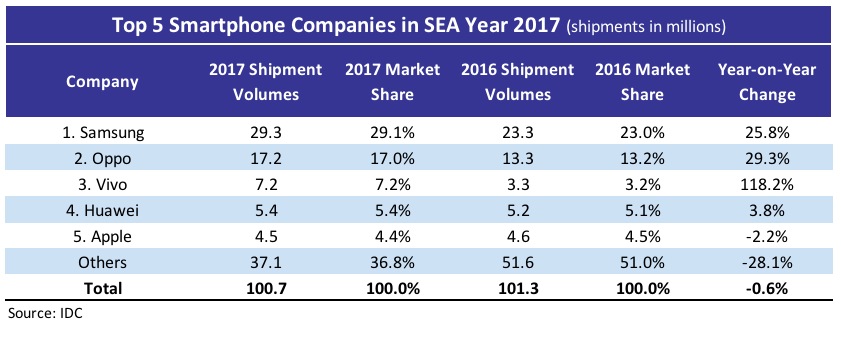

According to new data from IDC, total smartphone shipments in the emerging Southeast Asia (SEA) region recorded approximately 100 million units in 2017, declining by less than 1% year-on-year. IDC categorises Indonesia, Malaysia, Myanmar, Philippines, Thailand, and Vietnam as the emerging markets in SEA.

Myanmar and Philippines were the only countries to record a decline, where some of the vendors’ shipments have reduced significantly, pulling down the total shipments in SEA. Several local and smaller players were losing out competitively as the top four players continued to fortify their positions with their mix of low-end and mid-range handsets. IDC’s Jensen Ooi said:

“Apart from the growing popularity of the top four players that have been able to hold up shipment volumes, majority of end-users are in no rush to acquire a new handset if they have been using mid-range ones as the handsets are of decent quality and priced considerably high for this budget conscious region, resulting in longer lifecycles and replacement rates”.

mid-range smartphone shipments grew 53% year-on-year, driven by the top five players. While low-end devices still make up most of the market with a 37% share, mid-range handsets now make up 27% of the total market with 27.1 million units, versus 17% with 17.6 million units in 2016. Samsung takes the top spot in the mid-range segment with its affordable Galaxy J series. Oppo and Vivo continued to expand their brand presence with the usual celebrity endorsements and loud marketing activities, pushing their F and V series respectively. Huawei joined the competition with its Nova series and employed similar tactics to Oppo and Vivo. Meanwhile, Apple’s presence in the mid-range segment was represented by its older models, mainly the iPhone 5, iPhone SE and iPhone 6.

4G smartphones grew 44% year-on-year, while demand for 4G feature phones remains low. A long time coming, 4G smartphones finally became a norm in 2017. 4G smartphones now make up 81% of the total market versus with 81.1 million units, versus 56% of the market with 56.2 million units in 2016. 3G smartphones were shipped by local vendors and some global players still, targeting the price-conscious segments. Meanwhile, the adoption of 4G feature phones has been slow and recorded only close to a quarter-of-a-million units. They are mainly available in Tier-1 cities where the 4G network is more reliable, while lower-tier cities continue to opt for 2G feature phones. These 4G feature phones have been available in Thailand since 2016, while Indonesia and Philippines introduced them only towards late 2017.

Phablet shipments grew 71% year-on-year signalling a change of preference for larger screen sizes. Phablet shipments made up 35% of total shipments in 2017 with 35 million units, versus 20% with 20.5 million units in 2016. However, smartphones with screen sizes of 5” to 5.5” still hold the larger share of 50% with 50.5 million units. The growth of phablet shipments was spurred by the ongoing change in media consumption habits and vendors introducing thin-bezel smartphones to the market. Samsung recorded the largest shipments, while Vivo recorded the highest growth in this category. Ooi concluded:

“In 2018, local vendors will continue to feel the impact as end-users gradually shift their preference to more popular brands and are more willing to invest in their upgrade to larger-screen, mid-range smartphones. Most would soon be equipped with enticing features such as dual cameras, thin bezels, on-device AI and so on. To stay competitive, we expect local vendors to ship smartphones with some of these features as well and introduce devices that come with Android Oreo ‘Go edition’ while keeping the price affordable at less than $200, to suit the budget requirements of their local target segments”.