Despite the low seasonality factor and brands turning their focus away from volume growth, the demand for large display panels showed better-than-expected results in the first quarter of 2018, albeit still weak, according to IHS Markit.

The first quarter of each year is typically a slow season for the display market as set brands try to clear out carried inventories before they launch new models. In addition, particularly this year, top-tier brands were expected to stop focusing on volume growth, which lowered market expectation of panel demand.

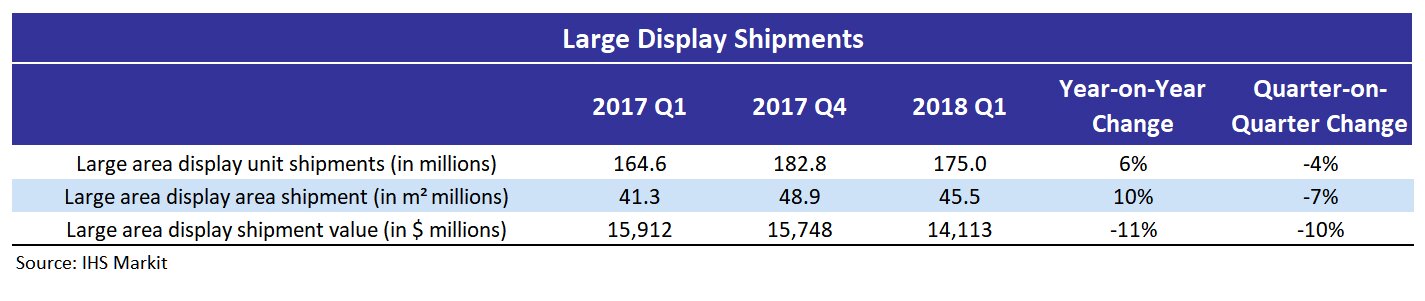

However, compared to a year ago, shipments of large displays — larger than 9″ — increased by 6% in terms of units and by 10% in terms of area.

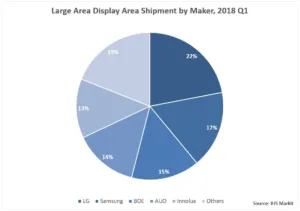

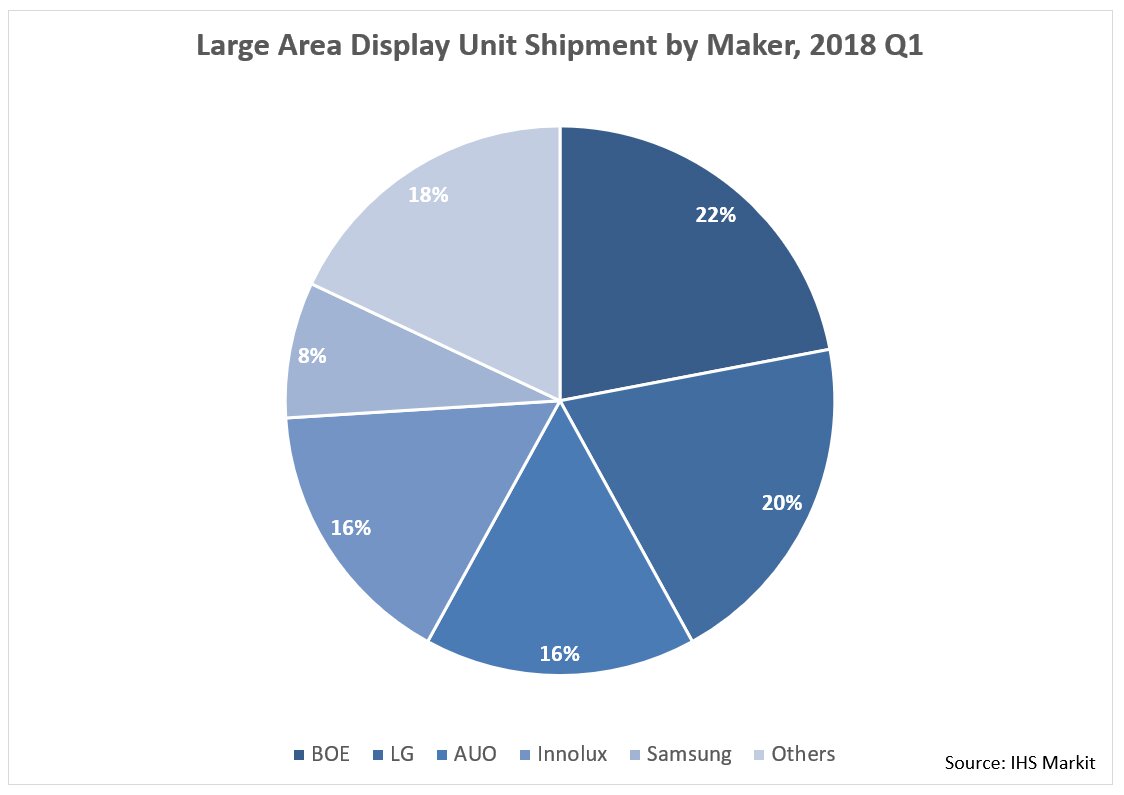

LG retained its lead in the large display panel market in terms of area shipments with a stake of 22%, followed by Samsung with 17%. In terms of unit shipments, BOE led the market with a 22% share. Principal analyst Robin Wu commented:

“In area shipments, South Korean panel makers keep their leading position in the large display market as they are strong in the TV display market”.

Shipments of TV displays increased by 12% in terms of units and by 11% in terms of area in the first quarter of 2018, compared to a year ago, leading to the better-than-expected trend. In particular, unit shipments of 55″-and-larger TV panels jumped 20% year-on-year in the first quarter.

Ultra HD TV display unit shipments also increased by 19% during the same period to 24.6 million units and OLED TV display shipments reached some 600,000 units, with a 110% year-on-year growth. Wu continued:

“Increases in large display panel production capacity, particularly in China, helped the year-on-year shipment growth, which was somewhat expected but if you look at the shipment growth in quarter-on-quarter terms, it is quite interesting”.

For the past three years from 2015 to 2017, on average, unit shipments of large display declined 10% in the first quarters compared to the previous quarter, and area shipments were down 8%. Wu also said:

“This year also shows declines in the first quarter with a 4% drop in unit shipments and 7% down in area shipments, but the contraction is narrower than previous years. This indicates the shipment trend in first quarter 2018 was better than expected”.

However, Wu noted that shipments dropped 10% in value due to continued erosion in panel price, which began in mid-2017.

“The major concerns to panel makers is how to achieve a turnaround in panel prices and when. Trends in TV display panels that are shifting to larger sizes and heading to higher-end products can be the key to overcome the challenge”.