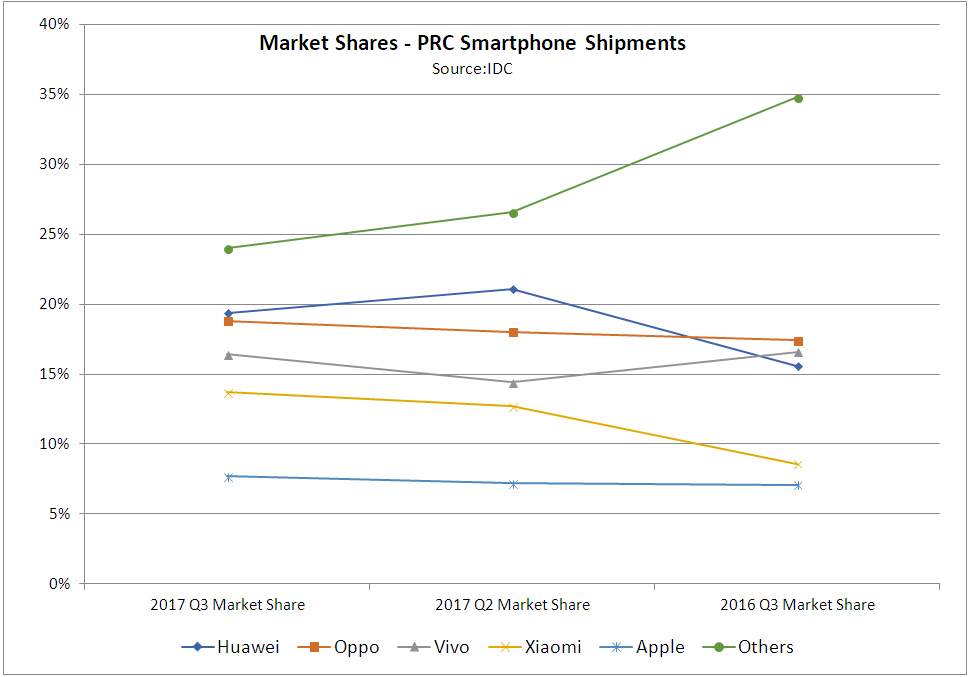

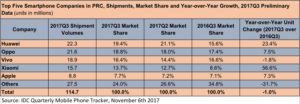

While the smartphone market in China saw a flat -1% year-over-year growth in the third quarter compared to the same period last year, the share of the top five smartphone companies grew from 65.2% in the third quarter of 2016 to 76.0% in the third quarter of 2017. In particular, Xiaomi saw a good year-over-year growth while Apple finally bounced back after declining for the past six quarters in China. Though the top smartphone companies are finding it harder to launch models with significantly different specifications or new technologies that will convince consumers to upgrade their phones, they continued to gain share from companies who have declined such as Samsung and LeEco.

Tay Xiaohan, Asia Pacific Manager of Client Devices Research at IDC, commented:

“Even though the market is getting saturated in China, smartphone companies are still aggressive in trying to steal market share from their competitors. Oppo and Vivo used to be the main companies with aggressive sponsorship of key television programmes. However, we see increased aggression from Huawei and Xiaomi in this aspect in recent months. Xiaomi began sponsoring three popular entertainment programmes on television.

With competition heating up, top smartphone players will need to either maintain or increase their marketing activities in the coming quarters. The implication for smaller players who do not have a high marketing budget is that it will be harder to thrive or survive in the saturated China smartphone market. The smaller smartphone companies that focus on the Tier 3 to Tier 5 cities will continue to depend on the subsidy from operators to target a very niche consumer segment”.

![]()

Key highlights for the quarter:

• More targeted marketing activities in promoting flagships. Oppo continues to be the only Chinese company out of the top four smartphone companies in China that can depend on one or two models to drive sales. Its R11 series made up more than half of its overall shipments in the third quarter of 2017. It has managed to succeed due to its streamlined portfolio, and the strong reputation it has built up for its key flagships through its marketing activities last year. Given its lean product portfolio compared to other companies, it can direct more resources on its key models. The other top smartphone companies have since followed suit and can be seen similarly promoting their key flagship models in the top entertainment shows in China.

• Differentiating the online and offline models. Oppo and Vivo have always been strong in the offline space, while Huawei has its Honor brand focused on the online space and Huawei branded phones focused on the offline space. Xiaomi started out strong in the online space and has been trying to expand into the offline space. Other than increasing its number of Mi Home stores, it has also offered models with different storage space and colors in the offline channel to differentiate its models and better market its models to retailers. It also worked more closely with the operators in China to broker deals with them. This helped Xiaomi develop a better relationship with its channel partners, which yielded a steady quarter-over-quarter growth in the third quarter of 2017.

![]() IDC Quarterly Mobile Phone Tracker – China Image:Meko

IDC Quarterly Mobile Phone Tracker – China Image:Meko

Things to look out for in the coming quarters:

- Launch of Apple’s iPhone X. Apple finally bounced back this quarter with the key activity being the launch of the iPhone 8 and 8 Plus. Apple’s rebound shows there is still pent-up demand for iPhones in China. The launch of the iPhone X is greatly anticipated in China, with market demand expected to be high especially given how different it looks from previous versions.

- Thin bezels/Bezel-less screens. On top of focusing marketing messages on dual cameras, companies are starting to also focus on thin bezels/bezel-less screens in their marketing messages in China. This can be seen with the launch of Xiaomi’s Mi Mix 2 and Vivo’s X20 in the third quarter of 2017. More companies will be launching such products in the coming quarters and will continue to highlight this point. That includes Huawei’s Mate 10 and Oppo’s R11s in the fourth quarter.

- “New Retail” (Integration of online and offline retail). This is a concept that was first introduced by Alibaba. We believe that smartphone companies will incorporate more elements of “New Retail” to help boost their sales in the future. Xiaomi has been aggressive in increasing its number of Mi Home stores in China, and it has also been incorporating some “New Retail” elements in its strategy.

For example, at this year’s Singles’ Day Sale, the discounts that are offered for its models by eTailers will also be able to be seen at the Mi Home stores. This blending of online and offline retail will be stronger in the coming quarters, and will help to increase the overall brand experience for consumers. Other smartphone companies, along with key retail stores, distributors and operators, will also move towards this direction in the near future.