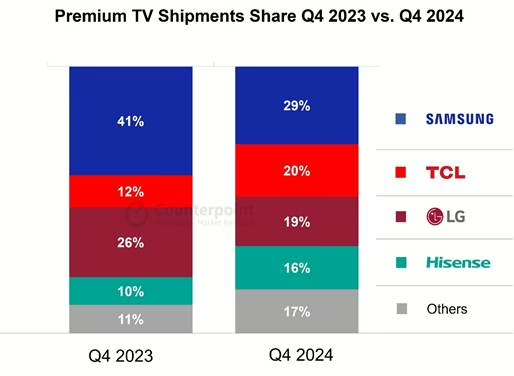

Premium TV shipments soared 51% YoY in Q4 2024, with Chinese manufacturer TCL surpassing South Korean giant LG Electronics to claim second place in the premium segment behind Samsung, according to a report from Counterpoint.

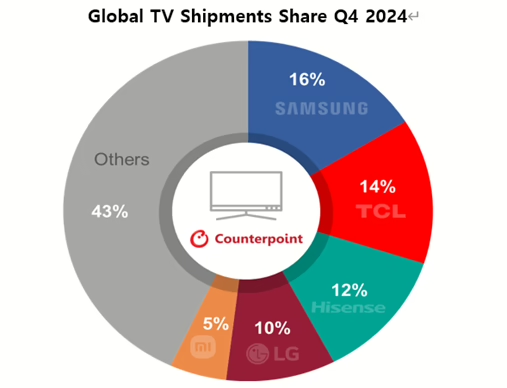

The global TV market showed signs of recovery with overall shipments growing 2% YoY to reach 61 million units in Q4 2024, marking the third consecutive quarter of growth. Annual shipments for 2024 also increased by 2%, totaling 230 million units.

Samsung Electronics maintained its leadership position with a 16% market share, while TCL followed closely at 14%. LG Electronics held steady in fourth place with a 10% share, unchanged from the previous year.

The premium TV segment, which includes OLED, QD LCD, NanoCell, and MiniLED LCD technologies, showed particularly strong performance, growing 38% for the full year 2024. Within this category, MiniLED LCD TVs experienced explosive growth of over 170% YoY, overtaking OLED TV shipments since Q2 2024. QD LCD TVs also saw substantial growth of more than 46%, exceeding 5 million units in quarterly shipments for the first time.

Despite maintaining its top position in the premium market with a 29% share, Samsung’s dominance has eroded, dropping 12 percentage points compared to the previous year as Chinese manufacturers intensified competition. TCL’s premium TV shipments more than doubled YoY, allowing it to leapfrog LG Electronics for second place with a 20% market share.

Industry analysts are expressing concern about potential challenges for Korean manufacturers due to proposed tariffs by the Trump administration. Counterpoint researcher Lee Je-hyeok warned that the implementation of a 25% tariff on products manufactured in Mexico could disproportionately impact Korean companies, which currently account for 53% of premium TV sales in North America.

While most regions showed positive growth, the TV market contracted in Japan and Asia, with YoY declines of 15% and 4% respectively.