The Indian wearables market witnessed impressive growth in the second quarter of 2018 as the overall wearables market grew 66% year-on-year and 40% sequentially, making it the biggest quarter for the wearables category in India. According to IDC, one million units were shipped in the second quarter, with the top-three brands retaining their position in the overall market.

This growth can be largely attributed to a precautionary measure against the expected implementation of national standard norms by the Bureau of Indian Standards (BIS) for the wearables category in the middle of the second quarter. In anticipation of this, companies shipped high numbers of units beforehand.

Additionally, e-tailers brought in more shipments to meet the demand coming via various online shopping sales in June and July. The market remains attractive for new entrants, as it witnessed the entry of the new players from fashion e-commerce, IOT and startups verticals. Associate research manager Jaipal Singh commented:

“After a relatively

slow 2017, the market looks to be finding its footing in 2018. Companies have increased their marketing spend, exploring alternate channels to sell their devices and updating their platforms to increase the gamification and maximise the user engagement”.

Outside of wristbands, which accounted for almost 90% of the shipments during the quarter, watches with wearable computing also grew 34% sequentially on the back of new launches and affordable finance schemes. In the smartwatch category, Apple emerged as a clear leader, with one out of every three watches sold in India during the quarter being Apple-branded.

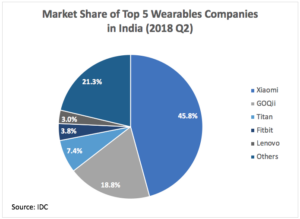

Xiaomi maintained its leadership of the market with 46% share and 31% quarter-on-quarter growth in the second quarter of 2018, although its share reduced marginally from the previous quarter. Most of its devices are still sold by e-tailers. However, the brand has now diversified into the retail channel, selling its devices through stores.

GOQii remained in second position with 74% annual growth and 36% sequential growth in its shipments. The vendor has taken its engagement beyond basic application monitoring when it comes to engaging with its user base. Interactive live video sessions, launching a health store and adding brain training games on its platform are some of the initiatives introduced by the vendor.

Titan, with its Fastrack Reflex range, saw a healthy 56% sequential increase in its overall shipments and maintained its position. However, its shipments saw a 45% decline annually, as it channelised its inventory before launching new devices to the market. The brand has an aggressive intent to go ahead with a high marketing spend on traditional media, to educate users about fitness bands in the coming quarters.

Fitbit replaced Fossil as the fourth-largest wearables company as its shipments quadrupled in the second quarter when compared to the first. Fitbit introduced the Versa watch, adding one more device in its watch portfolio. However, bands remain the top-selling category for the brand, with Flex 2 contributing more than half of the company’s overall shipments in this quarter.

Lenovo was able to secure a position in the top-five after three quarters. It launched three new models to strengthen its position in the fitness band category, which helped the brand to register a strong triple-digit growth.

With the implementation of product standardisation norms for wearables devices in India, IDC expects the long tail of wearable vendors — which includes many small and white-label brands — to face the challenge of becoming marginalised in the next few quarters. Brands who are aggressive on pricing will be the prime beneficiary of this consolidation. Commenting on the recent consumer trends, associate research director Navkendar Singh added:

“Today, health is becoming a priority in

urban India. Consumers are opting for fitness bands to monitor their routine and are also comfortable to spend on fitness devices to have a healthy lifestyle. However, large numbers of users are still facing difficulties seeing the real value from these devices in the absence of any tangible benefits. Vendors need to develop a services ecosystem around it to keep users motivated and drive repeat purchases”.