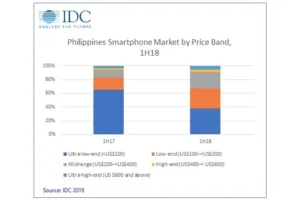

According to IDC, smartphone shipments in the Philippines reached 7.8 million units during the first half of 2018, a 5.6% growth year-on-year, allowing the market to bounce back from the -6.6% decline experienced in the first half of 2017. The smartphone market showed growth compared with last year because of the increase in shipments of mid-range smartphones. Although ultra-low-end smartphones still have the biggest market share, the ASP of a smartphone grew to $192 in the first half of 2018 compared with $127 during the first half of 2017.

Market analyst Polyne Gallevo commented:

“The higher ASP indicates th

at end users are willing to invest in a phone with better specifications and features to suit their latest needs. In addition, the use of phones has become heavier; aside from end users being accustomed to using smartphones as a platform for capturing, sharing, saving content and streaming videos, engagement in a higher form of mobile gaming has also been emerging.”

The availability of payment options has continued to make purchasing higher-priced smartphones less taxing for end users. Financing companies such as Home Credit and Flexi Finance and in-store retail credit allow customers who do not own credit cards to take advantage of instalment plans and make payments lighter. Gallevo added:

“Keeping in mind that Filipinos remain price-conscious and want to ensure they get the best value for their money, brands now highlight not only the quality of cameras but also features that make the smartphone experience better such as near-bezel-less screens, high-speed processors, quality speakers, AI features and long battery life to ensure customers that the brand represents enough bang for their buck”.

Cherry Mobile continues to lead the smartphone market in terms of unit market share but is experiencing a slight decline as it faces price competition with international brands and their strong marketing.

Samsung remains in the second spot as it continues its approach of being present in most price ranges, with the J and A series for low-end to mid-range buyers and its flagship S and Note series for the premium sector, combined with celebrity endorsements.

Vivo has climbed up a notch to third place in a year, thanks in part to aggressive marketing efforts during the launch of its V9 handset. Shipments for the Y series increased with the launch of Y71 and Y85. The X21 was also launched as the first smartphone with an in-display fingerprint sensor and the official smartphone of FIFA.

Oppo slips into fourth place as Vivo becomes more aggressive. The vendor maintains its presence through mall ads and promodisers. It has launched its F7, A71 and F7 Youth handsets and tapped up local celebrity endorsers who have a high reach among millennials.

Huawei shows significant growth. The vendor increased its marketing activities, with noticeable in-store displays in retail environments, online ads and celebrity endorsements.