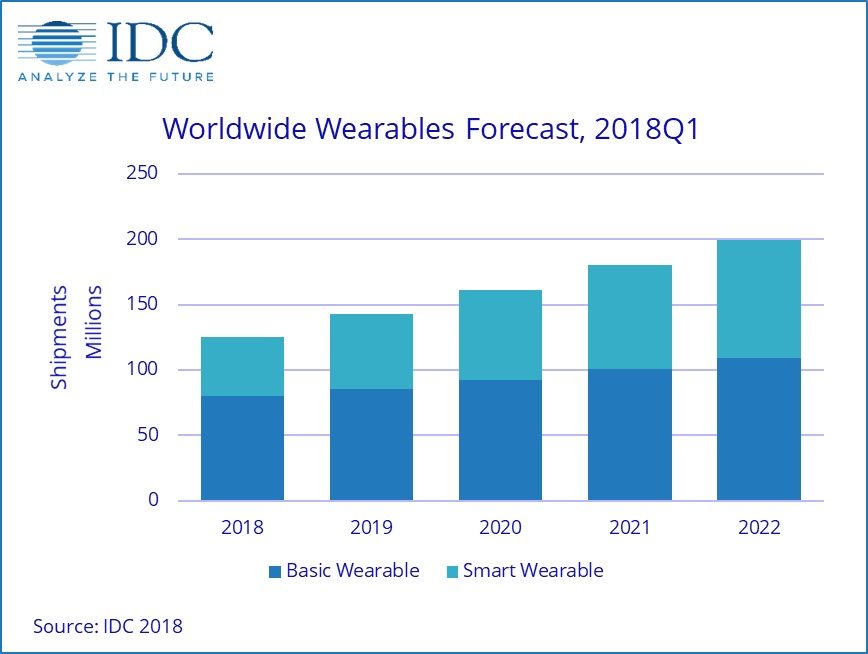

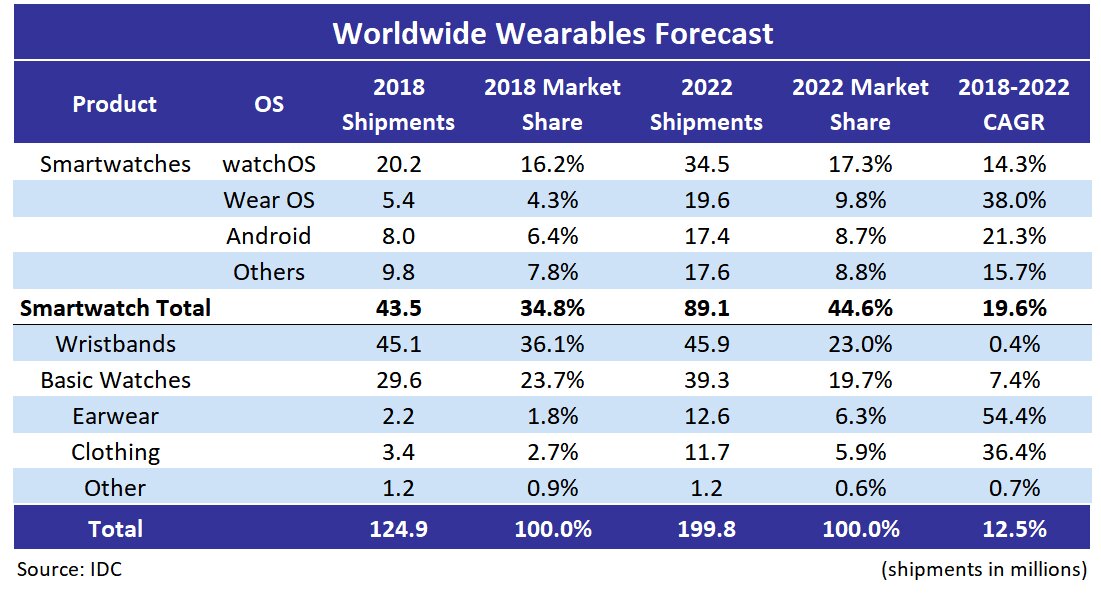

The worldwide wearables market is forecast to ship 124.9 million units by the end of 2018, up 8.2% from the prior year, according to IDC. Although this growth is slightly lower than the 10.3% growth experienced in 2017, the market is expected to return to double-digit growth from 2019 until 2022 as smartwatches and other form-factors grow in popularity.

Senior research analyst Jitesh Ubrani commented:

“The shift in consumer preferences towards smartwatches has been in full swing these past few quarters and we expect that to continue in the coming years. While Apple will undoubtedly lead in this category, what bears watching is how Google and its partners move forward.

WearOS (formerly Android Wear) has been somewhat of a laggard recently and despite expected changes to the OS and the release of new silicon, we anticipate Android-based watches to be WearOS’ closest competitor due to the high amount of customisation available to vendors and the lack of Google services in China”.

Research director Ramon T. Llamas also said:

“A

dditionally, keep an eye on the other smartwatch platforms, including Fitbit OS, Garmin’s Connected IQ and Samsung’s Tizen. Fitbit’s Versa has had a warm reception in the market and Garmin’s devices have had a steady presence for many quarters. Expect both companies to dive deeper into health and fitness, while exploring new areas as well. Samsung, meanwhile, continues to make strides in the commercial space, including health care and wearable workflows.

