After declining 0.3% in 2017, the worldwide smartphone market is expected to contract again in 2018 before returning to growth in 2019 and beyond, according to IDC.

After declining 0.3% in 2017, the worldwide smartphone market is expected to contract again in 2018 before returning to growth in 2019 and beyond, according to IDC.

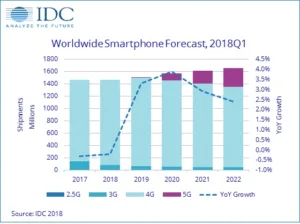

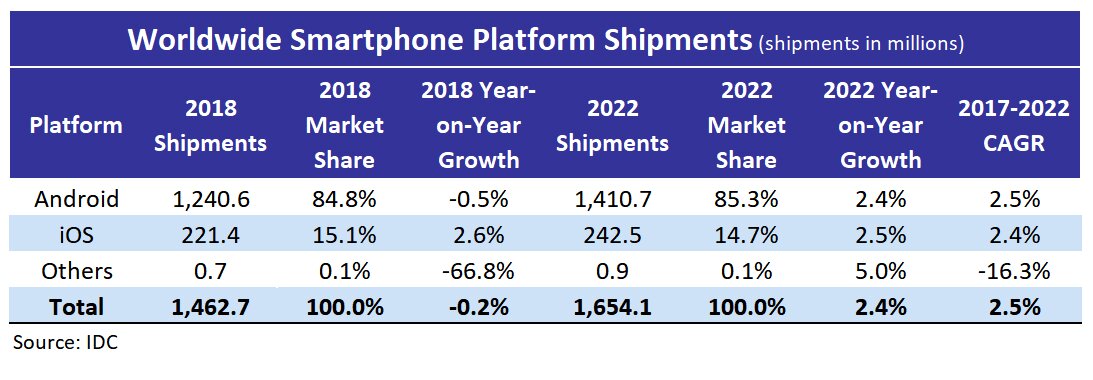

Smartphone shipments are forecast to drop 0.2% in 2018 to 1.462 billion units, which is down from 1.465 billion in 2017 and 1.469 billion in 2016. IDC expects the market is to grow roughly 3% annually from 2019 onwards, with worldwide shipment volume reaching 1.654 billion in 2022 and a five-year CAGR of 2.5%.

The biggest driver of the 2017 downturn was China, which saw its smartphone market decline 4.9% year-on-year. Tough times are expected to continue in 2018 as consumption in China declines another 7.1%, before flattening out in 2019. The biggest upside in Asia/Pacific continues to be India, with volumes expected to grow 14% and 16% in 2018 and 2019.

Chinese OEMs will continue their strategy of selling large volumes of low-end devices by shifting their focus from China to India. So far, most have been able to get around the recently-introduced India import tariffs by doing final device assembly at local Indian manufacturing plants. Most components are still being sourced from China. IDC’s Ryan Reith commented:

“With 2017 now behind us, a lot of interesting market dynamics are unfolding. Even though it declined 5% in 2017, China remains the focal point for many, given that it consumes roughly 30% of the world’s smartphones. However, plenty of pockets of growth can be found beyond China.

India is now grabbing headlines and the market itself is going through some rapid transformation. Local India manufacturing continues to ramp up, despite still having a heavy dependence on China for components. The boom in India is likely to continue in the years to come but the move toward building up local production has certainly caught the eye of many in the industry”.

Outside Asia/Pacific, the biggest regions for growth will be the Middle East, Africa and Latin America. All three regions have relatively low penetration rates and plenty of upside potential. Economic challenges have been the main inhibitor over the past two years, but IDC expects consumer spending to rise throughout the forecast, and smartphones to be a big benefactor.

The other catalyst to watch will be the introduction of 5G smartphones. IDC predicts the first commercially ready 5G smartphones will appear in the second half of 2019, with a ramp up across most regions happening in 2020. IDC projects 5G smartphone volumes to account for roughly 7% of all smartphones in 2020 or 212 million in total. The share of 5G devices should grow to 18% of total volumes by 2022. IDC’s Anthony Scarsella also said:

“Although overall smartphone shipments will decline slightly in 2018, the ASP of a smartphone will reach $345, up 10.3% from $313 in 2017. This year will continue to focus on the ultra-high-end segment of the market as we expect a surge of premium flagship devices to launch in developed markets in 2018.

