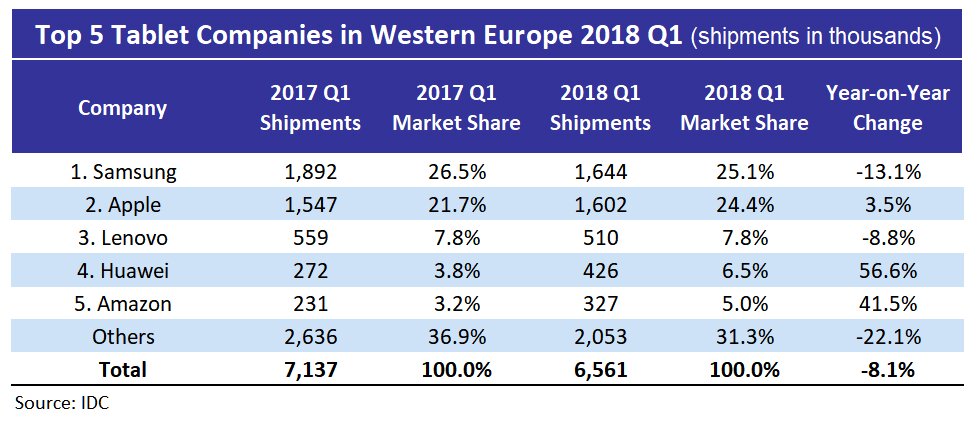

According to the latest figures published by IDC, the overall tablet market for Western Europe declined 8.1% year-on-year, shipping 6.6 million units in the first quarter of 2018, as the tablet market continues to exhibit a bleak outlook for the region.

Increasingly long life-cycles, combined with a near-saturated installed base led to a poor consumer performance across both product categories, bringing an overall decline of 8.8% year-on-year for the segment.

Certain OEMs continued to leverage the mobility advantages of a removable keyboard within a business setting, leading to 0.5% growth year-on-year for detachables in commercial. Research analyst Dennis Pedersen said:

“Despite the slowdown in detachables, they remained positive in the commercial segment, aided by the performance of the iPad Pro. The increasing push of tablets with keyboard capabilities by Apple has met with success among professionals with higher mobility needs, and their enhanced features in terms of battery life, display and optional connectivity have facilitated their use case as notebook replacements”.

Their commercial growth this quarter does not mask the fact that detachable volumes are showing strong signs of heading towards a downward trajectory. Important OEMs are increasingly focusing on profitability, showing concern for value over volume.

Concurrently, there is growing demand for convertible PCs, which are analogous in use case but seem to be gaining more traction within enterprises, resulting in a cannibalisation effect for detachable sales.

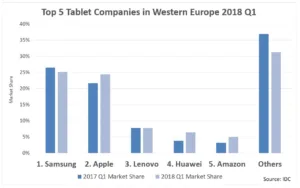

Samsung ranked first with 25.1% market share, but decreasing 13.1% year-on-year. Strategic direction still appears to be pointing towards profit over volume, as Samsung experienced another strong performance from its premium Android range.

Apple ranked second, recording a market share of 24.4% and increasing by 3.5% year-on-year. Its iPad Pro products continue to dominate the detachable market in both commercial and consumer segments, aiding in the company’s annual growth.

Lenovo ranked third with a market share of 7.8%, while declining 8.8% year-on-year. Ongoing expansions in its Windows detachable portfolio are being well received in the market, leading to a solid overall detachable performance.

Huawei ranked fourth with 6.5% market share, aided by a very strong growth of 56.6% year-on-year, as it continues to increase its footprint across Western Europe in all smart connected devices. Large tablet volumes were achieved by occupying the space in the low to mid-range left by vendors such as Acer and Asus.

Amazon ranked fifth with 5% market share, growing an impressive 41.5% year-on-year. A focus on enhancing the Alexa platform, including the announcement of Alexa hands-free mode becoming available for the smaller-screened tablets, led to strong sales.