The worldwide desktop monitor market hit more than 30 million units in Q2 of 2016, with 4.9% annual and 4.6% quarterly growth according to IDC. “The second quarter proved better than forecast overall, with the U.S., EMEA, and Canada markets recording solid year-over-year results. However, IDC expects the global monitor market will continue to decline at rates around 3% year over year from 2018 through 2020” said Maura Fitzgerald, senior research analyst.

For the year, IDC forecasts sales of 118 million monitors, and is forecasting a decline of 12.7% for Q2 next year. The decline is forecast to continue until 2020. Some highlights of the firm’s data are:

- Curved monitors continue to be on the rise, with 1.9% market share in 2Q16. This represents year-over-year growth of 221%.

- 21.5″ wide and 19.5″ wide segments continue to dominate the worldwide market, with 22.0% and 12.2% market share respectively in 2Q16. Of the top 10 screen sizes, 23.8″ wide and 31.5″ wide saw the largest year-over-year growth, posting 100.1% and 76.8%, respectively, in 2Q16.

- Monitors with TV tuners are expected to have 5.3% market share in 2Q17, up from 4.8% in 2Q16, led by LG and Samsung with a combined market share of 99.0% in this category.

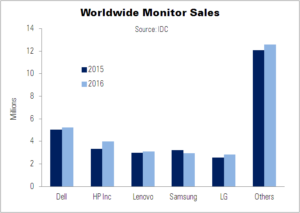

Turning to vendors, the company said that:

- Dell – Dell stayed in the top position in 2Q16 with worldwide market share of 17.0% on shipments of more than 5.2 million units. The vendor posted strong year-over-year growth in Central & Eastern Europe (31.2%), Canada (25.5%), and Middle East & Africa (18.0%).

- HP – HP saw 4 million units shipped, resulting in 13% share in 2Q16. Year-over-year unit increases of 51.1% in the U.S. and 22.4% in Central & Eastern Europe helped bring the vendor a total year-over-year increase of 19.6%.

- Lenovo – Lenovo made significant gains, moving into the top 3 position with year-over-year growth of 2.7% to more than 3 million units shipped. Lenovo also posted significant quarter-over-quarter growth of 27.1%, with especially large growth in Central & Eastern Europe (114.5%) and Asia/Pacific (excluding Japan) (33.1%).

- Samsung – Samsung moved down to the number four position with nearly 3 million units shipped. The vendor saw a year-over-year decline in all regions except Central & Eastern Europe, and Canada.

- LG Electronics – LG rounded out the Top 5 in 2Q16 with 9.2% market share in the worldwide market. The vendor logged year-over-year gains across all regions except Middle East & Africa.

|

Worldwide PC Monitor Unit Shipments, Market Share, and Year-over-Year Growth, Second Quarter 2016 |

|||||

|

Vendors |

2Q16 Unit Shipments |

2Q16 Market Share |

2Q15 Unit Shipments |

2Q15 Market Share |

2Q16/2Q15 Growth |

|

1. Dell |

5,223,170 |

17.0% |

5,034,096 |

17.2% |

3.8% |

|

2. HP Inc. |

4,000,639 |

13.0% |

3,343,622 |

11.4% |

19.6% |

|

3. Lenovo |

3,080,585 |

10.0% |

2,999,894 |

10.3% |

2.7% |

|

4. Samsung |

2,936,095 |

9.6% |

3,228,912 |

11.0% |

-9.1% |

|

5. LG Electronics |

2,833,722 |

9.2% |

2,564,196 |

8.8% |

10.5% |

|

Others |

12,598,019 |

41.1% |

12,067,622 |

41.3% |

4.4% |

|

Total |

30,672,231 |

100.0% |

29,238,344 |

100.0% |

4.9% |

|

Source: IDC Worldwide Quarterly PC Monitor Tracker, September 2016 |

|||||