The worldwide detachable tablet market grew to 6.5 million units in the fourth quarter of 2017, an increase of 10.3% from the previous holiday season, according to preliminary data from IDC. Growth for the entire year remained positive, although it showed signs of slowing as detachable tablets grew 1.6% year-on-year in 2017, down from the 24% growth in 2016. However, some of the slowness was attributed to the launch cadence of high-profile devices like the Surface, which was off-schedule, leaving older models on shelves as consumers and businesses laid in wait for product refreshes. Jitesh Ubrani, Senior Research Analyst with IDC, said:

“To date, much of the trajectory of the detachable market has been attributed to Microsoft and Apple pushing their wares in the US. However, continued success of this category hinges on the willingness of other PC vendors to participate and more importantly, consumers from other countries to adopt the new form factor over convertible PCs”.

Lauren Guenveur, Senior Research Analyst with IDC, also commented:

“After a concerning downturn in the last quarter of 2016 and first half of 2017, we are elated to see the detachable market maintain another quarter of growth. With the first wave of Windows on ARM products expected to begin shipping in the second quarter of 2018, we believe the detachables category has the potential to continue its growth trajectory. Many of these products are being introduced at the premium end of the market. What remains glaringly sparse, and needed, are strong players in the mid-segment of the market”.

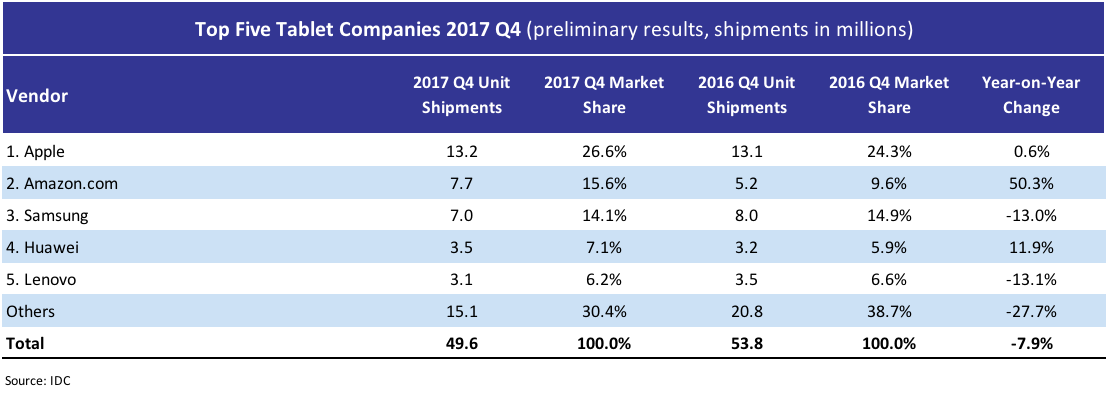

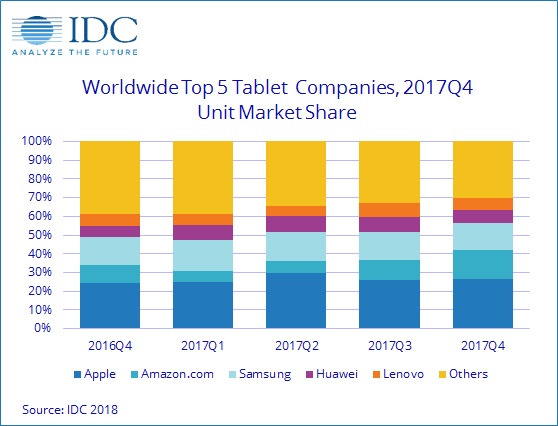

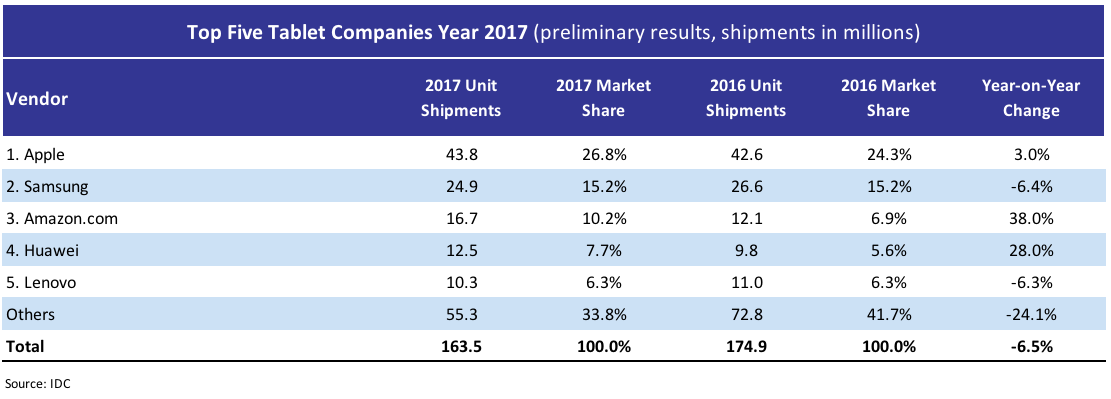

Outside of the detachable tablets, old-fashioned slate tablets continued to ship in large volumes, reaching 43.1 million units during the fourth quarter, and 141.7 million during the year. These devices do not offer much in terms of productivity and have been largely relegated to simple media consumption devices. With narrow margins, some vendors are using this form factor as a portal to their larger ecosystems or to promote their brand within the broader gadget market. Meanwhile, end-user demand has slowed significantly in the last few years, with 2017 declining 7.6% from the previous year.

