According to the International Data Corporation (IDC) Philippines’ Quarterly Mobile Phone Tracker, smartphone shipments reached 7.8 million units in 1H18, posting a 5.6% growth year over year (YoY) and allowing the market to bounce back from the -6.6% decline experienced in 1H17.

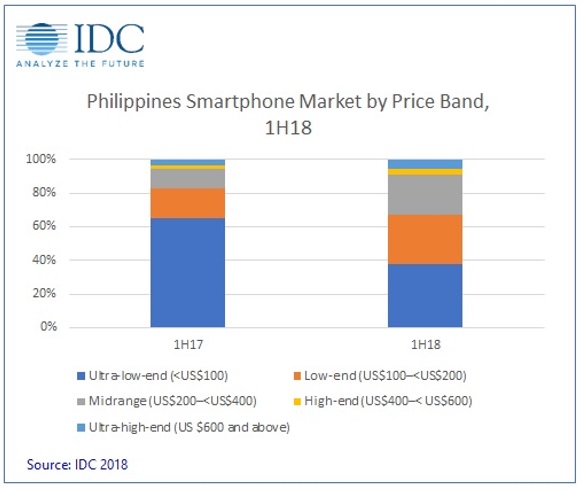

The smartphone market showed growth compared with last year because of the increase in shipments of midrange smartphones. Although the ultra-low-end smartphones still have the biggest market share, the average selling price (ASP) of a smartphone grew to US$192 in 1H18 compared with the US$127 before in 1H17.

“The higher ASP indicates that end users are willing to invest in a phone with better specifications and features to suit their latest needs. Use of phones have become heavier, aside from end users being accustomed to using smartphones as a platform for capturing, sharing, saving content, and streaming videos, engaging in higher form of mobile gaming has also been emerging” says Polyne Gallevo, Market Analyst, IDC Philippines.

The availability of payment options has continued to make purchasing higher priced smartphones less taxing for end users. Financing companies such as Home Credit and Flexi Finance, and in-store retail credit allow customers who do not own credit cards to get installment plans to make payments lighter.

“Keeping in mind that Filipinos remain to be price conscious and want to ensure they get the best value of their money, brands now highlight not only the quality of cameras but also features that make smartphone usage experience better such as near bezel-less screens, high-speed processors, quality speakers, AI features, and long battery life to ensure the customers that the brand is the bang for their buck,” Gallevo adds.

Top 5 Vendors of 1H18

Cherry Mobile continues to lead the smartphone market in terms of unit market share but experienced a slight decline as it faces price competition with international brands and their strong marketing.

Samsung remains at the second spot as it continues its approach of being present in most price points with the J and A series for low-end to midrange and its flagship phones S and Note series for the premium, combined with celebrity endorsements.

Vivo climbed up a notch to third place in a year with its aggressive marketing efforts and tapping of popular local celebrity endorsers in launching V9. Shipments for their Y series increased with the launch of Y71 and Y85. X21 was also launched as the first in-display fingerprint smartphone and the official smartphone of FIFA.

OPPO slips into fourth place as Vivo becomes more aggressive. The vendor maintains its presence through mall ads and promodisers. It launched OPPO F7, A71, and F7 Youth. OPPO also tapped local celebrity endorsers who have a high reach among the millennials and masses.

Huawei shows significant growth. The vendor increased its marketing activities with noticeable in-store display in retail, online ads, and celebrity endorsements.

For media inquiries, contact Glorie Perez at [email protected] or +6324787260 ext 423.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

IDC is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community make fact-based decisions on technology purchases and business strategy. More than 1,100 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. For more than 50 years, IDC has provided strategic insights to help our clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.