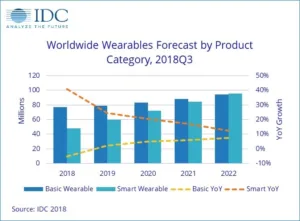

Global shipments of wearable devices are forecast to reach 125.3 million units in 2018, up 8.5% from 2017, according to the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker.

The growing popularity of smartwatches and greater wearables adoption in emerging markets will combine to produce a five-year compound annual growth rate (CAGR) of 11.0% with shipments jumping to 189.9 million units in 2022.

“The transition from basic wearables to smart wearables will continue over the next five years as the two approach parity in terms of market share by 2022,” said Jitesh Ubrani, senior research analyst for IDC’s Mobile Device Trackers. “The rise of smart wearables will not just be in mature markets, but also from emerging markets in Asia/Pacific and elsewhere. Japan will play an equally important role as they consume more than one third of all smart wearables.”

Among the smart wearable operating systems, WatchOS will remain in the lead although its share will decline from 44.4% in 2018 to 35.8% in 2022 as other platforms gain traction. The second largest OS is expected to be Android with 22.4% share in 2022. Android should not be confused with WearOS, as the open-source platform offers vendors an opportunity to customize the wearables’ experience while creating differentiation. With Google’s service being banned from China, many local brands have adopted this strategy and IDC anticipates the proliferation of these devices to continue in many neighboring countries as well. Behind WatchOS and Android, WearOS will capture 19.8% share in 2022 as additional vendors begin to offer products and as the platform catches up to competitors in terms of features. The remainder of the smart wearables landscape will be comprised of smaller platforms and vendors although IDC anticipates Samsung, Fitbit, and Garmin to dominate with their proprietary platforms.

Source IDC: WW Wearables Forecast

“Expect smartwatch operating systems to evolve along several vectors in the coming years,” said Ramon T. Llamas, research director for IDC’s Wearables team. “First, smartwatches will focus on convenience by proactively providing glanceable and actionable information to the user. Second, smartwatches will provide new means of communication between users, and this is where cellular connectivity will play a significant role in its development. Third, smartwatch operating systems will emphasize connection, not only between users but between wearers and other smart devices and systems. Finally, expect further developments focusing on health with the smartwatch playing a critical role in tracking your health goals and detecting potential ailments.”

Form Factor Highlights

Watches are forecast to reach 72.8 million units in 2018 with smartwatches accounting for roughly two thirds of the total volume. Total watch shipments are expected to reach 120.2 million by 2022 with a CAGR of 13.3%. Outside of smartwatches, hybrid watches and some basic kids’ watches will also continue to ship in large volumes although growth for these types of devices will remain relatively flat throughout the forecast period.

Growth for the Wristband category will remain muted with a 0.3% CAGR from 2018 to 2022. However, it’s important to note that this category will still account for 24.7% of the total market by 2022 with the total volume reaching 47,0 million. These wearable devices will continue to serve multiple purposes from acting as a stepping stone into the wearables market for first time buyers to serving as simpler alternatives for smartwatches. In developed markets, the low cost of these products will also enable them to serve as simple patient monitoring tools.

Earwear, accounting for less than 2% of the market in 2018, is on track to capture 6.8% share in 2022. Growth in this category is largely attributed to the disappearance of the traditional headphone jack on modern computing devices. Additionally, an increasing number of vendors are including biometric tracking into wireless headphones which will further help this category.

|

Worldwide Wearables Forecast by Product Category, Including Shipments, Market Share, and 2018-2022 CAGR(shipments in millions) |

|||||

|

Product |

2018 Shipments* |

2018 Market Share* |

2022 Shipments* |

2022 Market Share* |

2018-2022 CAGR* |

|

Clothing |

2.8 |

2.2% |

9.1 |

4.8% |

34.3% |

|

Earwear |

2.1 |

1.7% |

12.8 |

6.8% |

56.4% |

|

Modular |

0.7 |

0.6% |

0.6 |

0.3% |

-3.3% |

|

Other |

0.2 |

0.2% |

0.2 |

0.1% |

-3.8% |

|

Watch |

72.8 |

58.2% |

120.2 |

63.3% |

13.3% |

|

Wristband |

46.5 |

37.1% |

47.0 |

24.7% |

0.3% |

|

Total |

125.3 |

100.0% |

189.9 |

100.0% |

11.0% |

|

Source: IDC Quarterly Wearable Device Tracker, December 17, 2018. |

|||||

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. To see more of IDC’s worldwide wearables market data, go to https://www.idc.com/promo/wearablevendor.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading media, data and marketing services company that activates and engages the most influential technology buyers. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.