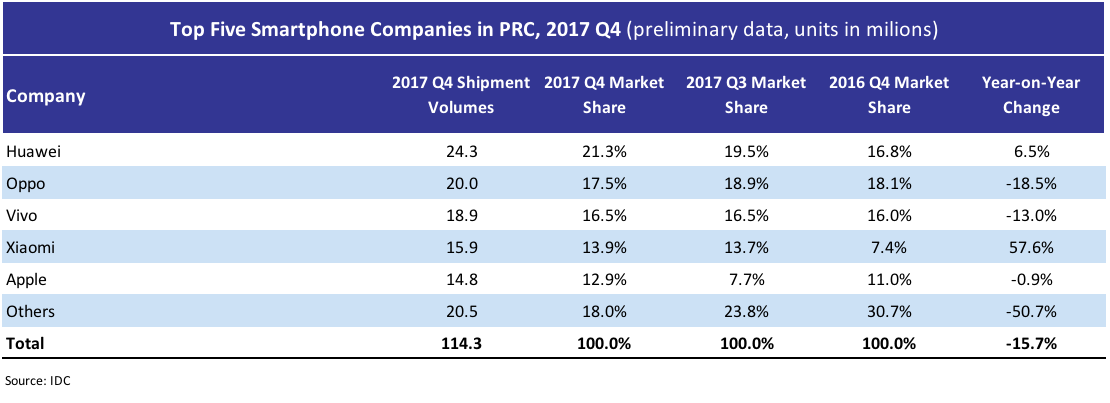

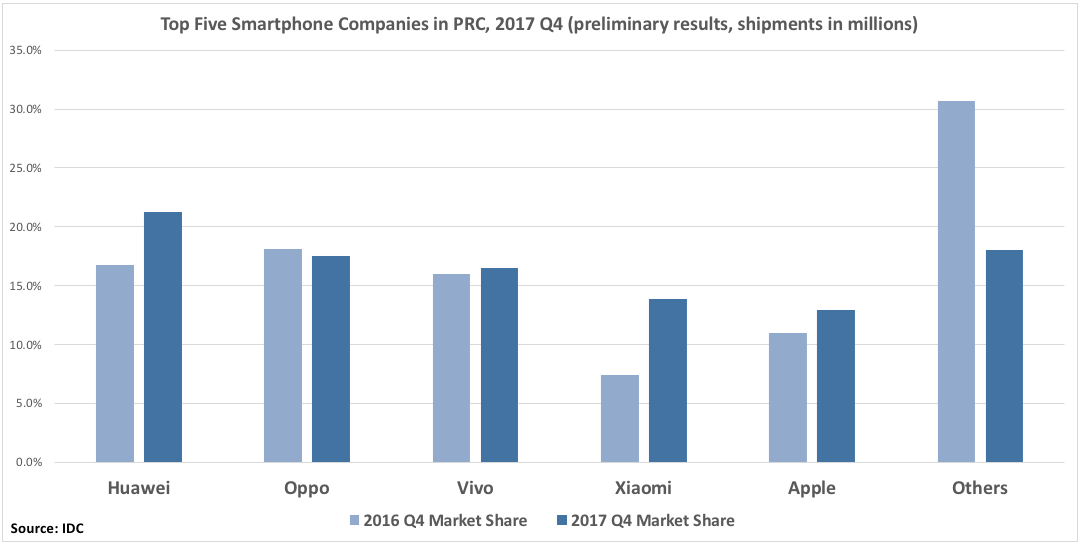

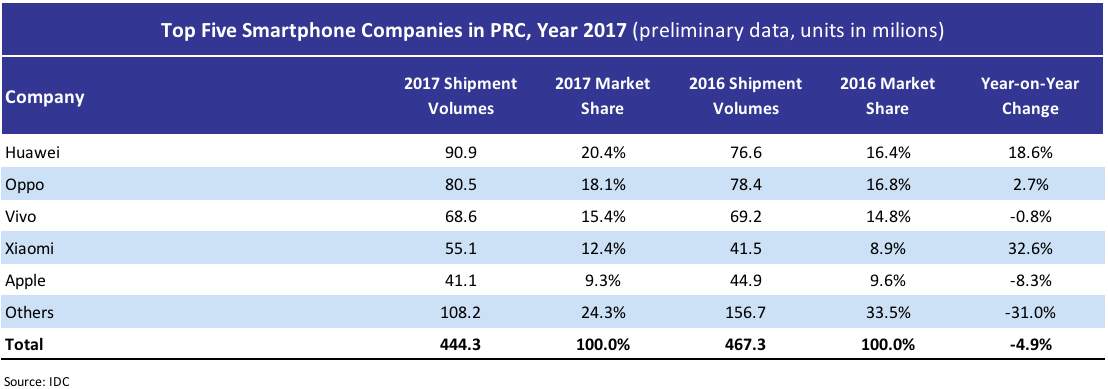

According to preliminary data from IDC, the China smartphone market declined 15.7% year-on-year in the fourth quarter of 2017 and 4.9% for the whole of 2017. Tay Xiaohan, Research Manager of IDC Asia Pacific’s Client Devices team, said:

“

In 2017, the minor upgrades that Chinese smartphone companies made to their offerings were not enough to move consumers to splurge on new models, resulting in a general slowdown in the market. The smaller players continued to suffer as the top five players grew their market share. A key space to look out for in the coming year will be how the top smartphone companies drive consumer upgrades”.

Apple is dominating the $600+ premium segment. Its share increased year-on-year and quarter-on-quarter. Although the iPhone X was initially in short supply when it was launched in early November, supply constraints eased towards the end of the quarter. Apple’s ASP increased by 23.9% year-on-year during the fourth quarter of 2017, largely due to shipments of the iPhone X.

Even though Apple’s shipments experienced a slight year-on-year decline, it remains the only company that dominates the premium segment in China. In the fourth quarter of 2017, Apple alone made up 85% of the overall shipments in that segment. It has not been easy for Chinese smartphone companies to drive higher volumes at higher prices but Apple is clearly still the market leader in this space.

While Apple has done well in the premium segment in China, this model has mostly done well in Tier 1 cities. Though the iPhone X has already helped increase the appeal of the iPhone, this model is still not within the reach of most consumers. If Apple were to launch new models this year with comparable specifications and design to that of the iPhone X at a lower price, this would help to increase the overall addressable market for Apple and increase its share in the premium segment of the market

