Worldwide monitor shipments totalled 31.7 million units in the fourth quarter of 2017, according to IDC. Senior research analyst Maura Fitzgerald said:

“The fourth quarter of 2017 was a strong one for monitors, posting 2.5% year-on-year growth. The holiday season helped fuel the consumer sector, benefiting consumer-oriented vendors like TPV, LG Electronics and Samsung. Looking ahead, monitors are expected to decline at rates around 2% year-on-year from 2018 through 2022. However, the fourth quarter of 2017 proved better than forecast overall with all regions recording positive year-on-year growth”.

IDC currently forecasts 116 million PC monitor units will be shipped in 2018 and expects to see a year-on-year decline of 3.6% in worldwide shipments to 30.6 million units in the fourth quarter of 2018. By 2020, worldwide shipments are expected to be less than 112 million units as the adoption of mobile devices at lower price points is expected to continue.

Curved monitors continue to show steady growth with 4.6% market share in the fourth quarter of 2017. This represents year-on-year growth of 64.6%. 21.5″ and 23.8″ widths dominated the worldwide market with 22.6% and 12.4% market share respectively. Of the top ten screen widths, 23.8″ and 27″ saw the largest year-on-year growth of 57.2% and 28.7% respectively. Monitors with TV tuners are expected to hold a 4.6% market share in the fourth quarter of 2018, down from 4.8% year-on-year, led by LG and Samsung, with a combined market share of 99% in this category.

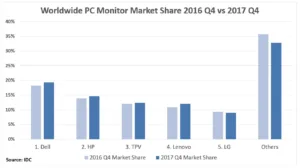

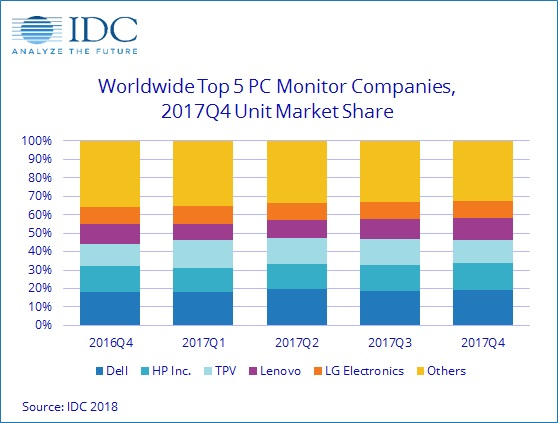

Dell retained the top position during the fourth quarter of 2017 with a worldwide market share of 19.3% on shipments of over 6 million units. The vendor posted strong year-on-year growth in Central & Eastern Europe (29.1%), Middle East & Africa (MEA) (14.6%) and Latin America (13.3%). The largest-growing screen widths year-on-year included 23.6″ and 34″.

HP saw more than 4.6 million units shipped, resulting in 14.6% share in the fourth quarter of 2017. Substantial year-on-year unit increases were posted in Japan (33%) and Central & Eastern Europe (36.7%) which contributed to a total year-on-year increase of 7.3%.

TPV experienced year-on-year declines in Central & Eastern Europe (-4.7%), Japan (-8.3%) and MEA (-5.9%). However, significant gains were made in their best-selling region, Asia Pacific excluding Japan (APeJ) with 5.1% year-on-year growth.

Lenovo maintained the number four position with strong year-on-year growth of 12.8% and more than 3.8 million units shipped. This was largely due to significant quarter-on-quarter growth in APeJ (20.7%) and Western Europe (30.3%). In terms of screen widths, 27″ and 23.8″ dominated with 487% and 309% year-on-year growth respectively.

LG rounded out the top five in the fourth quarter of 2017 with 2.8 million units shipped. Despite a year-on-year decline of 1.7%, the vendor witnessed year-on-year gains in the United States, Japan and MEA.

Analyst Comment

IDC’s forecast is for fewer monitors than IHS which expects monitor panel shipments of more than 140 million. Now, panel shipments and monitor shipments are always different, but timing differences wouldn’t account for such a wide discrepancy. (BR)