Global TV shipments increased by 7.9% to 50.6 million units in the first quarter of 2018 compared to a year ago, according to IHS Markit. LCD TV shipments rose 7.5% to 50.1 million units and OLED TV shipments jumped 115.8% to about 470,000 units during the same period.

According to the report, LCD TV unit shipments declined 3.6% in 2017. Average retail price hasn’t dropped as much as expected and that negatively impacted consumer demand in many regions. However, declines in LCD panel prices during late 2017 and early 2018 have led to better end-market pricing in the first quarter of 2018, and TV brands have increased shipments in advance of the 2018 World Cup for promotional activities in some key emerging market regions. Executive director Paul Gagnon commented:

“Emerging markets like Latin America typically see strong seasonal response to the World Cup. Particularly in Eastern Europe, with the World Cup taking place in Russia this summer, demand is expected to rise in the region”.

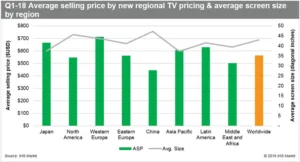

TV shipments in Latin America surged 40% in the first quarter of 2018 compared to a year ago, with a significant increase in 50″ and larger TV shipments. As a result, Latin America had the highest average selling price among emerging market regions.

China had the lowest average selling price among the eight regions covered in the report at $446, despite having the largest average screen size at 47.3″. Western Europe has the highest average price at over $712 on a price-per-inch basis, with less severe pricing competition and the second highest UHD mix among the regions. Gagnon concluded:

“Lower LCD panel prices are enabling more aggressive pricing competition among local brands in China”.