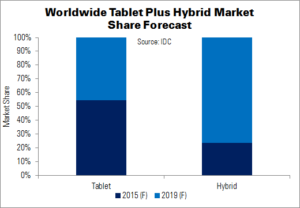

Shipments of tablet and hybrid PCs will fall 8% YoY this year, IDC has said – a significant fall from the previous -3.8% forecast. Shipments are now expected to reach 212 million, the majority being pure slates (rather than hybrids).

Overall tablet trends have not changed significantly in the past 18 months, although hybrid devices are becoming more popular. This sector is expected to grow 86.5% YoY this year, with 14.7 million units shipped.

Challenges for hybrid devices in the past included high prices, unattractive designs, “and, quite frankly, lack of demand for Windows 8, which was the OS most devices were running”, said Ryan Reith, IDC programme director. However, more OEMs are now offering such devices, bringing prices down significantly. The launch of new Android-based products, Windows 10 and – potentially – a larger iPad are also expected to have an impact.

Tablets have seen a very limited take-up in the commercial space, largely – it is thought – because of unclear usage scenarios. Hybrid products are expected to be more popular with commercial users, but IT buyers have been slow to move towards mobile devices beyond smartphones. Tablets and hybrids are still not seen as a true PC replacement. “[W]ith the arrival of the iPad Pro, the launch of Windows 10, which is better suited for the 2-in-1 form factor, and the introduction of Intel’s Skylake silicon, we expect a flurry of new devices to launch between now and December 2015”, said IDC research director Jean Philippe Bouchard.

With the number of low-cost Android models being introduced, the ASP of slate-style tablets is expected to fall below $300 this year. Additionally, smaller (7″ – 8″) whitebox devices are also bringing down prices. Despite this trend, IDC expects the share of larger (10″+) tablets and hybrids will grow from 18.6% in 2014 to 39.5% in 2019. Demand will be fuelled by the impact of phablets and growing demand for productivity solutions.

| Worldwide Tablet/Hybrid Forecast by OS (Millions) | |||||||

|---|---|---|---|---|---|---|---|

| Operating System | 2015 Unit Shipments | 2019 Unit Shipments | 2015 YoY Change | 2019 YoY Change | 2015 Market Share | 2019 Market Share | 5-Year CAGR |

| Android | 139.8 | 135.4 | -10.0% | -0.2% | 66.0% | 56.6% | -2.7% |

| iOS | 54.0 | 61.9 | -14.9% | 3.2% | 25.5% | 25.9% | -0.5% |

| Windows | 17.7 | 41.7 | 59.5% | 15.3% | 8.4% | 17.5% | 30.3% |

| Others | 0.4 | 0.0 | -15.8% | 0.0% | 0.2% | 0.0% | -100.0% |

| Total | 212.0 | 239.0 | -8.0% | 3.1% | 100.0% | 100.0% | 0.7% |

| Source: IDC | |||||||