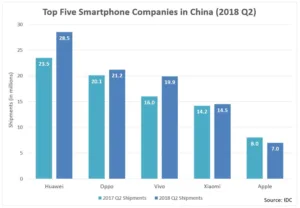

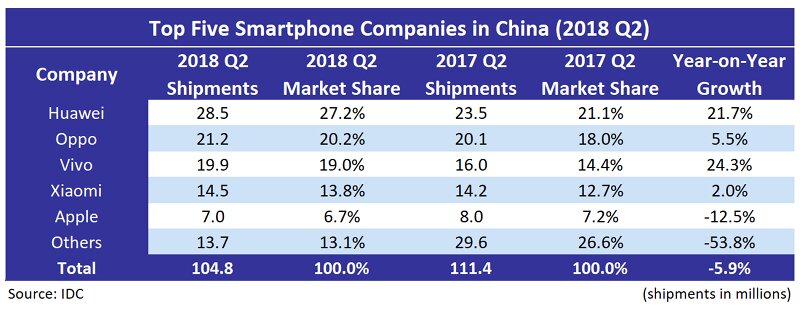

According to IDC, 104.8 million units shipped to the Chinese smartphone market during the second quarter of 2018, resulting in a 5.9% year-on-year decline. However, the pace of decline has narrowed compared to the first quarter, as channel activity normalised and new products were marketed. Senior market analyst Xi Wang remarked:

“Th

e market’s ASP increased 15% year-on-year in the second quarter. This suggests that consumers are willing to pay more for a phone targeted for their needs, including not just better cameras but also emerging categories such as gaming. Time spent on mobile phones continues to rise, and vendors should emphasise aspects like industrial design, quality and brand image to drive replacements in this market”.

IDC believes that market leaders in China’s smartphone market will continue to gain more share, marginalising smaller players in the process. Large vendors have been transforming from a single-channel and single-segment focus to multi-channel and multi-segment. Heavy investments here will make it more difficult for smaller players to compete.

Huawei continued to lead the Chinese smartphone market in the second quarter, with a 27.2% market share. The company cemented its position in the $600 to $800 price segment with the P20 Pro series, while Apple moved to even higher price bands, helping Huawei build a high profile during the off-season. Moreover, its “GPU Turbo” technology resonated with users, while China’s “6.18” online promotions led to strong sales for the company’s Honor range.

Oppo and Vivo maintained their positions while optimising their channels and releasing thin-bezel models, the Oppo Find X and Vivo Nex. Marketing activities during the World Cup increased store traffic and interest for both brands.

Xiaomi maintained its value-for-money approach, with dual-camera models priced at less than $150. Its new models also helped increase the company’s ASP by 21% year-on-year, which is the highest among the top-five vendors in China.

Apple shipments fell year-on-year, given that the high prices of its products kept them out of reach of many users. Nonetheless, the Apple brand name is still very strong in China, and IDC believes that the company will fare well should it release cheaper options later in the year.

IDC expects a relatively flat market for China in 2018, although exchange rates and trade wars are downside risks to watch out for going into the second half.

Analyst Comment

The absence of Samsung in the top five makes China an unusual market compared to the rest of the world. Of course, if the shares were calculated on value, Apple’s position would look very different because of the company’s ASP. DSCC has said that the blended ASP (ASP over all the products, not just for similar products) is three times higher for Apple than Samsung and that would be even more against the Chinese brands. (BR)