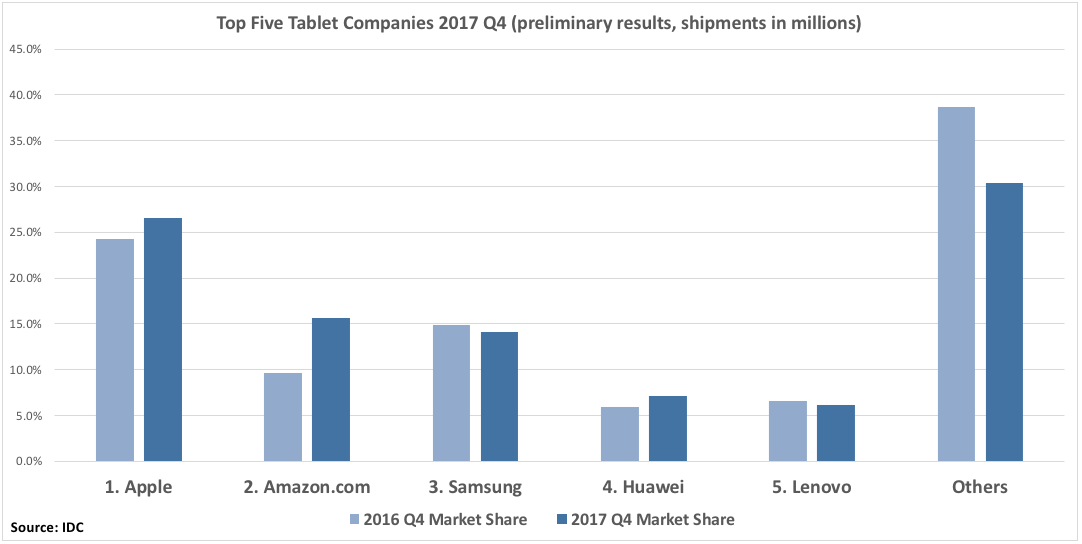

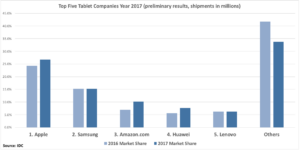

Apple maintained a solid lead in the holiday quarter, driving growth, both through its lower-priced 9.7″ iPad as well as its newly-refreshed iPad Pro products. While the lower-price iPad has continued to drive a strong consumer upgrade cycle, the focus is shifted to the iPad Pro and its potential in the commercial and education segments. With the only expected tablet growth to come from these segments, Apple’s recent launch of “Apple at Work” shows the company’s commitment to maintain its leader position.

Amazon.com was able to steal the second position from rival Samsung as the online giant offered steep discounts during the holiday season. The company’s low-cost tablets have been quite effective as shopping catalogs for Amazon’s online storefront. In recent quarters, the company has taken things a step further by including its voice assistant, Alexa, in its latest tablets and expanding to new markets around the world.

Samsung dropped to the third position behind Amazon. Shipments of its detachable portfolio continue to rise. However, these gains are outweighed by the declines seen among its slate models. As its lower-cost Tab A and E series are challenged by vendors promising better value, Samsung will face a particular challenge in upgrading its base to both a higher-priced and detachable device.

Huawei’s half-hearted approach to the growing detachable segment does not offer a promising outlook for the company. However, the company’s strong brand, aggressive channel strategy and inclusion of cellular connectivity in its slate tablets has helped cement its rank in the top five.

Lenovo’s ability to leverage its strength from the traditional PC business is starting to pay off, as the company’s detachable tablet business has grown in the past year. However, the bulk of Lenovo’s tablets are still comprised of slates that offer great value at low prices.