After a gestation period of about 20 years, OLEDs are now most definitely in a growth stage – rising TV sales show it, and Apple’s (rumoured) adoption of the technology for the 2018 iPhone as good as confirms it.

However, it is extremely unlikely that we will see a complete conversion of LCD to OLED, for several reasons:

- The industry cannot afford it;

- The leading OLED makers also own LCD fabs;

- Greenfield (new) fabs essentially cost the same as converting old LCD fabs, once the opportunity cost of lost production is factored in. This means OLED growth will mainly come through greenfield plants.

That being said, OLED does have several key differentiators that separate it from LCD. For example, the ability to form curved and flexible displays, and incredibly flat screens like LG’s ‘Wallpaper OLED’. Many of these applications are new areas of differentiation and may not lead to changes in profit creation without a change in behaviour.

After two generations of Galaxy Edge phones from Samsung, however, consumers are more accepting of some of the unique value propositions of OLED. Again, another driver of growth is Apple’s apparent willingness to invest: IHS has predicted that Apple’s adoption would almost double demand for small OLED screens. Chinese display companies like BOE are increasingly committing to AMOLED based on this indicator of future intent.

| Apple iPhone OLED Adoption Scenario Analysis (Millions) | |||||||

|---|---|---|---|---|---|---|---|

| Vendor | Scenario | 2014 | 2015 | 2016 (E) | 2017 (E) | 2018 (E) | 2019 (E) |

| Samsung | 100 | 180 | 225 | 270 | 297 | 327 | |

| YoY Growth | 80% | 25% | 20% | 10% | 10% | ||

| Apple | Full Adoption (2018) | – | – | – | – | 115 | 240 |

| Partial Adoption (2018) | – | – | – | – | 50 | 120 | |

| Samsung + Apple | Full Adoption (2018) | 100 | 180 | 225 | 270 | 412 | 567 |

| iPhone as % of total | – | – | – | – | 23% | 40% | |

| Partial Adoption (2018) | 100 | 180 | 225 | 270 | 347 | 447 | |

| iPhone as % of total | – | – | – | – | 10% | 20% | |

| OLED Mobile Demand | 174 | 264 | 339 | 402 | 510 | 602 | |

| Source: Bernstein | |||||||

Equipment, materials and manufacturing technology also play a part in the timing. These have now reached a level of maturity that allow many new players to consider an entry to the market – although OLED remains a tricky technology (we recently reported that LG’s OLED TV yields may be as low as 50%: Drinking the QD “Kool-Aid” – TA). We must see this bubble of expansion for what it is, though: a bubble, with high investment levels taking place despite a weak financial outlook. Display vendors are investing to be ready for the next pricing upswing.

The Apple Effect

Apple’s move into OLED will have a knock-on effect felt throughout the industry. Most obviously, it will make LTPS-LCD as a technology less valuable. Expect to see current plans for new G6 LTPS fabs (six are planned in China) cancelled or modified, as Apple purchases 50% of all LTPS panels.

We will see new players entering the OLED market. Although some Chinese makers had withdrawn from their previous OLED announcements, expect to see these revived if Apple does announce an OLED iPhone. Japan Display has already announced plans to enter the OLED market (next year at the earliest), and Foxconn is pushing Sharp in this direction, too. Other companies, like AUO and Everdisplay Optronics, have also held discussions.

Smaller companies and those with no OLED capacity will come under pressure in such a market. CPT, for example, has been working on IGZO. Currently the impact on Innolux and Hannstar is unclear.

Not a Complete Conversion

OLED screens will not fully replace LCD units, as some OLED evangelists are hoping. We predict an incremental capacity investment, of about 15% of the current TFT-LCD total, to be taken up by OLED by 2022. The conversion will be limited by what the industry can afford, as OLED is an expensive technology – costing almost 2.5x as much to implement as a-Si in terms of capex.

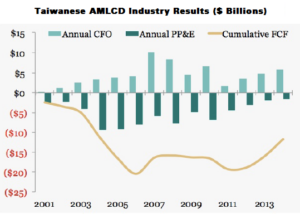

2014-2015 analysis of the Taiwanese LCD industry’s free cash flow – cumulatively down $15 billion since 2001. Taiwan, at least, does not have the money to invest in OLED.Samsung has recently boasted about its near-cost parity with LCD. However, it has taken the company more than 10 years and half a billion displays to reach this point! It’s going to take other companies a long time to bring their OLED costs down, if they need to go through the same learning process.

A complete industry conversion to OLED would cost between $150 billion and $180 billion in new capex. However, the industry spends at most $12 billion on capex per year at present, across large and small panels. It would, at that rate, take around 15 years just to replace the small LCD panel industry.

Growth Opportunities

OLED technology provides opportunities for growth with five new areas of innovation:

- Flexible, foldable and rollable;

- Other form factor innovations;

- Transparent and mirror applications;

- Colour gamut options battle against LCD; and

- Stronger performance trajectory.

Flexible and bendable displays have been covered in great detail in the past. Briefly, such displays are not so easily made or are not possible with LCD technology and will have applications in new areas, with automotive being a significant market.

However, stronger than the 3D flexible/foldable applications are ‘other innovations’, driven by OLED on polyimide. These displays are lightweight and rugged, with narrow bezels. They can be manufactured in unusual shapes.

The transparent and mirror category has so far struggled to establish itself, especially outside the signage market. The category is not yet proven.

The transparent and mirror category has so far struggled to establish itself, especially outside the signage market. The category is not yet proven.

For colour, OLED has progressed from its early implementations (too much green) to being similar/superior to LCD (although LCD has not remained stationary, with the addition of quantum dot films). Samsung is also now talking about colour manipulation to help colour blind users.

Finally, OLED technology is progressing strongly and matches or outmatches LCD in areas of colour, contrast, viewing performance and other metrics in mass production displays. As it is a young technology, there are likely to be even higher performance levels that can be squeezed out of OLED. It is this potential performance trajectory, some of the benefits which haven’t been shown yet, that make it an exciting technology.

The last point to consider is OLED’s fixed and variable costs. Above, I said that OLED technology is about 2.5x more expensive to implement than a-Si in capex terms. If that cost is fixed, then to maintain parity with LCD displays OLED prices will need to come down, eating into the bottom line. This is especially true if the OLED market enters oversupply, as looks increasingly likely. This could mean bigger losses for OLED makers than LCD makers, who benefit from comparatively low fixed costs.

– Ian Hendy

Ian Hendy is CEO of Hendy Consulting Limited, a management consulting company focused on high technology markets and specifically the display industry. Hendy Consulting solves client bespoke business problems focused on growth and market entry, partnering and technology