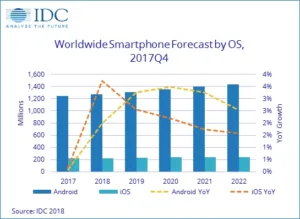

As we have previously reported, according to IDC, worldwide smartphone shipments declined 0.5% in 2017, the first year-on-year decline the market has experienced since the introduction of smartphones. Smartphone companies shipped a total of 1.46 billion devices in 2017 with nearly all of that volume running either Android or iOS. Looking forward, IDC expects shipment volumes to return to low single-digit growth in 2018 and the overall market to experience a CAGR of 2.8% over the 2017-2022 forecast period, with volumes forecast to reach 1.68 billion units in 2022.

Platform Highlights

Android: Volumes were essentially flat in 2017, with OEMs shipping a total of 1.24 billion handsets running Google’s OS. After years of vendors customising Android’s OS to put their own spin on the UI, we are finally hitting a point where everyone is pivoting back to stock Android. This is an initiative that Google has been pushing for quite some time, as standardisation of software can bring faster updates, minimise consumer confusion and potentially allow Google to gain back some control of the platform. The biggest change for Android devices in 2017 was that ASPs grew for the first time since 2010. This is largely due to the low-end players migrating their portfolios upstream toward mid-tier pricing. Consumers have gone along with this trend, although many low-end buyers have grown increasingly frustrated with poor battery and performance issues experienced after just a few months of use.

iOS: Coming off of the first year-on-year decline in iPhone shipments in 2016, Apple returned to growth in 2017, albeit only of 0.2%. Apple shipped 215.8 million iPhones in 2017 with 64% of those coming from Plus-size iPhones—including the iPhone X. The shift to bigger, more expensive devices has allowed Apple to continue to grow its ASPs while simultaneously facing the challenge of growing its shipment volumes. IDC expects iPhone shipments to grow 3.7% to 223.8 million units in 2018 and reach 242.4 million in 2022. Overall iPhone volumes are expected to grow at a five-year CAGR of 2.4%. Apple will continue to experience challenges breaking into some of the remaining high-growth developing markets but they are far from being pushed out of the premium market segment. Apple continues to build out its device upgrade program, a move IDC believes could be a catalyst to support growth over the next five years.

|

Worldwide Smartphone Platform Shipments, Market Share, and 5-Year CAGR, 2017 and 2022 (shipments in millions) |

|||||

|

Platform |

2017 Shipment Volume |

2017 Market Share |

2022 Shipment Volume* |

2022 Market Share* |

2017-2022 CAGR* |

|

Android |

1,244.0 |

85.1% |

1,435.8 |

85.5% |

2.9% |

|

iOS |

215.8 |

14.8% |

242.4 |

14.4% |

2.4% |

|

Others |

2.2 |

0.1% |

0.7 |

0.0% |

-21.1% |

|

Total |

1,462.0 |

100.0% |

1,678.9 |

100.0% |

2.8% |

|

Source: IDC Worldwide Quarterly Mobile Phone Tracker, February 27, 2018 |

|||||

Table Note: 2022 figures are forecast projections.