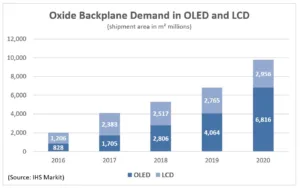

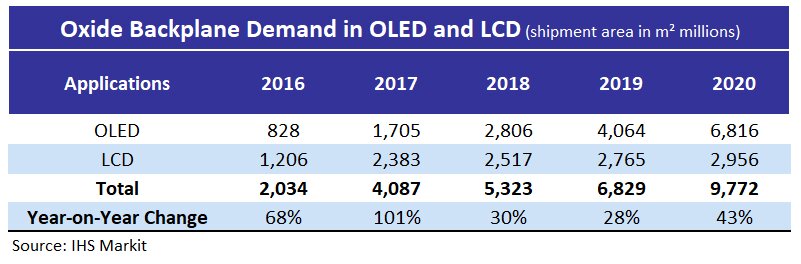

Demand for panels—both TFT LCD and AMOLED—using oxide backplane technology doubled in 2017, in terms of area, compared to a year ago, according to a report from IHS Markit. The market is forecast to grow 30% in 2018 to 5.3 billion m². Oxide backplane technology offers the benefit of higher resolution while consuming less power, which is better suited to IT consumer products that require high mobility.

With Apple’s increasing adoption of oxide TFT LCD panels for its tablet and notebook products in 2017, demand surged 98% year-on-year in 2017. Area demand for OLED TV panels using the oxide backplane technology also increased by 106% during the same period. Principal analyst Linda Lin said:

“Demand for oxide panels will continue to grow in 2018 along with increasing demand for OLED TVs with 55″ or larger screens. Increasing demand from IT products and rising penetration of OLED panels will help growing demand for LCD and OLED panels using oxide backplane technology in 2018”.

Panels using oxide backplane technology are mainly supplied by Sharp and LG Display. While Sharp is focusing on TFT LCD for IT applications, LG Display is targeting OLED panels for TVs. Both are planning to expand their oxide capacity in 2018.

Sharp’s 6G fab in Kameyama, Japan is solely dedicated to producing LTPS panels. To grab more orders for the Apple iPad, the company is going to change 40% of its LTPS capacity to oxide at the end of 2018.

Its 8G fab in Kameyama is also planning to gradually increase the oxide capacity, from 50% of its capacity in the last quarter of 2017 to 75% by the end of 2018. On the other hand, panel price will be key in increasing the technology’s market share and a deciding factor as to whether Sharp can continue to increase its capacity in the future.

LG Display also plans to increase its oxide panel capacity to prepare for growth in its OLED TV panel business. Its 8.5G OLED fab in Guangzhou, China plans to start mass production of oxide backplane OLED panels in the second half of 2019, with a capacity of 60,000 units per month. In Paju, South Korea, the company is also working to build 10.5G fabs for both a-Si and oxide backplane panels.