According to IDC, the Indian smartphone market witnessed a healthy 14% annual growth with a total shipment of 124 million units in 2017, making it the fastest growing market amongst the top 20 smartphone markets globally. The market resumed its double-digit growth after a temporary slowdown in 2016 caused by factors such as demonetisation and a shortage of smartphone components. This contrasts with China, the world’s largest smartphone market that saw its first decline this year, while the USA was relatively flat.

The smartphone category saw a sharp dip of 22% quarter-on-quarter in the fourth quarter of 2017 as vendors focused on clearing channel inventory. However, it registered a healthy 18% growth compared to last year’s weak quarter which was impacted by demonetisation. China-based vendors further strengthened their positions in the smartphone category with the collective share of China-based vendors reaching 53% in 2017 from 34% a year ago. Senior market analyst, Jaipal Singh, said:

“The untapped demand in the lower-tier cities remains the key attraction for China-based brands to explore the growth trajectory in India. Their strength in their home market of China and weakening position of local players has helped some of these China-based players to solidify their operations in India”.

India is the world’s third-largest smartphone market, and also continues to hold its position of being the biggest feature phone market globally. 2017 has been an exceptional year for this category, as it witnessed a 17% annual growth after declining for three consecutive years. While feature phones remain relevant to a large consumer base in India, the Indian telecom operator Reliance Jio saw huge shipments of 4G-enabled feature phones, taking the leadership position on its maiden quarter in this category. This resulted in a total of 164 million feature phone shipments in 2017 from 140 million a year ago. In the fourth quarter of 2017, vendors shipped a total of 56 million units, the highest-ever in a single quarter. The category registered a huge 67% year-on-year growth and 33% growth from the previous quarter. Senior market analyst, Upasana Joshi, also commented:

“Xiaomi taking a lead over Samsung in the smartphone market and Reliance Jio emerging as the leading feature phone company in India were the two key highlights of the last quarter of 2017. The growth of both the vendors was propelled by their aggressive pricing. Xiaomi’s offline expansion and higher marketing spends were other key factors for the vendor’s high shipments in the seasonally low quarter”.

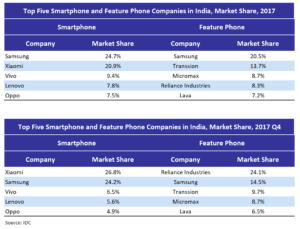

Xiaomi replaced Samsung for the leadership position in the fourth quarter of 2017. Xiaomi tripled its shipments year-on-year and sold more than two million units from its offline channel. In continuation of its offline expansion through Mi stores and preferred partners, Xiaomi appointed its first product endorser, and is now very aggressive in above-the-line marketing, which helped the brand to gain traction in the offline channel.

Samsung slipped to second position in the smartphone ranking in the last quarter of the year but leads for the year overall. Despite growing 13% year-on-year in the fourth quarter of 2017, it faced challenges in competing with the aggressive pricing strategy of Xiaomi in India. However, the channel trust remains strong on brand and Samsung’s distribution strength remains strong too, even as other vendors approach retailers and channel partners with lucrative offers.

Vivo rose to the third position after dropping to fourth in the last quarter. However, its shipments saw a 41% decline from the previous quarter and remained flat year-on-year. To extend its omni-channel experience, Vivo launched its maiden experience centre in India and also participated in Amazon and Flipkart’s winter sales this quarter.

Lenovo (including Motorola) slipped to fourth position as its shipments declined sequentially and annually in the fourth quarter of 2017. Lenovo continues its efforts to strengthen its Motorola brand in India as Lenovo-branded shipments declined almost 60%, while its Motorola portfolio saw a marginal increase compared to a year ago.

Oppo maintained its position, though its shipments dropped by almost half compared to its record-breaking third quarter of 2017. Oppo made changes to its channel strategy as it started focusing more on selective outlets instead of having a presence across all outlets. Singh concludes:

“While the competitive landscape is becoming more challenging in India, the low smartphone penetration remains a major attraction for all devices vendors, and they are now making serious attempts to address the problem of affordability in India with the introduction of more affordable products, resulting in initiatives such as Android Oreo ‘Go edition’, telco bundling with low-cost 4G smartphones and even the 4G feature phone JioPhone. Also, as consumers experience and get hooked on to data, their need to be on a digital platform will go up and smartphones will be the first platform for many of them. IDC expects the Indian smartphone market to continue double-digit growth for next couple of years”.