The smartwatches of 2022, even 2020, will make today’s smartwatches seem quaint. Health and fitness is a strong start but when you include cellular connectivity, integration with other IoT devices and systems, and how smartwatches can enable greater efficiencies, the smartwatch market is heading for steady growth in the years to come”.

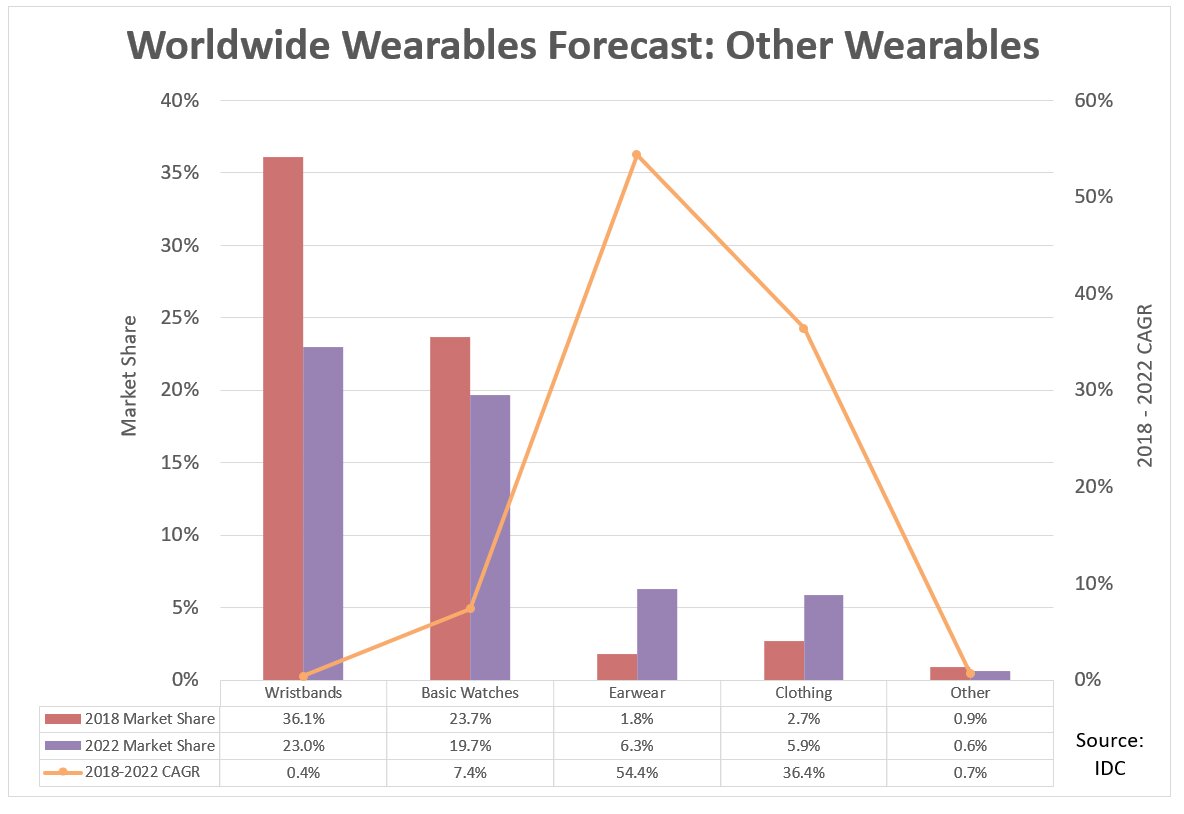

Beyond the typical wrist-worn devices, IDC also anticipates earwear to gain momentum as various brands start to capitalise on the growing interest in smart assistants. Qualcomm’s upcoming silicon designed for this category is likely to also help bolster supply by offering brands a platform solution to build their products. Clothing with built-in sensors is also expected to grow and double its share by 2022.

Smartwatches will gain an increasing amount of market share over the course of the forecast, accounting for 44.6% of all wearables shipped by the end of 2022.

Smartwatches will gain an increasing amount of market share over the course of the forecast, accounting for 44.6% of all wearables shipped by the end of 2022.

Apple’s decision to include cellular connectivity on its latest Apple Watch has helped bring some much-needed attention to the smartwatch category from telcos and more importantly, it has helped with consumer acceptance.

It’s only a matter of time before other vendors — beyond those who have already dabbled with it — begin to include this capability and consumers, along with developers, take advantage of the tech to enable additional use cases.

Basic watches, which have been primarily comprised of sport watches, kids’ watches and hybrid watches, are forecast to see a CAGR of 7.4% from 2018 to 2022. Though these devices offer many advantages such as long battery life, simplified interfaces and highly fashion-forward designs, this category will continue to remain in the shadow of smartwatches as its share declines from 23.7% in 2018 to 19.7% in 2022.

The entire category also faces internal challenges as many sport watch and kids’ watch vendors are focused on transitioning their user base to smartwatches in the hope of increasing revenue.

The entire category also faces internal challenges as many sport watch and kids’ watch vendors are focused on transitioning their user base to smartwatches in the hope of increasing revenue.

The market for wristbands is expected to decline 6.6% in 2018 as demand for these simple devices has cooled off and incumbents like Fitbit and Garmin continue to pursue smartwatch growth instead. Beyond 2018, the category is expected remain largely flat with growth below 1% in the following years. Meanwhile, ASPs are expected to drop below $50 by 2022.