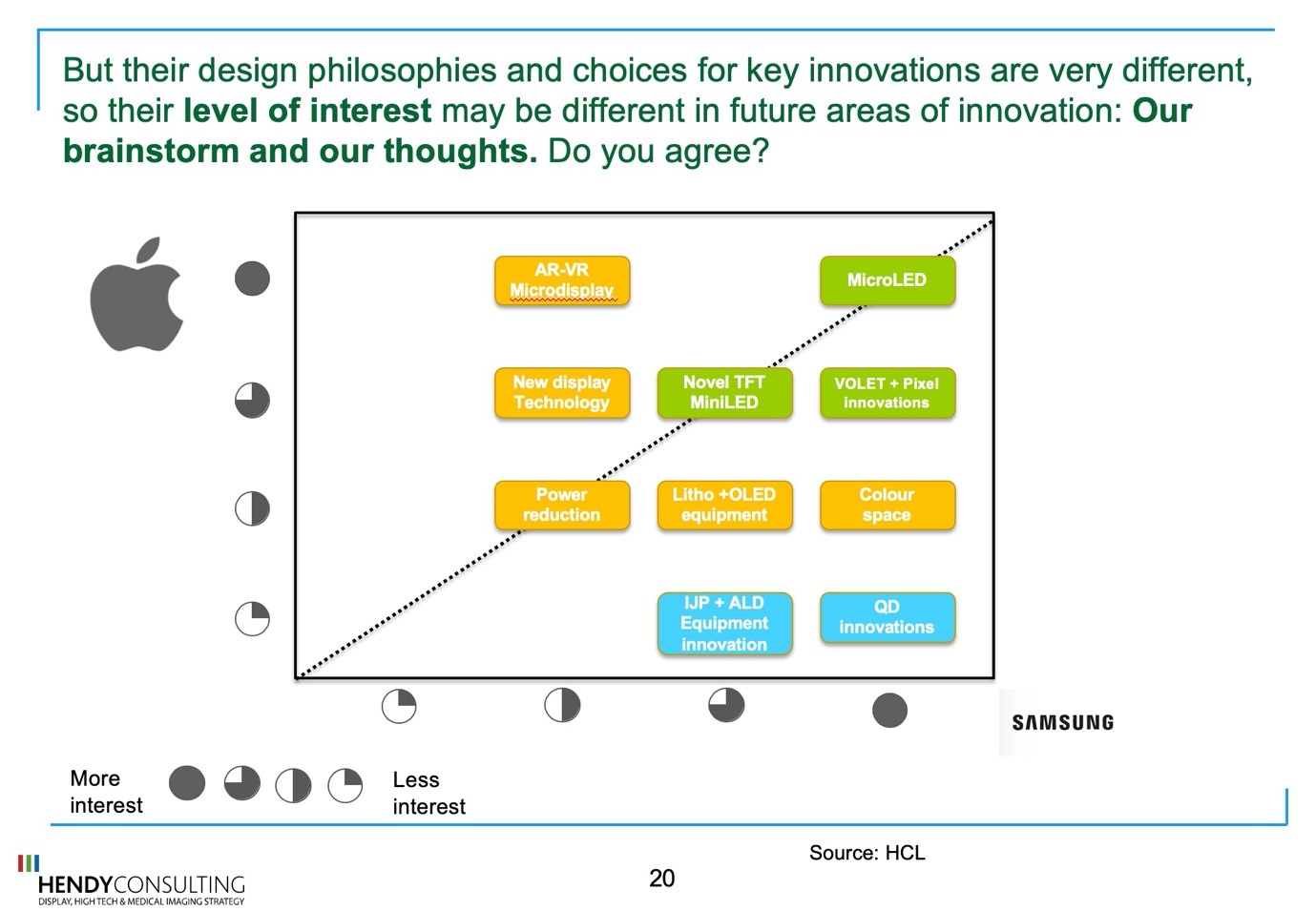

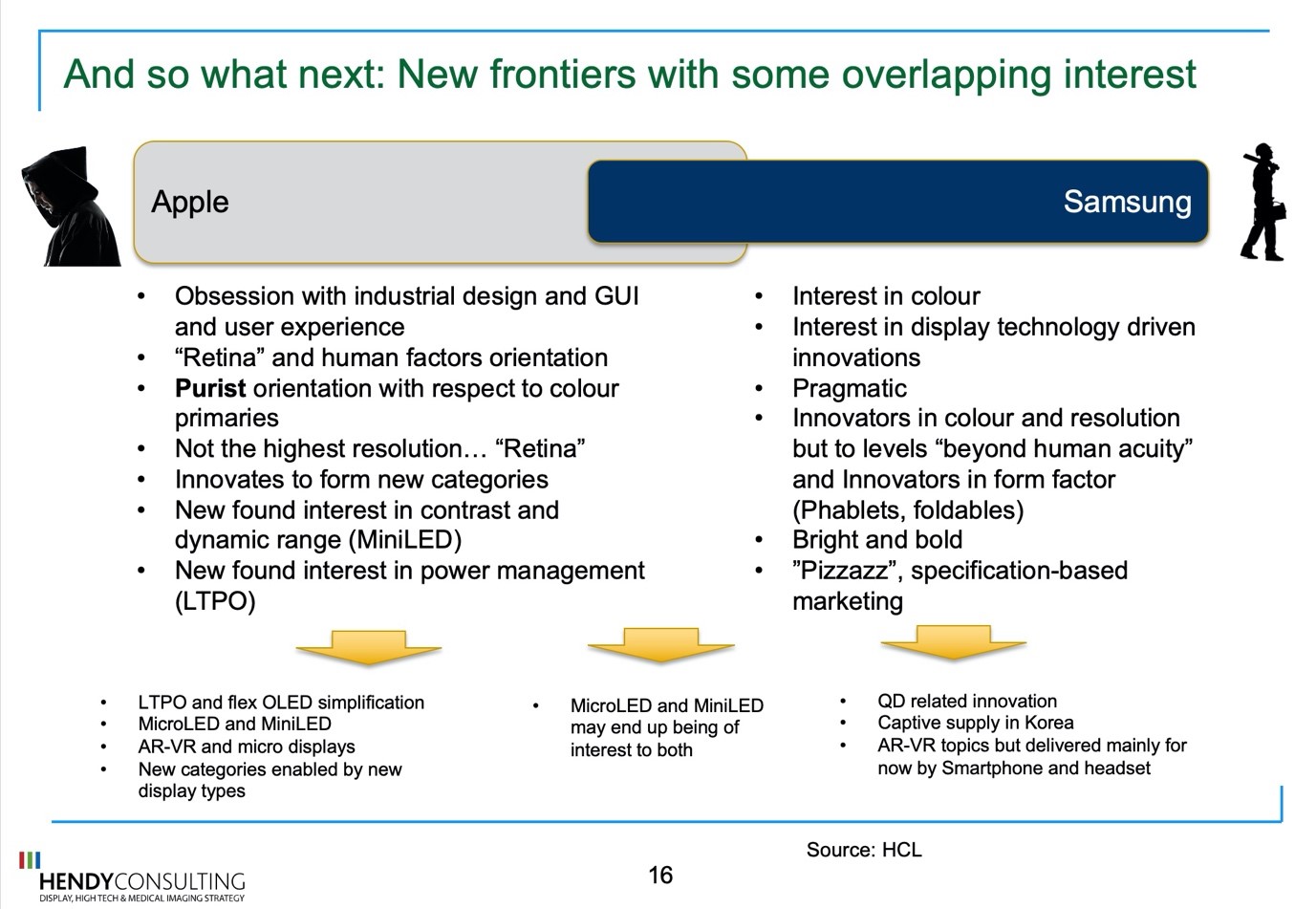

The two companies are both prime innovators, but different: the priest and the pragmatist.

What might we expect from the two of them going forward? The two do have very different focuses and Samsung has much more interest in manufacturing-based innovation. What is fascinating is that Mini and MicroLED innovations are of importance to both, if for different reasons: Samsung Electronics is interested for TV and signage, and Apple for Smartwatches.

One can indeed try to trace back a pattern of things that both have shown interest in over the years. Based on this we can try to guess, and these are indeed guesses, on areas of interest for them both in the future. Samsung is still more likely to be interested in manufacturing breakthroughs and the theme of innovation around QD or related LED material systems seems important. Integrated functionality is a key SDC theme and both SEC and SDC have shown support for foldables.

Apple, in the meantime, may well show more and more interest in the fine detail of TFT device design building on their work on LTPO. They have in house work on Apple glass(es) and MicroLED smartwatches and may even support new display technologies that are not today mainstream.

Overall, the era of inorganic material systems seems on the ascendancy and colour and high dynamic range remain important. Beyond this there are new thrusts, lowering power, increasing form factor innovation and delivering the consumer better, brighter displays.

Both Apple and Samsung have a high capability to define complete new categories of display-related products. Their innovations change the shape of the display market as each key innovation ripples through the display industry with several display companies supporting each innovation. These moves create technologies, support the development of new equipment and new materials. We look forward to a continuous era of display innovation and to watching the moves of Apple and Samsung. (IH)

Ian Hendy is CEO of Hendy Consulting. Hendy Consulting is a management consulting company focus on the display and related high technology industries. We advise multinationals and start-ups alike on issues of technology innovation, market entry, growth, M&A target assessment and many other areas. Contact [email protected] for more information.

The whole of this presentation on Apple and Samsung can be found at www.hendyconsulting.com/downloads/Apple and Samsung in displays.pdf