Devices featuring large AMOLED bezel-less displays, advanced camera functions and an overall increase in speed and performance will be the driving factor in the increase of ASPs. Moving forward, we can expect this trend to continue as the ASP for a smartphone will continue to grow throughout the forecast period. In 2022, the final year of our forecast period, the ASP for a smartphone will be $362, resulting in a five-year CAGR of 2.9%”.

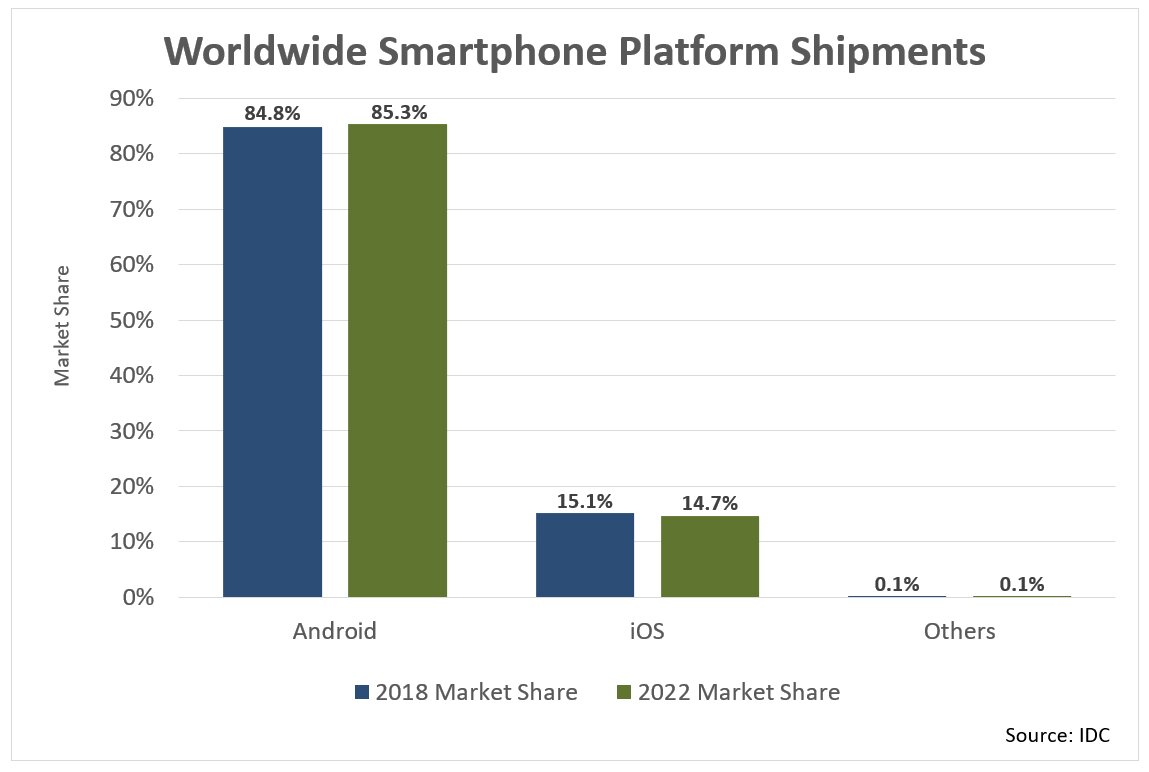

Android’s share of total smartphones is expected to remain relatively stable at 85% of total shipments worldwide. Volumes are expected to grow at a five-year CAGR of 2.5%, with shipments totalling 1.41 billion by 2022. There is no question that Android is the OS of choice for the mass market and nothing leads us to believe this will change.

Given the large number of Chinese OEMs dependent on Google’s OS, as well as components from other US companies like Qualcomm, it will be interesting to see how things develop with all the discussion about a US-China trade war.

Android OEMs continue to drive down the coast of new technology features at a rapid pace. IDC estimates that 98% of Android phones will ship with screens larger than 5″ by 2022, with 36% being 6″ or larger. While some of this will remain premium flagship models, the aggregate ASP of Android phones with a 6″ screen or greater by 2022 is projected to be $414.

iPhone volumes are expected to grow 2.6% in 2018 to 221 million in total. IDC is forecasting iPhones to grow at a five-year CAGR of 2.4%, reaching volumes of 242 million by 2022. With rumours of some upcoming larger-screen iOS smartphones, IDC has changed its screen size forecast for Apple by introducing volumes greater than 6″.

Products are likely to begin shipping in the fourth quarter of 2018, with volumes ramping up and accounting for 36% of all iPhones shipped by 2022.