At the (almost) standing room only Display Week Business Conference to kick off the Society for Information Display’s yearly symposium and expo, the pre-show audience was flooded with marketing data from presentations documenting the past – benchmarking the present – and predicting the future of all things display.

In his talk “Flat Panel Display – Is Low Cost the Only Path to Success?” Senior Director at IHS, David Hsieh compared LCD TV panel brands versus profits, looked at the flat panel capacity numbers for this year and next, revealed trends in the move to smart display technology, and higher pixel density across virtually all application types and even had time to examine the AMOLED market. His conclusion to the question on the single path to success being low cost is decidedly not, as value increase will continue to drive both differentiation and profitability in the industry. Here’s how.

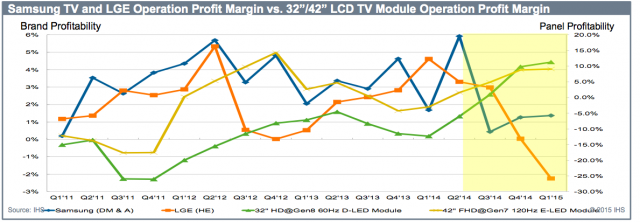

To start, Hsieh said he wanted to “scare” us showing how, as panel profitability rose, TV set profitability declined. His chart tracked the operating profit margin of number one and two TV set suppliers, Samsung and LG versus the cost of the LCD modules. He used 32- and 42-inch LCD TV’s as representative sizes for the industry. Hsieh said that part of the reason for this situation is the LCD module is 70-80% of the cost of an LCD TV set, and most of the value-added features are in the LCD panel rather than the TV chassis. Another factor is LCD panel capacity, where LCD component shortages can drive prices up making for an unsustainable long term business model for LCD TV set makers.

To start, Hsieh said he wanted to “scare” us showing how, as panel profitability rose, TV set profitability declined. His chart tracked the operating profit margin of number one and two TV set suppliers, Samsung and LG versus the cost of the LCD modules. He used 32- and 42-inch LCD TV’s as representative sizes for the industry. Hsieh said that part of the reason for this situation is the LCD module is 70-80% of the cost of an LCD TV set, and most of the value-added features are in the LCD panel rather than the TV chassis. Another factor is LCD panel capacity, where LCD component shortages can drive prices up making for an unsustainable long term business model for LCD TV set makers.

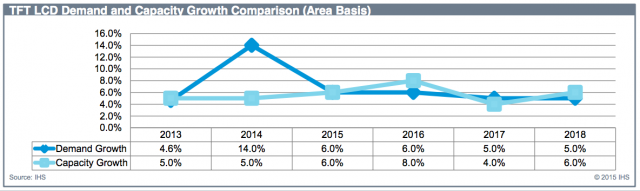

But Hsieh showed that the capacity versus demand balance is beginning to stabilize. His chart indicated that over the next four years, 2015 to 2018 we should see demand and capacity growth difference expanding to no greater than 2% (in 2016) leading to “…a very stabilized state in demand versus supply for the industry”, he said. This creates a much better chance for the industry to achieve and maintain profitability in the mid term.

But Hsieh showed that the capacity versus demand balance is beginning to stabilize. His chart indicated that over the next four years, 2015 to 2018 we should see demand and capacity growth difference expanding to no greater than 2% (in 2016) leading to “…a very stabilized state in demand versus supply for the industry”, he said. This creates a much better chance for the industry to achieve and maintain profitability in the mid term.

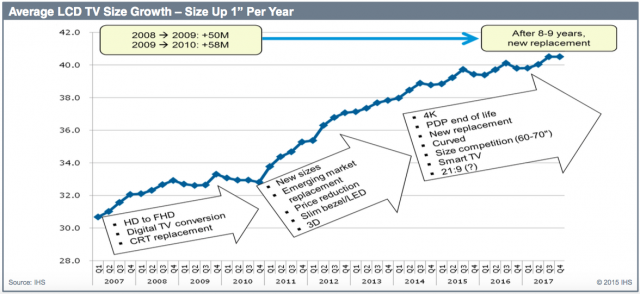

Part of this stability is due to LCD TV area growth that helps to “digest” the growing supply of LCD panel capacity. In fact between 2007 and 2017 IHS reckons the average size TV display (globally) will have grown from 31-, to 41-inch, roughly 1-inch in diagonal size per year over that 10 year period. Overall demand area growth is tracking at >4% for LCD panels and as long as this continues Hsieh sees supply/demand stability going forward.

There is also the trend of moving toward “smart displays” not just in phones but basically all display applications from mobile and wearable devices to fixed TV and monitor displays. To IHS, a “smart” display requires higher resolution, better color, slim and light weight and smarter interface such as touch integration. Going even further, Achin Bhowmik of Intel in a later presentation showed its Real Sense technology giving devices sensing ability in 3D space that helps discern “user intent” in an intuitive way and taking “smart” to a whole new level.

There is also the trend of moving toward “smart displays” not just in phones but basically all display applications from mobile and wearable devices to fixed TV and monitor displays. To IHS, a “smart” display requires higher resolution, better color, slim and light weight and smarter interface such as touch integration. Going even further, Achin Bhowmik of Intel in a later presentation showed its Real Sense technology giving devices sensing ability in 3D space that helps discern “user intent” in an intuitive way and taking “smart” to a whole new level.

Beyond this, we are also seeing 4k resolution panels become a standard not just in the TV space, but moving into the mobile domain as well. In fact IHS reckons that the 4k display market will hit a whopping 35% of the display industry or $52B (billion) by the end of the decade (2020). Top application areas beyond fixed placed displays and will include smartphones and tablets, according to IHS.

IHS is tracking value increase initiatives in both display products and on the process side. Some examples of gaining higher value displays include: Bigger size and size diversity, and in the TV space that includes 32-, 39-, 42-, 43-, 46-, 47-, 48-, 49-inch diagonal. Resolution gains including HD and UHD, wide color gamut, higher brightness\lower power consumption (particularly for mobiles), dynamic contract, slim and ultra slim bezel, even no bezel, curved and flexible displays with a long term eye toward foldable, plus moving to niche markets like the booming automotive, and more stable public display markets. Some of the top value up initiatives on the display process side include: AMOLED, LTPS TFT LCD, Oxide, Copper (Cu) process for faster electronics mobility, and thinner glass substrates.

Suffice it to say the industry is still driven by lower cost displays, but it’s the higher value add on that will help display makers move from a low margin commodity product to higher profits while delivering on the ever expanding needs of the customer. – Steve Sechrist