Huawei has appeared on the radar to compete with Apple in the premium segment. Huawei grew in the fourth quarter of 2017, largely due to strong shipments of both its Honor and Huawei-branded phones in the up-to-$200 segment. Its main strength is that it has the Honor, Huawei and Nova-branded phones covering the different segments of the market. The Singles’ Day sale also helped to push its Honor-branded phones in the market.

While Huawei’s overall share in the premium segment still remains low, it has grown from making up 2% of the shipments in this segment in during the fourth quarter of 2016 to 8% in the same quarter of 2017. With its Mate 10 and Mate 10 Pro series proving popular, Huawei will be a potential competitor to Apple in the premium segment in China. With Samsung’s continued troubles in the China market, Huawei has successfully managed to break into the high-end Android vendor space, although price points of Huawei’s flagship phones are carefully priced to be lower than the iPhone at launch.

Oppo and Vivo are focusing more on the mid-range segment, with a higher share of their portfolio focused on the mid-range segment compared to a year ago. The reduction in the number of Oppo and Vivo models in the low-end segment also contributed to their year-on-year decline in the final quarter of 2017.

While focusing more on the mid-range segment has hurt its overall shipment growth, Oppo and Vivo’s overall ASPs have increased year-on-year. In terms of revenue, Oppo ranked second to Apple and above Huawei. Vivo follows in fourth place. Thus, while Oppo’s shipments may have declined, it is growing in terms of its overall revenue.